Hologic Intrinsic Value – NFL Rookie Kelee Ringo and Family Partner with Hologic for Inspirational Collaboration

May 17, 2023

Trending News ☀️

Hologic ($NASDAQ:HOLX) is proud to announce a unique collaboration with the Ringo family, led by NFL rookie Kelee Ringo. The Ringos are an inspirational family, and Hologic is excited to partner with them on this project. Hologic is a global leader in diagnostic imaging, breast health, and women’s health. With a portfolio of innovative and trusted products, Hologic is dedicated to helping people lead healthier lives. The partnership between Hologic and the Ringo family stands to be an inspiring one, with the goal of helping families across the country.

Through this collaboration, Hologic hopes to bring attention to important topics that can be difficult to discuss with families. The partnership aims to raise awareness of the importance of family communication and support, as well as other social issues that are important to Kelee and his family. Hologic looks forward to working with the Ringo family to spread their message and inspire families everywhere to stay connected. Together, the Ringos and Hologic will strive to create a lasting legacy of positive impact on families across the nation.

Price History

The collaboration aims to provide an inspiring message to families across the country who are dealing with similar hardships as the Ringo family. The collaboration was marked by a slight downturn for HOLOGIC‘s stock, which opened on Tuesday at $82.0, and closed at $81.3, down 1.2% from its previous closing price of 82.4. Despite the small dip in the stock, the Ringo family is still enthusiastic about their partnership with HOLOGIC and the impact it will have on the lives of other families. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Hologic. More…

| Total Revenues | Net Income | Net Margin |

| 4.06k | 753 | 18.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Hologic. More…

| Operations | Investing | Financing |

| 959 | -99.3 | -573 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Hologic. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.45k | 4.15k | 21.54 |

Key Ratios Snapshot

Some of the financial key ratios for Hologic are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.9% | 33.4% | 25.0% |

