INSP Intrinsic Value Calculation – Stifel Downgrades Inspire Medical Systems Stock to Hold on GLP-1 Impact

January 3, 2024

☀️Trending News

Inspire Medical Systems ($NYSE:INSP), Inc. is a medical technology company that designs, manufactures, and markets innovative neurostimulation-based therapies for sleep apnea. The company’s Inspire therapy is the first and only approved neurostimulation technology that offers a safe and effective treatment alternative to CPAP for those with moderate to severe Obstructive Sleep Apnea (OSA). Recently, Stifel has downgraded their rating of Inspire Medical Systems stock to Hold, citing the impact of GLP-1 drugs as the reason. GLP-1 drugs are a type of medication typically prescribed for people who are overweight and unable to control their blood sugar levels. These drugs can have a negative impact on Inspire Medical System’s bottom line by causing people to lose weight, which could reduce the number of people needing the company’s treatments. Although Stifel has downgraded their rating on Inspire Medical Systems, the company still has a strong product portfolio and is continuing to develop innovative therapies that can help those suffering from sleep apnea.

Additionally, with a number of new treatments currently in development, the company is well-positioned to capitalize on any potential upside from the GLP-1 drugs market. Ultimately, Stifel’s downgrade of Inspire Medical Systems stock to Hold should be seen as more of a cautionary measure than anything else.

Stock Price

On Tuesday, INSPIRE MEDICAL SYSTEMS stock opened at $184.6 and closed at $187.8, representing a drop of 7.7% from its last closing price of 203.4. This change in the stock price was in response to Stifel’s downgrade of the company’s stock to hold. GLP-1 drugs are believed to be a competitor for INSPIRE MEDICAL SYSTEMS’ products, meaning that the company’s market share could be threatened by these drugs. Stifel is expecting that this competition from GLP-1 drugs will put pressure on INSPIRE MEDICAL SYSTEMS’ stock price in the short-term and has downgraded the stock to reflect this likelihood. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for INSP. More…

| Total Revenues | Net Income | Net Margin |

| 570.19 | -32.77 | -5.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for INSP. More…

| Operations | Investing | Financing |

| 26.66 | -146.05 | 31.35 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for INSP. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 639.49 | 95.31 | 18.43 |

Key Ratios Snapshot

Some of the financial key ratios for INSP are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 80.9% | – | -5.6% |

