Hotel Royal Stock Fair Value – Royal Orchid Hotels Soars 50% in 5 Weeks, Reaching New Highs!

May 12, 2023

Trending News ☀️

The stock of Royal Orchid Hotel ($SGX:H12)s has been making waves in the stock market recently, soaring 50% in five weeks and reaching an all-time high. Royal Orchid Hotels is a hospitality chain that caters to both business and leisure travelers. The strong performance of the stock is a testament to the success of the business model adopted by the company. Royal Orchid Hotels has consistently offered quality services to its customers, which has earned them the loyalty of their guests. They also have a very efficient marketing team that has been successful in driving up the demand for their services.

The company has also invested heavily in its infrastructure, which has helped them become more competitive in the hospitality industry. The surge in the stock of Royal Orchid Hotels is expected to continue as the company is looking to expand its operations further. They have already opened new properties in India and are planning to expand into international markets over the next few years. This is certainly good news for investors, as they will now be able to benefit from the future growth potential of Royal Orchid Hotels.

Analysis – Hotel Royal Stock Fair Value

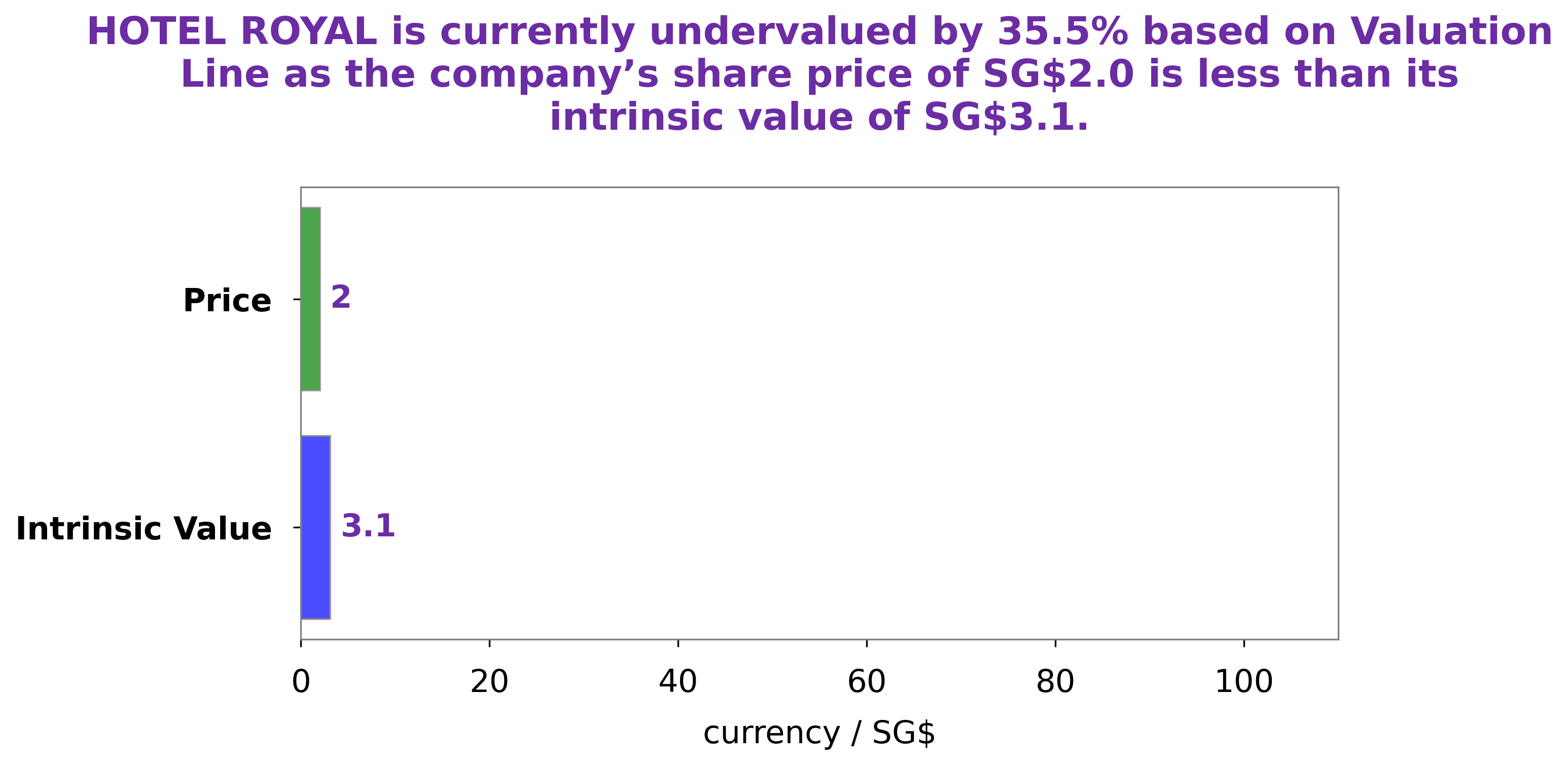

At GoodWhale, we have performed an analysis of HOTEL ROYAL‘s financials. Based on our proprietary Valuation Line, our calculations indicate that the fair value of HOTEL ROYAL share is around SG$3.1. Interestingly, the current trading price of HOTEL ROYAL stock at SG$2.0 is undervalued by 36.2%. Therefore, this presents an interesting investment opportunity for investors to capitalise on the potential upside. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Hotel Royal. More…

| Total Revenues | Net Income | Net Margin |

| 41.89 | -3.44 | -12.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Hotel Royal. More…

| Operations | Investing | Financing |

| 5.71 | -9.5 | 20.86 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Hotel Royal. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 826.33 | 195.21 | 5.38 |

Key Ratios Snapshot

Some of the financial key ratios for Hotel Royal are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -10.1% | -24.8% | 6.8% |

| FCF Margin | ROE | ROA |

| -7.5% | 0.3% | 0.2% |

Peers

