Leslie’s Stock Fair Value – LESLIE’S Aims To Improve Capital Returns

April 3, 2023

Trending News ☀️

Leslie’s ($NASDAQ:LESL) (NASDAQ:LESL) announced recently that its goal is to improve its return on capital. In order to achieve this goal, Leslie’s is taking a number of steps, such as focusing on cost efficiency, improving their operations and looking for opportunities to grow their market share. The company plans to invest in technology and processes that will help them streamline their operations and reduce costs.

Additionally, Leslie’s has been seeking out strategic partnerships that can support their growth objectives and help them reach their target markets. Finally, they are actively looking for opportunities to enter new markets or expand into existing markets that have not yet been tapped by the company. By taking these steps, Leslie’s hopes to increase its return on capital and drive sustainable growth. The company is confident that these measures will improve their competitive position and help them maximize their profits in the long run. Investors should be encouraged by the company’s commitment to improving returns on capital and watch for further developments in the coming months.

Price History

On Monday, LESLIE’S opened at $10.7 and closed at $10.6, representing a rise of 0.7% from its prior closing price of 10.5. This move demonstrates LESLIE’S ongoing commitment to improving capital returns for its shareholders. By consistently striving to maximize returns, LESLIE’S is working towards the long-term stability and growth of its stock value. Despite the current volatility within the market, LESLIE’S is confident that by utilizing sound investment strategies, it can weather any market climate and continue to increase returns. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Leslie’s. More…

| Total Revenues | Net Income | Net Margin |

| 1.57k | 143.22 | 9.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Leslie’s. More…

| Operations | Investing | Financing |

| 7.79 | -142.2 | 83.76 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Leslie’s. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.08k | 1.3k | -1.23 |

Key Ratios Snapshot

Some of the financial key ratios for Leslie’s are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 18.9% | 25.2% | 14.3% |

