Hologic Intrinsic Stock Value – Hologic Stock Outperforms Despite Day’s Losses, S&P 500 Struggles

April 22, 2023

Trending News 🌧️

Hologic ($NASDAQ:HOLX) Inc., a medical technology company that specializes in diagnostics, surgical and medical imaging systems, has seen its stock price outperform its peers despite Tuesday’s losses. On Tuesday, the stock dropped 1.35% to $82.51 during a mixed trading session for the S&P 500. Despite this loss, Hologic Inc. showed resilience in comparison to the S&P 500, which struggled throughout the day. Hologic Inc. is a global leader in developing innovative solutions to advance women’s health in healthcare.

With products ranging from ultrasound systems to robotics and digital breast health solutions, Hologic Inc. has become an industry leader in diagnostics and surgical imaging solutions. Hologic Inc. is also known for its commitment to providing quality healthcare services and products to patients around the world. The company’s goal is to ensure that every patient receives the highest level of care they need and deserve.

Stock Price

On Wednesday, HOLOGIC Inc. delivered an impressive performance despite losses in the broader stock market. HOLOGIC stock opened at $82.8 and closed at $84.0, up 1.8% from its last closing price of $82.5. It is clear that the stock of HOLOGIC Inc. has been performing well in spite of the rough market conditions.

Investors seem to be confident in the company’s future prospects and have been buying up its shares. This is a reflection of the strength of the company and its ability to weather difficult times. Hologic_Stock_Outperforms_Despite_Days_Losses_SP_500_Struggles”>Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Hologic. More…

| Total Revenues | Net Income | Net Margin |

| 4.47k | 990.2 | 22.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Hologic. More…

| Operations | Investing | Financing |

| 1.81k | -73.8 | -726 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Hologic. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.29k | 4.2k | 20.65 |

Key Ratios Snapshot

Some of the financial key ratios for Hologic are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.7% | 69.7% | 29.2% |

