Hologic Intrinsic Stock Value – Raymond James Financial Services Advisors Reduces Stake in Hologic,

October 25, 2023

🌥️Trending News

Raymond James Financial Services Advisors Inc. has recently announced that it is reducing its stake in Hologic ($NASDAQ:HOLX), Inc. Hologic, Inc. is a leader in the medical device and diagnostics industry. It provides diagnostic solutions for medical imaging, biopsy and surgical applications in a range of areas, including women’s health, general surgery, osteoporosis, and molecular diagnostics. The company also offers mammography, ultrasound, magnetic resonance imaging (MRI), computed tomography (CT) and X-ray imaging systems and services. Its products are used to diagnose and treat a variety of medical conditions, including breast cancer, thyroid disease, osteoporosis, and other gynecologic diseases.

Hologic’s diagnostic tools are used to detect and diagnose various types of cancers and other illnesses in both women and men. Hologic’s stock has seen a rise in recent months and Raymond James Financial Services Advisors Inc. appears to be taking a step back for now. Its decision to reduce its stake in the company could signify a potential shift in investor sentiment towards Hologic’s stock.

Share Price

On Tuesday, Raymond James Financial Services Advisors Inc. announced that it has significantly reduced its stake in Hologic, Inc. This news sent HOLOGIC stock prices climbing, as it opened at $67.2 and closed at $67.9, up by 0.5% from its previous closing price of 67.6. The company has yet to release any specific details on why it has decided to reduce its stake in Hologic. However, investors seem to be optimistic about the future of the company, as evidenced by the slight increase in stock prices. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Hologic. More…

| Total Revenues | Net Income | Net Margin |

| 4.04k | 484.1 | 13.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Hologic. More…

| Operations | Investing | Financing |

| 961.1 | -128.2 | -442.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Hologic. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.34k | 4.16k | 21.16 |

Key Ratios Snapshot

Some of the financial key ratios for Hologic are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.0% | 19.7% | 19.3% |

