Lemaitre Vascular Intrinsic Value Calculator – CEO of Lemaitre Vascular Sells Over $1 Million in Company Shares

December 15, 2023

☀️Trending News

Lemaitre Vascular ($NASDAQ:LMAT) is a global leader in the medical device industry, specializing in innovative products for the treatment of peripheral vascular disease. Lemaitre Vascular provides a full range of vascular products and services that are used to diagnose and treat arterial and venous diseases. These products include catheters, stents, and other endovascular solutions for the treatment of peripheral vascular disease. It is also committed to providing quality patient care, utilizing innovative technologies and providing superior customer service.

The recent sale of shares by George LeMaitre highlights the confidence of investors in Lemaitre Vascular’s long-term success. With its global reach and commitment to innovation, Lemaitre Vascular looks set to continue delivering strong shareholder returns in the years ahead.

Stock Price

On Tuesday, LEMAITRE VASCULAR stock opened at $54.2 and closed at $53.8, a decline of 1.1% from its previous closing price of $54.4. This came after the company’s CEO, George Lemaitre, sold over $1 million worth of the company’s shares. This recent sale follows a pattern set by Lemaitre in the past, with similar sales occurring frequently over the years. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Lemaitre Vascular. More…

| Total Revenues | Net Income | Net Margin |

| 185.56 | 27.27 | 14.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Lemaitre Vascular. More…

| Operations | Investing | Financing |

| 25.6 | -10.37 | -9.23 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Lemaitre Vascular. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 334.01 | 45.38 | 12.96 |

Key Ratios Snapshot

Some of the financial key ratios for Lemaitre Vascular are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.0% | 12.7% | 18.7% |

