Idacorp Intrinsic Value Calculation – IDACORP: Invest Now and Reap the Benefits of Idaho’s Economic Expansion

April 27, 2023

Trending News ☀️

Investing in Idaho’s leading energy holding company, IDACORP ($NYSE:IDA), Inc. (NYSE: IDA), is an excellent opportunity to capitalize on the state’s growing economy. IDACORP is a publicly-traded energy holding company that operates in the United States and Canada, headquartered in Boise, Idaho.

Additionally, the stock has seen an increase in volume over the last few years, indicating that investors are bullish on the company’s future growth prospects in the region. Furthermore, IDACORP has a strong balance sheet with a solid credit rating from Moody’s Investors Service. This financial stability provides further confidence in the stock’s long-term growth potential. With its strong presence in the Northwest and strong financials, investors can look to benefit from Idaho’s economic expansion by investing in IDACORP.

Stock Price

IDACORP is an Idaho-based utility and energy company that has been experiencing rapid economic expansion in recent years. On Tuesday, IDACORP stock opened at $112.3 and closed at $112.9, up 0.4% from its last closing price of 112.4. This is indicative of the strong performance of the company in recent months, as investors are beginning to reap the benefits of its ongoing expansion. IDACORP has been making strategic investments in infrastructure, technology and personnel, which has allowed them to experience increased revenue and profits. They have also been taking advantage of the recently favorable market conditions and are making moves to expand their presence in the region.

For those investors looking to capitalize on Idaho’s economic growth, IDACORP is a great option. With its strong foundation and a strategic approach to growth, IDACORP is poised to continue its upward trajectory for years to come. Investing now is an opportunity for investors to benefit from the company’s growth and reap the rewards of a successful investment. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Idacorp. IDACORP_Invest_Now_and_Reap_the_Benefits_of_Idahos_Economic_Expansion”>More…

| Total Revenues | Net Income | Net Margin |

| 1.64k | 258.98 | 13.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Idacorp. IDACORP_Invest_Now_and_Reap_the_Benefits_of_Idahos_Economic_Expansion”>More…

| Operations | Investing | Financing |

| 351.29 | -424.27 | 35.32 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Idacorp. IDACORP_Invest_Now_and_Reap_the_Benefits_of_Idahos_Economic_Expansion”>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.54k | 4.73k | 55.52 |

Key Ratios Snapshot

Some of the financial key ratios for Idacorp are shown below. IDACORP_Invest_Now_and_Reap_the_Benefits_of_Idahos_Economic_Expansion”>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.9% | 3.4% | 23.5% |