| FCF Margin | ROE | ROA |

| 20.6% | 9.3% | 5.2% |

Analysis – Hologic Intrinsic Stock Value

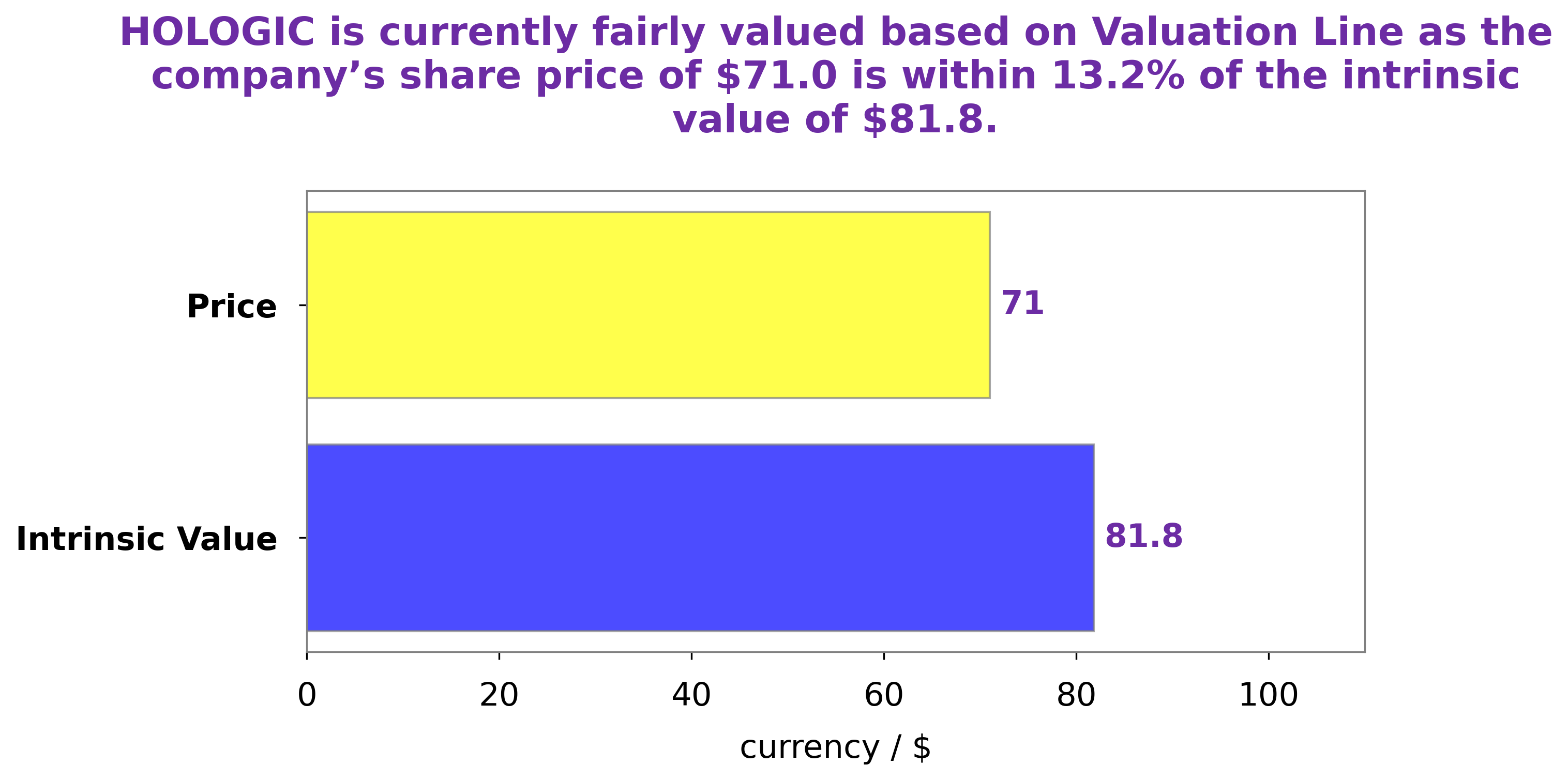

As GoodWhale, we have conducted an analysis of HOLOGIC‘s wellbeing and have determined that its intrinsic value is around $63.6. This calculation was made with the help of our proprietary Valuation Line. More…

Peers

The company’s products are used in a variety of settings, including hospitals, clinics, and physician offices. Hologic also provides a range of services, including support, training, and education. The company has a strong presence in the United States and international markets, and its products are backed by a large body of scientific research. ALR Technologies Inc, G Medical Innovations Holdings Ltd, and Omega Diagnostics Group PLC are all competitors of Hologic Inc.

– ALR Technologies Inc ($OTCPK:ALRT)

ALR Technologies Inc is a publicly traded company with a market capitalization of $19.32 million as of 2022. The company has a return on equity of 17.26%. ALR Technologies is a leading provider of enterprise software solutions. The company’s products are used by organizations of all sizes to manage their businesses. ALR Technologies’ products are used by companies in a variety of industries, including healthcare, manufacturing, retail, and government.

– G Medical Innovations Holdings Ltd ($NASDAQ:GMVD)

As of 2022, Aetna’s market cap was 5.58M and its ROE was 783.79%. Aetna is a diversified healthcare benefits company that offers a broad range of traditional and consumer-directed health insurance products and related services, including medical, pharmacy, dental, behavioral health, group life and disability plans, and medical management capabilities and health care management services for Medicaid plans.

– Omega Diagnostics Group PLC ($LSE:ODX)

Omega Diagnostics Group PLC is a medical diagnostics company. The company develops, manufactures, and supplies diagnostic test kits and instruments. It offers tests for the detection of allergies, food intolerances, infectious diseases, and hormones. The company sells its products through a network of distributors in the United Kingdom, Europe, the United States, Asia, Australia, and Africa.

Summary

Hologic, Inc. (NASDAQ: HOLX) has seen a decrease in investments from Raymond James Financial Services Advisors Inc., as reported in a recent filing with the Securities and Exchange Commission. Analysts have noted that while Hologic’s performance has been good, it has recently been struggling in the Health Care Technology sector. This has caused investors to be wary of the stock, even with its good history and strong fundamentals. Despite the recent dip, many analysts believe that Hologic’s long-term outlook is still positive.

They are encouraged by Hologic’s strong product lineup and innovation capabilities. As such, investors may want to consider investing in Hologic for the long run.

Recent Posts