| FCF Margin | ROE | ROA |

| 10.2% | 7.6% | 6.5% |

Analysis – Lemaitre Vascular Intrinsic Value Calculator

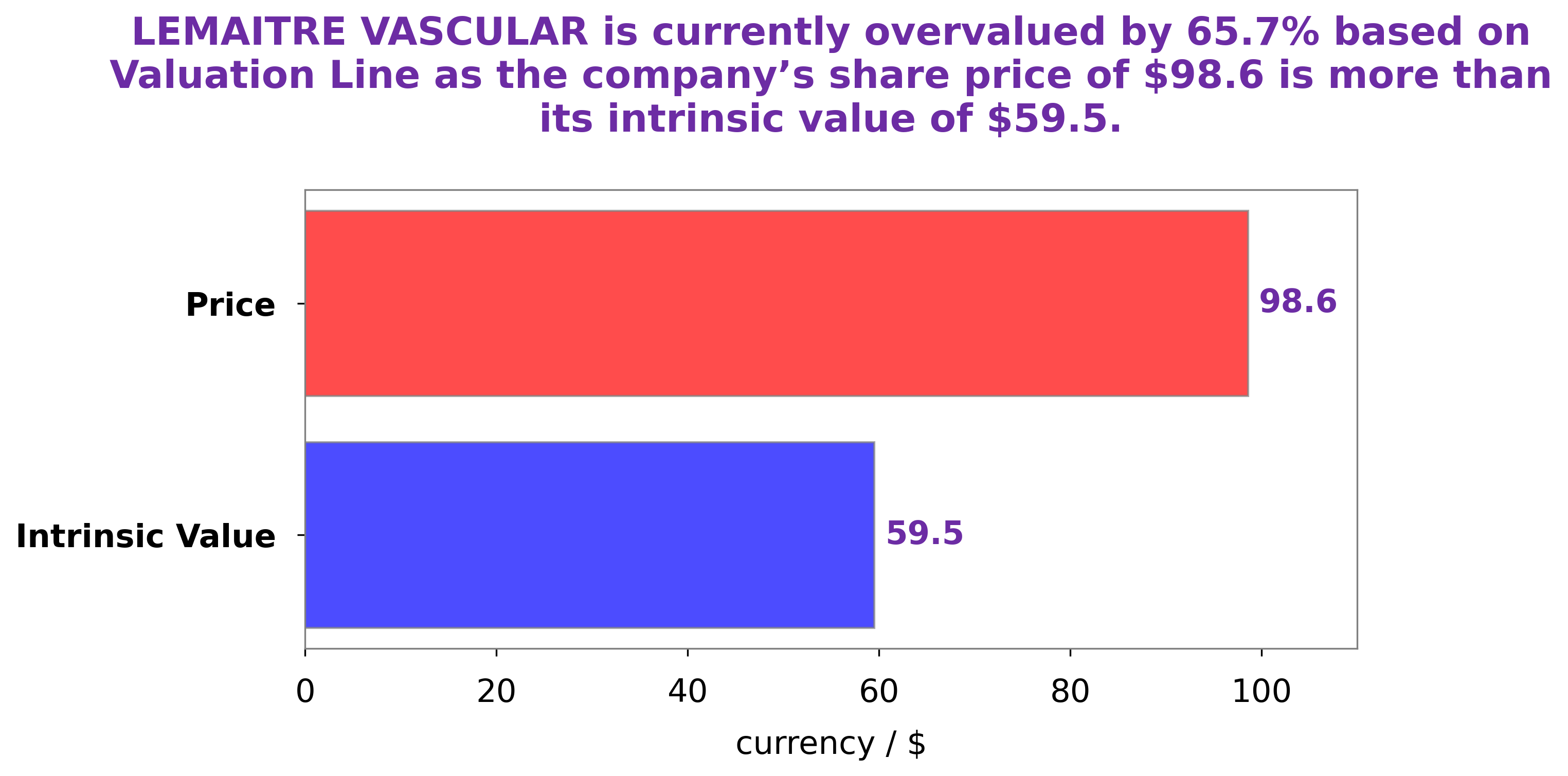

At GoodWhale, we have thoroughly analyzed the fundamentals of LEMAITRE VASCULAR to determine its value. Our proprietary Valuation Line indicates that the fair value of its shares is around $57.5. Currently, the price of the stock is $53.8, which is undervalued by a fair 6.4%. More…

Peers

It focuses on the development, manufacture and marketing of minimally invasive products for the treatment of peripheral vascular diseases. The company operates through two segments, Direct and OEM. The Direct segment offers proprietary products to hospitals and other medical institutions through direct sales force. The OEM segment provides stents and other products to Original Equipment Manufacturers (OEMs) for sale under their own brands. LeMaitre’s competitors include Atrion Corp, Implanet SA, Vycor Medical Inc.

– Atrion Corp ($NASDAQ:ATRI)

Atrion Corporation is a medical device company that develops, manufactures and markets products primarily for use in cardiac and ophthalmic surgery. The company’s products include Cardiax, a cannula used in cardiac surgery; Ophthalmic products, including the HydroVue and Glaucoma Shunt systems to treat glaucoma; and PerQCat, a catheter used in urology procedures.

– Implanet SA ($OTCPK:IMPZY)

Implanet SA is a French company specializing in the design and manufacture of medical implants for the treatment of orthopedic pathologies. The company’s products are used in the treatment of various conditions, including osteoarthritis, degenerative disc disease, scoliosis, and deformities of the hip, knee, and shoulder. As of 2022, Implanet SA had a market capitalization of 3.88 million euros and a return on equity of -114.56%. The company’s products are sold in over 50 countries worldwide and its customers include some of the world’s leading orthopedic surgeons and hospitals.

– Vycor Medical Inc ($OTCPK:VYCO)

Vycor Medical Inc is a medical device company that specializes in the development and commercialization of minimally invasive products for neurosurgery. The company’s products are designed to provide surgeons with improved access and visualization during surgery, while minimizing tissue damage and surgical time. Vycor Medical’s products are sold in over 30 countries worldwide.

As of 2022, Vycor Medical Inc had a market capitalization of 3.17 million and a return on equity of 6.36%. The company’s products are used in a variety of neurosurgical procedures, including brain surgery, spinal surgery, and skull-base surgery.

Summary

Lemaitre Vascular is a publically traded company that provides devices and implants used in the treatment of peripheral vascular diseases. Recent analysis of the company has revealed that CEO George LeMaitre recently sold 51,000 of his own shares in the company, suggesting a change in investor sentiment. Investors should consider further research into the financial health and outlook of the company before investing. Factors to consider include current market conditions, past performance, debt levels, and current growth opportunities.

Additionally, forecasting potential returns on investment and understanding the management team’s strategy can be helpful when deciding whether to invest in Lemaitre Vascular or not.

Recent Posts