| FCF Margin | ROE | ROA |

| 1.4% | -3.7% | -3.1% |

Analysis – INSP Intrinsic Value Calculation

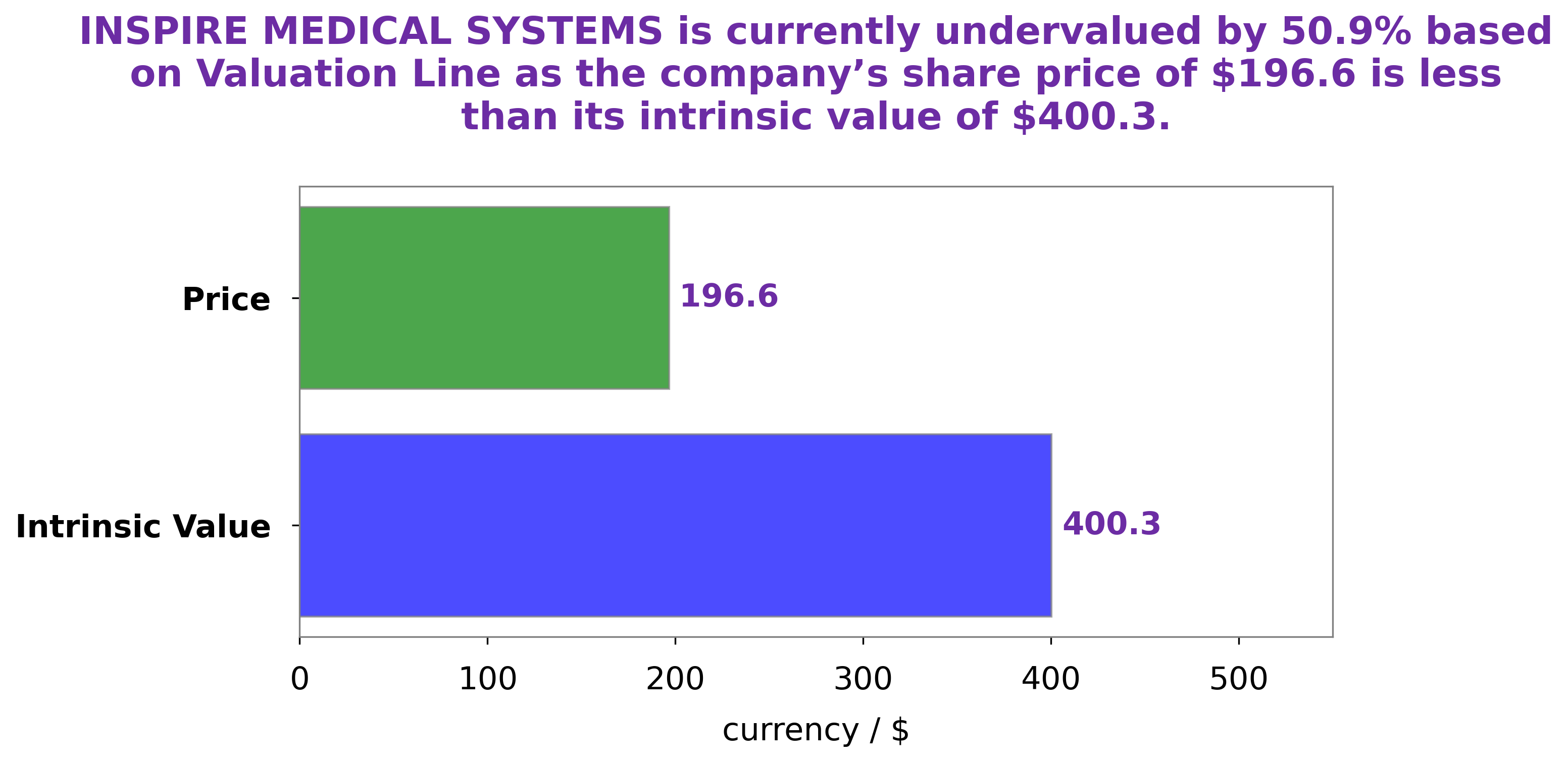

GoodWhale has performed an analysis of INSPIRE MEDIAL SYSTEMS’s fundamentals to provide investors with a complete understanding of the company. After careful consideration, GoodWhale has determined that the intrinsic value of INSPIRE MEDICAL SYSTEMS shares is around $411.3. This determination was made using our proprietary Valuation Line. Currently, INSPIRE MEDICAL SYSTEMS’s stock is trading at $187.8 – an astonishing 54.3% discount to its true worth. More…

Peers

The company’s competitors include ShockWave Medical Inc, InMode Ltd, and INVO Bioscience Inc.

– ShockWave Medical Inc ($NASDAQ:SWAV)

ShockWave Medical Inc is a medical device company that uses shockwave technology to treat cardiovascular disease. The company has a market cap of 9.73B as of 2022 and a return on equity of 19.56%. The company’s products are used to treat a variety of cardiovascular diseases, including coronary artery disease, peripheral artery disease, and heart failure.

– InMode Ltd ($NASDAQ:INMD)

InMode Ltd is a medical technology company that develops and manufactures minimally invasive aesthetic solutions. The company has a market capitalization of $2.71 billion as of 2022 and a return on equity of 41.58%. InMode’s products are used by physicians and patients in over 90 countries and the company has a strong presence in the United States, Europe, Asia, and Latin America. InMode’s products are backed by clinical research and have been featured in numerous peer-reviewed journals.

– INVO Bioscience Inc ($NASDAQ:INVO)

INVO Bioscience Inc is a medical device company that has developed a patented in vivo intravaginal culture (IVC) system, which is used to treat infertility. The company’s IVC system is designed to provide a more natural environment for embryo development and is intended to improve the success rates of in vitro fertilization (IVF). INVO Bioscience’s IVC system is currently being used at fertility clinics in the United States and Europe.

Summary

Inspire Medical Systems is a medical device company that develops implantable systems for treating obstructive sleep apnea. Recently, Stifel downgraded their rating to “Hold” from “Buy”, citing concerns about the potential impact of new GLP-1 drug therapies on the company’s sales. On the day of the downgrade, Inspire Medical Systems’ stock price fell significantly.

Investing analysis suggests that investors should be cautious when considering Inspire Medical Systems due to the potential impact of new drug therapies. Despite the downgraded rating, analysts remain optimistic about the company’s long term growth prospects given its strong product pipeline and competitive advantages.

Recent Posts