| FCF Margin | ROE | ROA |

| -1.5% | -66.2% | 13.0% |

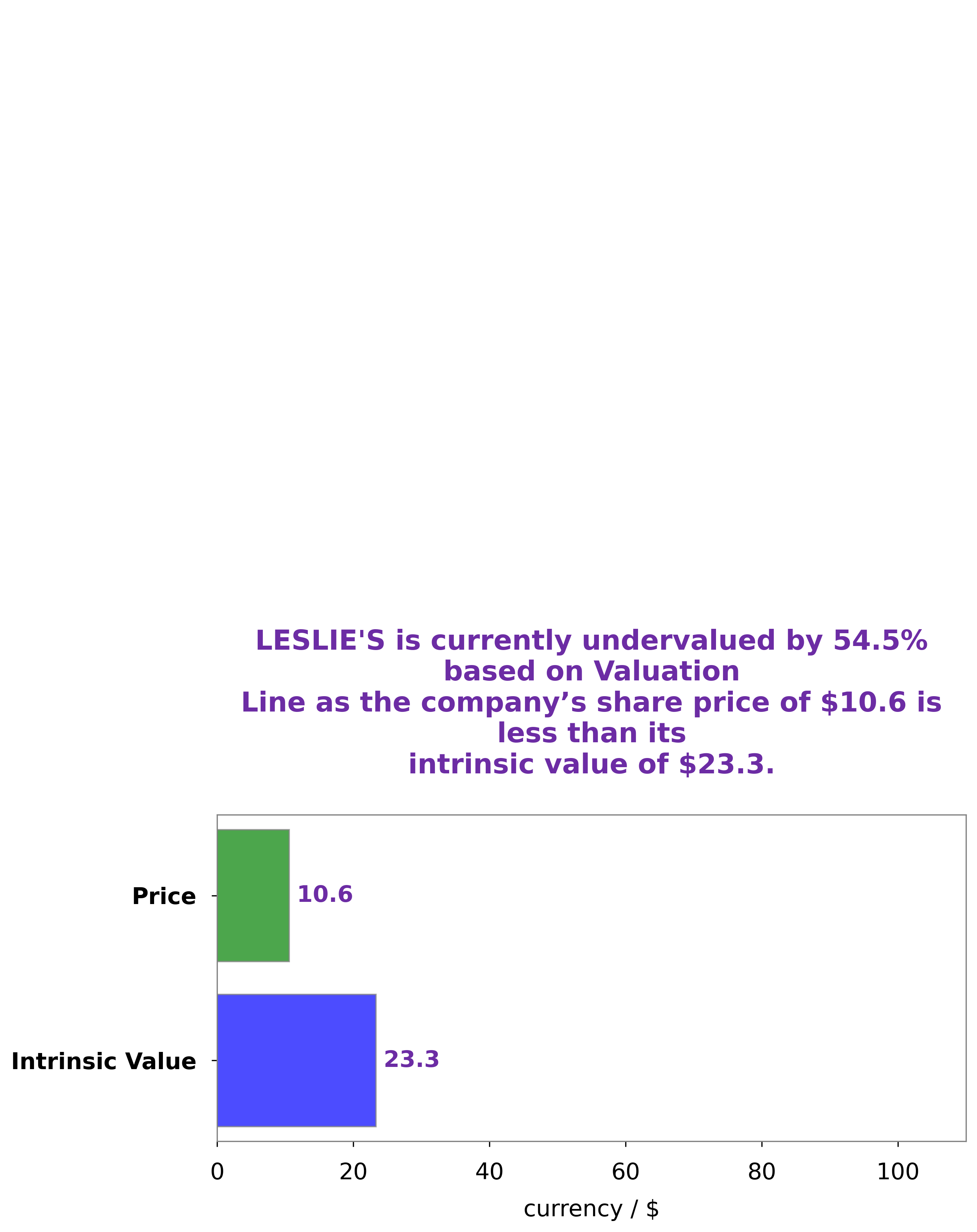

Analysis – Leslie’s Stock Fair Value

We have performed a comprehensive analysis of LESLIE’S fundamentals, and our proprietary Valuation Line reveals that the intrinsic value of the share is around $23.3. Currently, the stock is trading at $10.6, which represents an undervaluation of 54.5%. We believe this presents a great opportunity for investors to gain exposure to LESLIE’S at an advantageous price. More…

Peers

Leslie’s is the world’s largest retailer of swimming pool supplies. Headquartered in Phoenix, Arizona, the company operates over 900 retail stores in the United States and Canada. Leslie’s also operates an e-commerce website and direct mail catalog business. The company was founded in 1963 by brothers John and Bill Leslie. Pool Corp is the world’s largest wholesale distributor of swimming pool supplies and equipment. Headquartered in Covington, Louisiana, the company operates over 360 distribution centers in North America, Europe, South America, and Australia. Pool Corp was founded in 1993. Tandem Group PLC is a leading designer, manufacturer, and distributor of swimming pool and spa products. Headquartered in the United Kingdom, the company operates in over 30 countries worldwide. Tandem Group PLC was founded in 1981. Real American Capital Corp is a leading provider of financing solutions for the swimming pool and spa industry. Headquartered in Boca Raton, Florida, the company operates in the United States, Canada, and Europe. Real American Capital Corp was founded in 2008.

– Pool Corp ($NASDAQ:POOL)

Pentair plc, through its subsidiaries, provides water and fluid solutions worldwide. The company operates in two segments, Industrial and Residential & Commercial. The Industrial segment offers a range of products and services that meet the needs of customers in the water and fluid solutions industry, including filtration, separation, fluid control, fluid movement, fluid management, and heat transfer. The Residential & Commercial segment provides products and services that meet the needs of customers in the residential and commercial water markets. Pentair plc was founded in 1966 and is headquartered in London, the United Kingdom.

– Tandem Group PLC ($LSE:TND)

The Tandem Group plc is a holding company that engages in the design, development, manufacture, and distribution of bicycles and bicycle products under the Raleigh, Diamondback, and Redline brands. The company operates through two segments, Bicycles and Accessories, and Pools. The Bicycles and Accessories segment offers bicycles, bicycle parts, and bicycle accessories. The Pools segment provides above-ground and in-ground swimming pools, related equipment, and chemicals. The company was founded in 1887 and is headquartered in Kent, the United Kingdom.

Summary

Leslie’s (NASDAQ:LESL) is a company focused on providing pool maintenance supplies, chemicals and services. Investors are looking for the company to improve its returns on capital in order to reward shareholders. To achieve that, the company is seeking to expand its customer base and find cost-effective ways to manage its operations. It is also looking to diversify its product offerings, both online and in stores, in order to increase its visibility and sales.

Additionally, the company is focusing on increasing its cash flows through strategic partnerships and acquisitions. All of these efforts are aimed at improving the company’s bottom line and generating long-term returns for shareholders.

Recent Posts