| FCF Margin | ROE | ROA |

| 38.0% | 16.3% | 8.8% |

Analysis – Hologic Intrinsic Stock Value

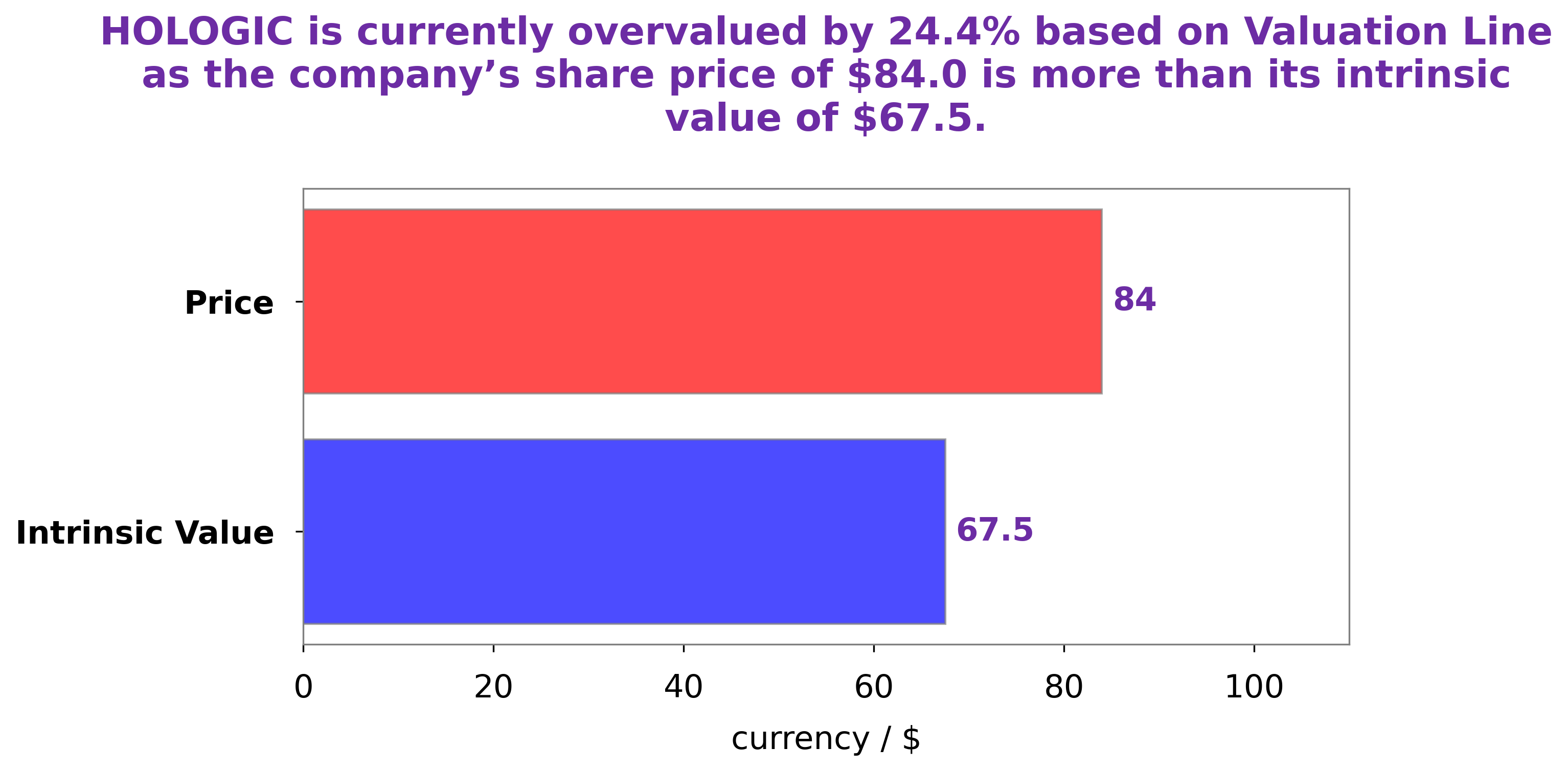

At GoodWhale, we recently conducted an analysis of HOLOGIC’s wellbeing. Our proprietary Valuation Line determined the fair value of HOLOGIC share to be around $67.5. However, the current market price is $84.0, resulting in an overvaluation of 24.5%. It is worth noting that the valuation of HOLOGIC might change in the future due to various factors. We suggest investors carefully review the company and its financials before making any decisions. Hologic_Stock_Outperforms_Despite_Days_Losses_SP_500_Struggles”>More…

Peers

The company’s products are used in a variety of settings, including hospitals, clinics, and physician offices. Hologic also provides a range of services, including support, training, and education. The company has a strong presence in the United States and international markets, and its products are backed by a large body of scientific research. ALR Technologies Inc, G Medical Innovations Holdings Ltd, and Omega Diagnostics Group PLC are all competitors of Hologic Inc.

– ALR Technologies Inc ($OTCPK:ALRT)

ALR Technologies Inc is a publicly traded company with a market capitalization of $19.32 million as of 2022. The company has a return on equity of 17.26%. ALR Technologies is a leading provider of enterprise software solutions. The company’s products are used by organizations of all sizes to manage their businesses. ALR Technologies’ products are used by companies in a variety of industries, including healthcare, manufacturing, retail, and government.

– G Medical Innovations Holdings Ltd ($NASDAQ:GMVD)

As of 2022, Aetna’s market cap was 5.58M and its ROE was 783.79%. Aetna is a diversified healthcare benefits company that offers a broad range of traditional and consumer-directed health insurance products and related services, including medical, pharmacy, dental, behavioral health, group life and disability plans, and medical management capabilities and health care management services for Medicaid plans.

– Omega Diagnostics Group PLC ($LSE:ODX)

Omega Diagnostics Group PLC is a medical diagnostics company. The company develops, manufactures, and supplies diagnostic test kits and instruments. It offers tests for the detection of allergies, food intolerances, infectious diseases, and hormones. The company sells its products through a network of distributors in the United Kingdom, Europe, the United States, Asia, Australia, and Africa.

Summary

Hologic Inc. has had a strong performance in the stock market, despite recording losses on the day. Its stock price dropped 1.35%, closing at $82.51 on Tuesday. The wider market was mixed, with the S&P 500 ending the session flat. Investors seem to remain positive about Hologic despite the losses, suggesting that the company is well positioned for growth.

Analysts recommend investors look favorably on Hologic as the stock has outperformed its competitors. They suggest monitoring the company’s fundamentals and risk factors when considering investing in their stock.

Recent Posts