JBT Stock Intrinsic Value – American Century Companies Reduces Stake in John Bean Technologies Co

June 12, 2023

🌥️Trending News

John Bean Technologies ($NYSE:JBT) Co. (JBT) is a leading global provider of technology and services primarily used in the food and beverage industry. The company designs, develops, manufactures, and markets a wide range of solutions that allow customers to process and package their products. Recently, American Century Companies Inc. has reduced its stake in JBT. The size of the stake was not revealed but it is speculated to be significant.

American Century Companies Inc. is a long-term investor in JBT and this move could indicate a shift in its strategies regarding the company. John Bean Technologies Co. has been performing well over the past few years. Despite this drop in American Century Companies Inc.’s stake, JBT remains optimistic about its future prospects as it continues to make advances in food and beverage technology.

Stock Price

This news caused the stock to open at $118.5 and close at $118.8, a dip of 0.4% from its previous closing price of 119.3. John Bean Technologies Co is an American manufacturer of automated industrial food processing and air transportation equipment. Its shares are traded in the New York Stock Exchange under the ticker symbol JBT. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for JBT. More…

| Total Revenues | Net Income | Net Margin |

| 2.23k | 130.7 | 6.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for JBT. More…

| Operations | Investing | Financing |

| 124.8 | -408 | 248.2 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for JBT. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.58k | 1.69k | 28 |

Key Ratios Snapshot

Some of the financial key ratios for JBT are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.9% | -4.4% | 8.0% |