The company competes with Shangri-La Asia Ltd, Shangri-La Hotels Malaysia Bhd, and Portsmouth Square Inc.

– Shangri-La Asia Ltd ($SEHK:00069)

Shangri-La Asia Ltd is a Hong Kong-based investment holding company principally engaged in hotels and resorts operation. The Company operates its businesses through five segments. The Hotel Operations segment is engaged in the operation of hotels, resorts and serviced apartments under the Shangri-La, Kerry, Traders and Hotel Jen brands. The Property Development and Investment segment is engaged in the development and investment of properties. The Property Management segment is engaged in the provision of property management services to properties. The Trading and Manufacturing segment is engaged in the trading of food and beverage products and the manufacturing of food products. The Others segment includes the provision of corporate guarantee, management and consultancy services.

– Shangri-La Hotels Malaysia Bhd ($KLSE:5517)

Founded in Malaysia, Shangri-La Hotels is a premier hospitality company that owns and operates hotels, resorts, and residences around the world. The company has a market capitalization of 1.51 billion as of 2022 and a return on equity of -6.52%. Shangri-La Hotels is committed to providing exceptional customer service and luxurious accommodations to its guests. The company’s properties are located in some of the most desirable destinations in the world, including Malaysia, Singapore, Hong Kong, China, and the United Arab Emirates.

– Portsmouth Square Inc ($OTCPK:PRSI)

Portsmouth Square is a publicly traded real estate investment trust that focuses on owning and operating commercial real estate properties in the United States. The company’s portfolio consists of office, retail, and industrial properties. Portsmouth Square’s market cap is $28.56 million, and its ROE is -1.19%.

Summary

This surge in stock prices is attributed to Royal Orchid’s increasingly positive financial performance. The hotel chain has seen increased revenue and profits on the back of strong occupancy rates and higher average room rates. Over the same period, their occupancy rates have increased while their sales have also grown significantly.

The company has also undertaken various initiatives to improve their service offerings and customer experience. With these efforts, Royal Orchid is well-positioned to continue its growth trajectory for the foreseeable future.

Recent Posts