Icu Medical Intrinsic Stock Value – Citigroup Exercises Caution with ICU Medical Holdings in Volatile Investing Landscape

June 21, 2023

🌥️Trending News

In light of the tumultuous investing landscape, Citigroup Inc. has taken a conservative approach by reducing its stake in ICU ($NASDAQ:ICUI) Medical Holdings. ICU Medical Holdings is a medical device company based in San Clemente, California that specializes in the manufacturing and distribution of medical products for infusion therapy, oncology, and critical care applications. The company’s products are used in hospitals, ambulatory care centers, long-term care facilities, and alternate care sites. Citigroup had been a major investor in ICU Medical, but recent changes in the market have led the firm to scale back its holding. Citigroup does not appear to have any plans to completely divest from ICU Medical, however this move indicates a degree of caution in the face of rapid market instability.

Stock Price

On Thursday, ICU Medical Holdings found itself in a volatile investing landscape, with Citigroup Inc. taking a cautious approach. The stock opened at $191.6 and closed at $191.9, without much of a change throughout the day. Although the stock did not experience any drastic movement, investors remain wary of potential volatility in the coming weeks and months.

Citigroup Inc. has advised investors to exercise caution when dealing with ICU Medical Holdings amid the volatile investing environment, emphasizing that the company’s performance could suffer due to the unpredictable nature of the market. The company has yet to comment on how it will handle the uncertain investing climate, but investors can expect further caution from the financial giant. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Icu Medical. More…

| Total Revenues | Net Income | Net Margin |

| 2.31k | -46.03 | -1.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Icu Medical. More…

| Operations | Investing | Financing |

| -19.54 | -56.9 | -27.72 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Icu Medical. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.47k | 2.37k | 87.29 |

Key Ratios Snapshot

Some of the financial key ratios for Icu Medical are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 22.2% | -43.0% | 0.3% |