| FCF Margin | ROE | ROA |

| -4.9% | 8.7% | 3.2% |

Analysis – Idacorp Intrinsic Value Calculation

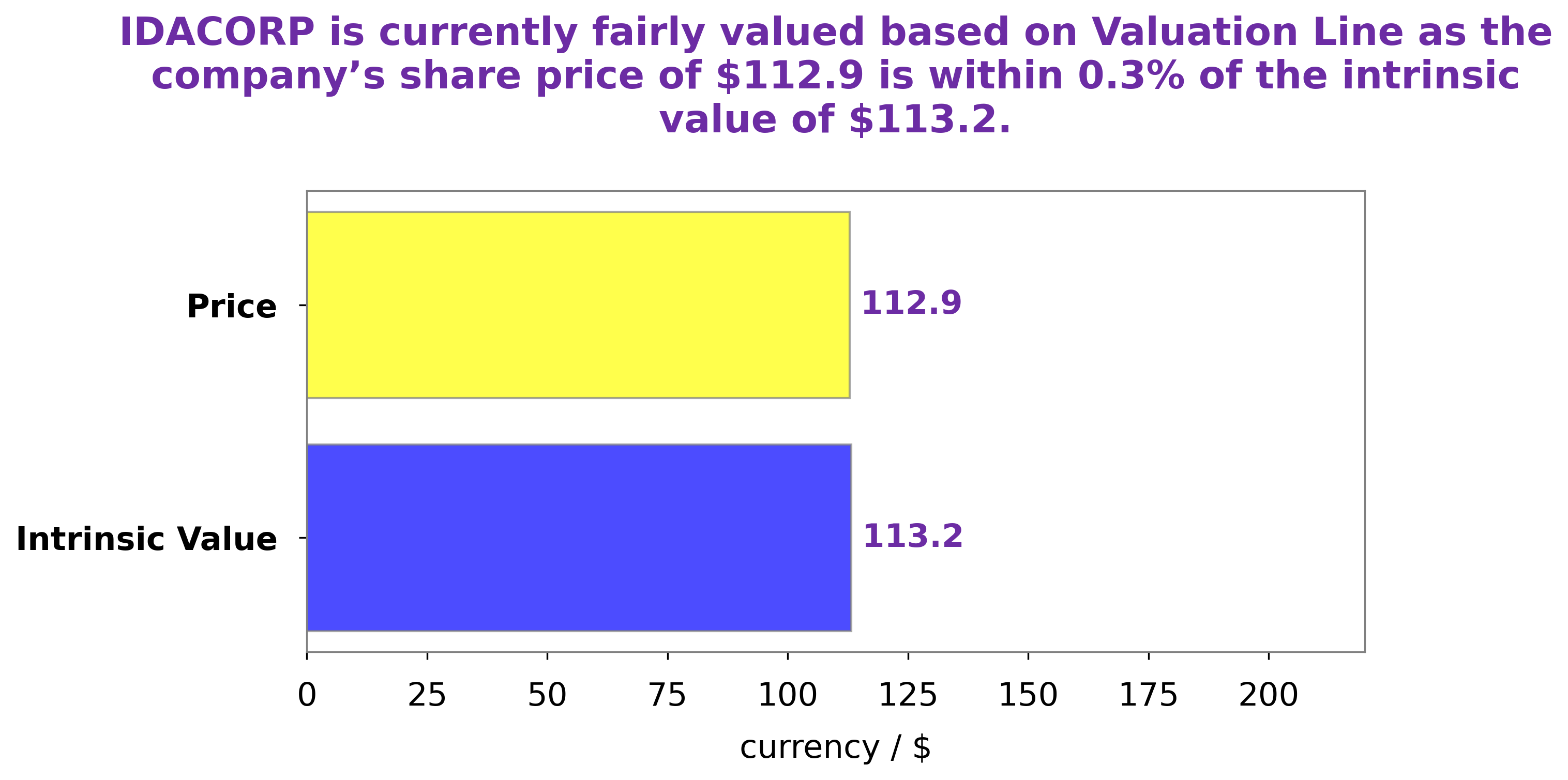

At GoodWhale, we have conducted a thorough analysis of the fundamentals of IDACORP. Based on our proprietary Valuation Line, we have determined that the intrinsic value of IDACORP share is around $113.2. This suggests that the current price of the stock at $112.9 is a fair price, indicating that there are no significant upsides or downsides to owning the shares. We believe investors should consider IDACORP as a potential investment opportunity as it appears to be trading at a fair price. More…

Peers

Since its establishment in 1898, Idacorp Inc has been engaged in electric utility businesses in the United States. The company is currently one of the leading electric utility providers in the country, with a customer base of over 500,000. Idacorp Inc has a strong presence in the western United States, particularly in Idaho, Oregon, and Washington. The company’s main competitors are American Electric Power Co Inc, PNM Resources Inc, and Energa SA. These companies are all engaged in the business of electric utility provision and have a significant presence in the United States. While Idacorp Inc is the largest electric utility provider in Idaho, American Electric Power Co Inc is the largest provider in Ohio. PNM Resources Inc is the largest electric utility provider in New Mexico. Energa SA is a Polish electric utility company with a significant presence in the United States.

– American Electric Power Co Inc ($NASDAQ:AEP)

American Electric Power Company, Inc. (AEP) is a holding company that provides electric service through its subsidiaries in 11 states in the United States. AEP’s subsidiaries generate, transmit, and distribute electricity to residential, commercial, and industrial customers. The company also owns and operates coal, oil, natural gas, and renewable energy plants. In addition, AEP’s subsidiaries engage in transmission and distribution operations, including transmission infrastructure development.

– PNM Resources Inc ($NYSE:PNM)

PNM Resources Inc is a holding company that invests in energy businesses. Its portfolio includes electric utility, natural gas, and oil businesses. The company operates through two segments: Electric Utility and Non-Utility. The Electric Utility segment engages in the generation, transmission, and distribution of electricity in New Mexico and Texas. The Non-Utility segment includes the company’s investments in energy businesses, including natural gas pipelines and gathering systems, and oil and gas exploration and production.

– Energa SA ($LTS:0QX7)

Energa SA is a Polish electricity company with a market capitalization of 2.57 billion as of 2022. The company has a return on equity of 11.25%. Energa SA is involved in the generation, transmission, and distribution of electricity. The company also supplies gas and heat.

Summary

IDACORP is an energy company based in Idaho, and investors may want to consider investing in the company to benefit from the state’s current economic growth. The analysis of IDACORP involves examining a number of factors such as financial and operational performance, industry trends, competitive landscape, and management expertise. A technical analysis of IDACORP can help investors identify potential opportunities and risks. This would include looking at chart patterns, technical indicators, and other technical tools in order to spot potential entry and exit points.

Fundamental analysis is also important, and should include an assessment of the company’s financials, customer base, debt levels, and future prospects. Finally, assessing management performance and strategy are key when it comes to making a successful and informed investment.

Recent Posts