Inventrust Properties Stock Fair Value Calculator – InvenTrust Properties (NYSE:IVT) Price Target Lowered to $23.00

March 31, 2023

Trending News 🌧️

INVENTRUST ($NYSE:IVT): InvenTrust Properties (NYSE:IVT) has recently seen its price target lowered to $23.00. InvenTrust is a REIT (Real Estate Investment Trust) that owns and manages a diverse portfolio of retail, office, industrial, and multifamily properties. InvenTrust has a strong balance sheet and a diversified approach to its investments, allowing it to ride out market volatility and provide long-term stability. The company also has a strong track record of delivering consistent returns to its shareholders.

Price History

Tuesday marked a tough day for INVENTRUST PROPERTIES as their stock opened at $22.4 and closed at $22.6, having risen by 0.4% from the last closing price of $22.5. The new target is still higher than the current market price of INVENTRUST PROPERTIES, suggesting that there is still potential upside for investors in the stock. Nevertheless, the lower target does represent a decrease in the positive sentiment towards INVENTRUST PROPERTIES, and traders will be keeping an eye on the stock to see if it can recover from this drop. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Inventrust Properties. More…

| Total Revenues | Net Income | Net Margin |

| 236.71 | 52.23 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Inventrust Properties. More…

| Operations | Investing | Financing |

| 125.8 | -144.46 | 111.57 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Inventrust Properties. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.47k | 869.12 | 23.77 |

Key Ratios Snapshot

Some of the financial key ratios for Inventrust Properties are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 14.9% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis – Inventrust Properties Stock Fair Value Calculator

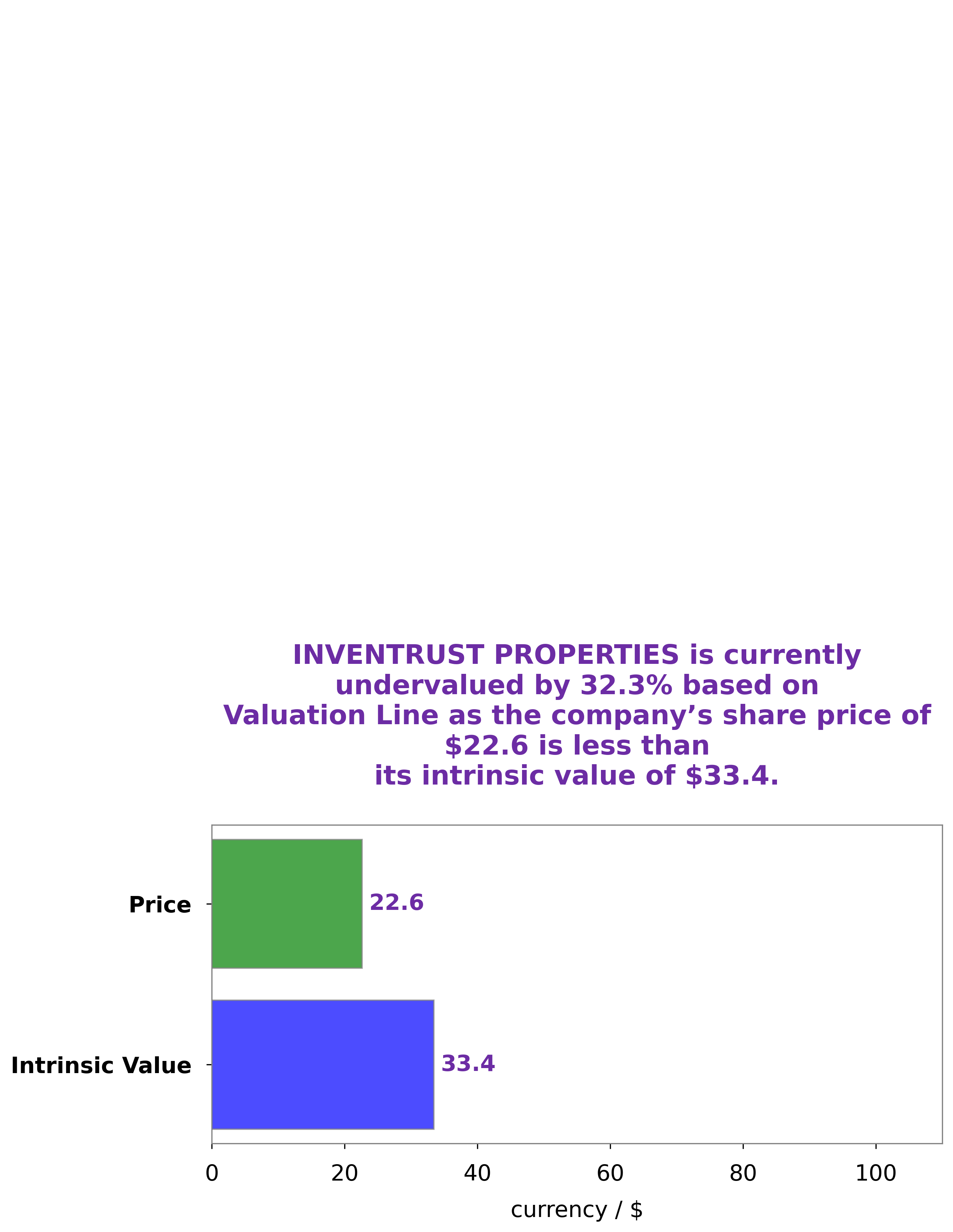

At GoodWhale, we recently analyzed the financials of INVENTRUST PROPERTIES and the results of our analysis were quite promising. Our proprietary Valuation Line showed an intrinsic value of the INVENTRUST PROPERTIES share to be around $33.4. Currently, the stock is trading at $22.6, which is a 32.2% discount to its intrinsic value. Thus, we believe that INVENTRUST PROPERTIES is currently undervalued and this presents a great opportunity for investors. More…

Peers

The company’s portfolio includes retail, office, and industrial properties. The company’s competitors include Slate Grocery REIT, KBS Real Estate Investment Trust III Inc, Inland Real Estate Income Trust Inc.

– Slate Grocery REIT ($TSX:SGR.UN)

Slate Grocery REIT is a Canadian real estate investment trust that owns and operates a portfolio of grocery-anchored retail properties across Canada. The company’s market cap as of 2022 is 858.1M.

– KBS Real Estate Investment Trust III Inc ($OTCPK:KBSR)

KBS Real Estate Investment Trust III Inc, a real estate investment trust, focuses on acquiring, owning, and operating office properties in the United States. It also provides debt and equity financing for the acquisition and development of office properties. The company was founded in 2007 and is based in Newport Beach, California.

– Inland Real Estate Income Trust Inc ($OTCPK:INRE)

Inland Real Estate Income Trust Inc is a real estate company that focuses on the ownership and operation of income-producing properties, including retail, office, industrial, and multifamily properties. As of December 31, 2020, the company owned and operated a portfolio of 97 properties totaling 12.8 million square feet of gross leasable space. Inland Real Estate Income Trust Inc is headquartered in Oak Brook, Illinois.

Summary

InvenTrust Properties is a real estate investment trust (REIT) that focuses on acquiring, developing and managing a diversified portfolio of retail properties. The lower price target reflects a lower than expected FFO guidance and the lack of near-term catalysts. The analyst also noted that while the company has a strong portfolio of assets, they are concerned with the company’s ability to grow earnings and cash flow due to limited growth opportunities. Investors should monitor InvenTrust’s financial performance and management’s ability to execute its strategy to unlock value in its portfolio.

Recent Posts