| FCF Margin | ROE | ROA |

| -4.8% | 0.2% | 0.1% |

Analysis – Icu Medical Intrinsic Stock Value

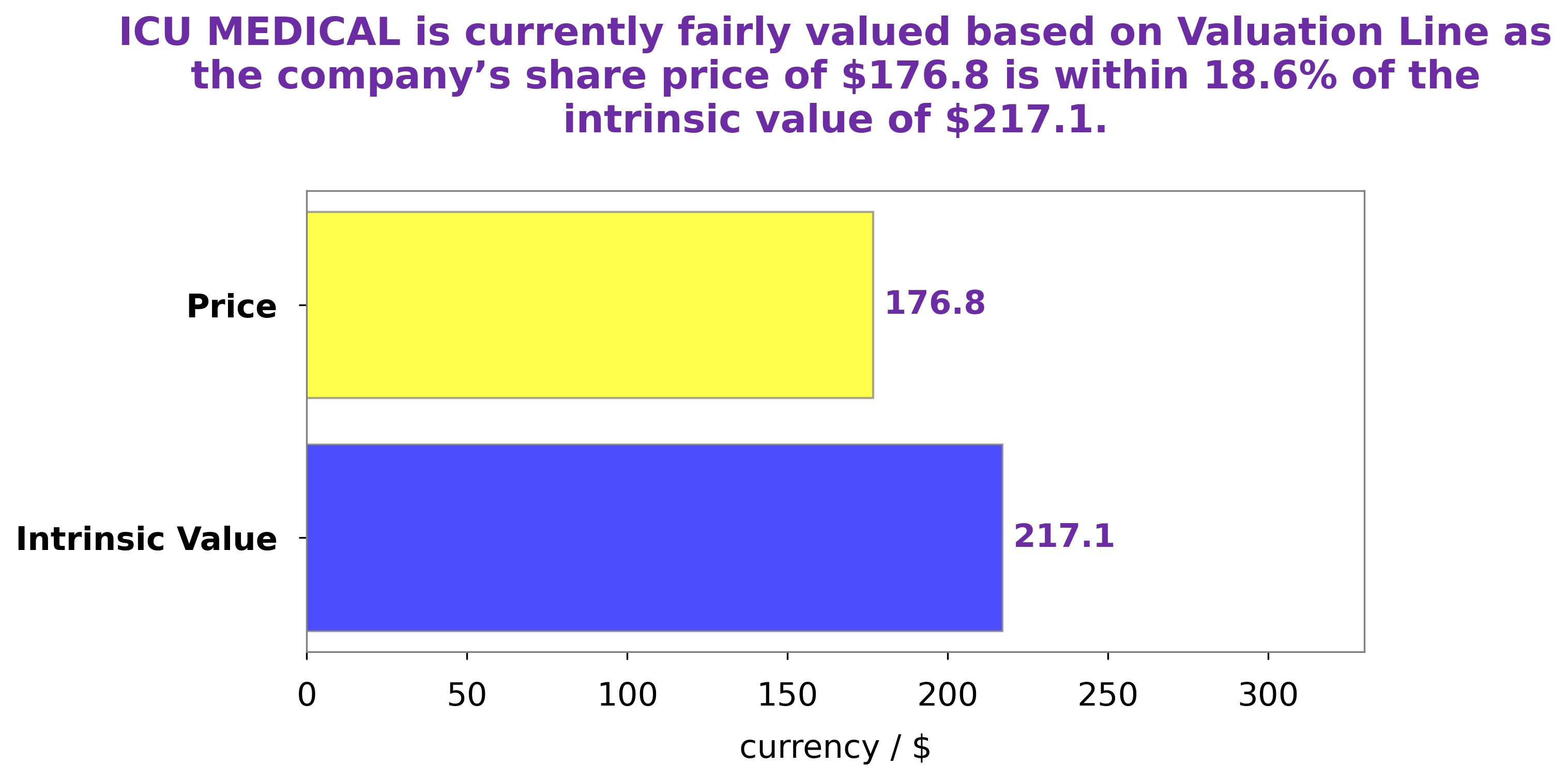

At GoodWhale, we’ve been analyzing the fundamentals of ICU MEDICAL, and have determined that the stock is undervalued. Using our proprietary Valuation Line, we have calculated a fair value of $269.8 per share, which is 28.9% higher than the current trading price of $191.9. In other words, there’s a great buying opportunity right now for long-term investors who believe in the company’s potential. More…

Peers

It operates in a highly competitive market that includes major competitors such as Ypsomed Holding AG, Coloplast A/S, and Cardiovascular Systems Inc. These companies all strive to provide the best quality products and services to meet the needs of their customers.

– Ypsomed Holding AG ($LTS:0QLQ)

Ypsomed Holding AG is a leading Swiss medical technology company that designs, develops, and manufactures healthcare products for delivery of drugs and other treatments. The company has a market capitalization of 2.34 billion as of 2022, reflecting the confidence of investors in the company’s potential and its ability to grow in the coming years. Ypsomed Holding AG also has a Return on Equity of 4.93%, which is a measure of the company’s profitability relative to its shareholders’ equity. This indicates that the company is using its resources efficiently and delivering value to its shareholders.

– Coloplast A/S ($LTS:0QBO)

Coloplast A/S is a Danish medical device company that develops, manufactures, and markets medical products and services worldwide. The company has a market cap of 183.14B as of 2022 and a Return on Equity (ROE) of 50.58%. The market cap is an indication of the overall size of the company and its potential to generate profits. A high ROE indicates that the company is able to generate a significant return on the invested capital, making it an attractive investment. Coloplast is known for its products and services in the areas of urology, continence care, ostomy care, and wound and skin care, which have helped to ensure the company’s continued success.

– Cardiovascular Systems Inc ($NASDAQ:CSII)

Cardiovascular Systems Inc is a medical device company that develops, manufactures, and markets innovative interventional treatment systems for peripheral and coronary artery disease. The company has a market cap of 576.3M as of 2022 and a Return on Equity of -9.45%. This indicates that the company is not generating enough profits to cover its costs, which is not a good sign for the investors. Despite this, the company continues to innovate and develop new products in order to improve its financial performance.

Summary

Citigroup Inc. recently reduced its holdings in ICU Medical Inc., the world’s largest provider of specialty medical products. The move serves as a reminder of the volatile investment environment and the importance of taking caution when investing. While ICU Medical has long been viewed as a stable investment and a reliable source of income, recent market volatility, uncertain economic conditions, and heightened competition have raised red flags in the eyes of investors.

Despite these factors, ICU Medical remains well-positioned with a strong presence across multiple markets and a diverse product portfolio. As such, investors should continue to monitor the company’s performance and exercise caution when making decisions regarding their investments.

Recent Posts