| FCF Margin | ROE | ROA |

| 20.7% | 12.2% | 6.7% |

Analysis – Hologic Intrinsic Value

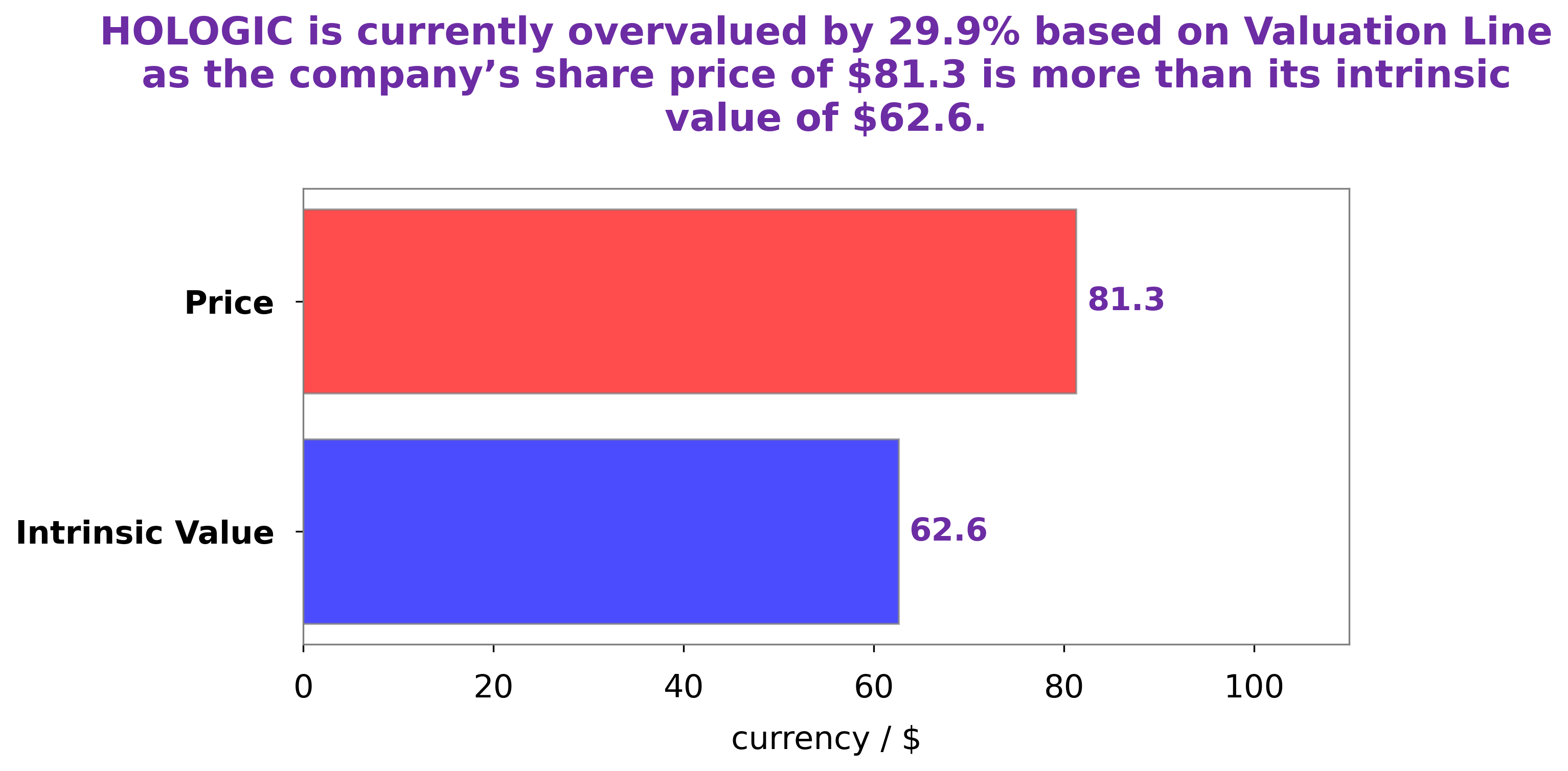

GoodWhale has conducted an analysis of HOLOGIC‘s wellbeing, and we determined that the fair value of their share is around $62.6. This calculation was done using our proprietary Valuation Line, which takes into account various factors such as financial statements, market conditions, and historical trends. Despite this, the current market price of HOLOGIC stock is $81.3, resulting in an overvaluation of 29.9%. This can be attributed to a surge in investor demand due to strong earnings reports and bullish sentiment in the markets. However, in the long-term, it is unlikely that the stock will remain overvalued and hence investors should be cautious when considering investing in HOLOGIC. More…

Peers

The company’s products are used in a variety of settings, including hospitals, clinics, and physician offices. Hologic also provides a range of services, including support, training, and education. The company has a strong presence in the United States and international markets, and its products are backed by a large body of scientific research. ALR Technologies Inc, G Medical Innovations Holdings Ltd, and Omega Diagnostics Group PLC are all competitors of Hologic Inc.

– ALR Technologies Inc ($OTCPK:ALRT)

ALR Technologies Inc is a publicly traded company with a market capitalization of $19.32 million as of 2022. The company has a return on equity of 17.26%. ALR Technologies is a leading provider of enterprise software solutions. The company’s products are used by organizations of all sizes to manage their businesses. ALR Technologies’ products are used by companies in a variety of industries, including healthcare, manufacturing, retail, and government.

– G Medical Innovations Holdings Ltd ($NASDAQ:GMVD)

As of 2022, Aetna’s market cap was 5.58M and its ROE was 783.79%. Aetna is a diversified healthcare benefits company that offers a broad range of traditional and consumer-directed health insurance products and related services, including medical, pharmacy, dental, behavioral health, group life and disability plans, and medical management capabilities and health care management services for Medicaid plans.

– Omega Diagnostics Group PLC ($LSE:ODX)

Omega Diagnostics Group PLC is a medical diagnostics company. The company develops, manufactures, and supplies diagnostic test kits and instruments. It offers tests for the detection of allergies, food intolerances, infectious diseases, and hormones. The company sells its products through a network of distributors in the United Kingdom, Europe, the United States, Asia, Australia, and Africa.

Summary

Hologic, Inc. has recently announced a partnership with NFL rookie Kelee Ringo and his family. The strategic alliance between Hologic and Ringo is set to bring a larger brand presence in the football market for Hologic. The company is hopeful that this partnership will boost its investor confidence and attract more attention from potential investors. Hologic is a leading global medical technology company with a strong emphasis on providing innovative healthcare solutions.

Its product offerings span the cancer, women’s health, and diagnostic solutions markets, and it remains focused on improving the quality of life for individuals through its range of products. Analysts believe that the strategic alliance with Ringo is likely to create positive sentiment among investors, as well as potentially drive increased awareness of the company’s products and services.

Recent Posts