| FCF Margin | ROE | ROA |

| 2.1% | 12.7% | 4.3% |

Analysis – JBT Stock Intrinsic Value

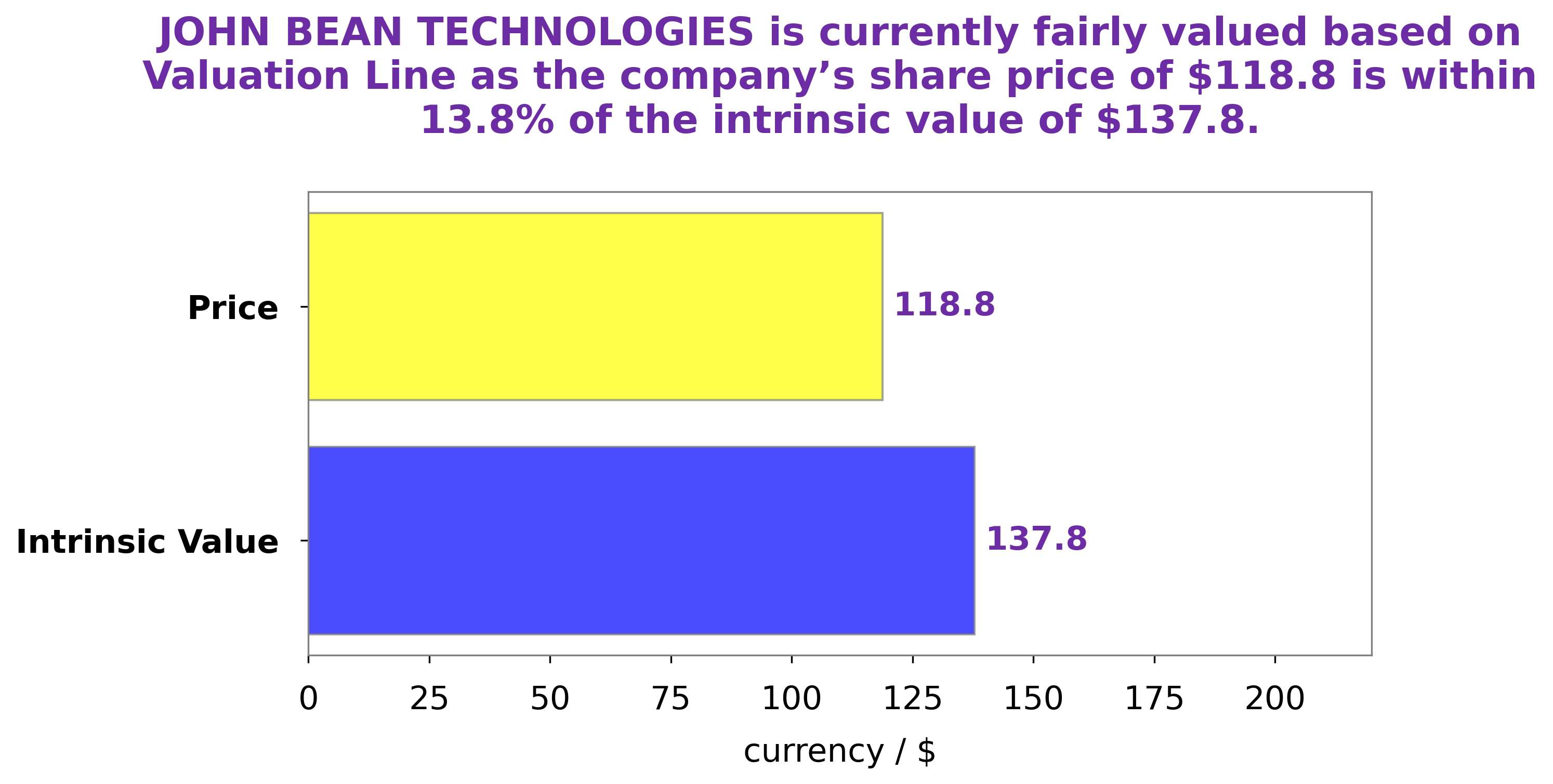

At GoodWhale, we have conducted an analysis of JOHN BEAN TECHNOLOGIES’s wellbeing. After accounting for the company’s financials, industry outlook, and competitive landscape, our proprietary Valuation Line determined that the fair value of JOHN BEAN TECHNOLOGIES share is around $137.8. Despite this, the stock is currently being traded at $118.8, representing a fair price that is undervalued by 13.8%. This presents a great opportunity for investors to potentially maximize their returns by investing now. More…

Peers

The company’s products are used by customers in more than 100 countries around the world. John Bean Technologies Corp has a strong competitive position in the market, with a wide range of products and a global customer base. The company’s competitors include Dover Corp, Shenzhen Genvict Technologies Co Ltd, Crawford United Corp.

– Dover Corp ($NYSE:DOV)

Dover Corporation is a global manufacturer of industrial products and components. The company’s products are used in a variety of industries, including aerospace, transportation, energy, and medical. Dover’s products are sold through a network of distributors and retailers. The company has a market cap of 18.29B as of 2022 and a Return on Equity of 22.89%. Dover is a publicly traded company on the New York Stock Exchange (NYSE) under the ticker symbol DOV.

– Shenzhen Genvict Technologies Co Ltd ($SZSE:002869)

Shenzhen Genvict Technologies Co Ltd has a market cap of 4.08B as of 2022. The company’s return on equity is -3.9%.

Shenzhen Genvict Technologies Co Ltd is a leading provider of Internet of Things (IoT) solutions. The company’s products and solutions are used in a wide range of industries, including smart city, transportation, energy, environment, healthcare, and manufacturing.

– Crawford United Corp ($OTCPK:CRAWA)

Crawford United Corp is a publicly traded company with a market capitalization of $61.6 million as of 2022. The company has a return on equity of 10.27%. Crawford United Corp is engaged in the business of providing engineering, construction and maintenance services to the energy, industrial and commercial markets.

Summary

John Bean Technologies Co. is a global leader in food and beverage processing and packaging equipment. It is widely recognized as an industry innovator for its investments in research and development. Its positioning in the market is further enhanced by its strong customer base, including leading food and beverage brands. Investing in John Bean Technologies Co. offers potential investors the opportunity to benefit from the firm’s successful track record, reliable product offerings, and experienced management team.

The company’s revenue streams are diversified across multiple industries, so there is potential to grow the business through new contracts and acquisitions. Moreover, due to its international presence, John Bean Technologies Co. offers exposure to global markets and potential for expansion in key markets. As the company is already well-established in the food and beverage equipment market, it offers investors a safe and reliable option for investment.

Recent Posts