Gt Steel Construction Intrinsic Value Calculator – GT Steel Construction Group Sees 17% Increase in Revenue for Q1 2023

May 24, 2023

Trending News ☀️

GT ($SEHK:08402) Steel Construction Group, a leading steel constructions and engineering company based in Singapore, saw a 17% increase in revenue for the first quarter of 2023 compared to the same period in 2022. The total revenue for this quarter reached S$3.60m, reflecting the company’s strong performance in the period. This surge in revenue is attributed to GT Steel Construction Group’s commitment to providing high-quality products and services to its clients, its focus on innovation and development, and its ability to maintain efficient operations. The company’s research and development team has consistently explored new ways to improve its products and services, while its operations team has been able to streamline processes and improve efficiency. The company’s stock price has also seen an increase over the past quarter, as investors recognize the potential of the company and its strong financial performance.

GT Steel Construction Group’s commitment to sustainability and strong corporate governance has contributed to its positive share price performance. Overall, GT Steel Construction Group’s strong financial performance in the first quarter of 2023 is a testament to its commitment to quality and innovation. With its sound financial standing, the company is well-positioned to capitalize on future opportunities in the industry.

Analysis – Gt Steel Construction Intrinsic Value Calculator

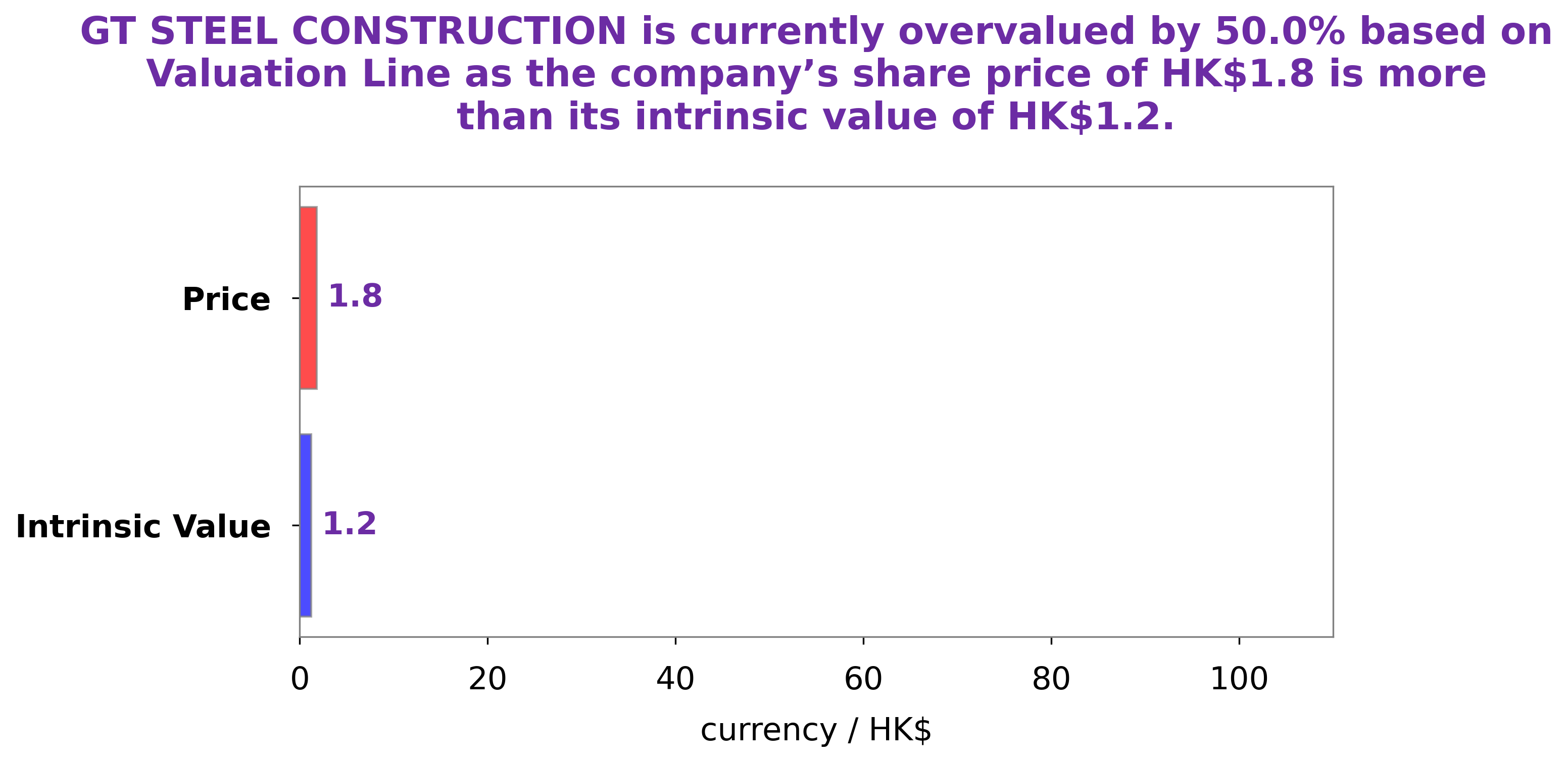

At GoodWhale, we’ve conducted an analysis of GT STEEL CONSTRUCTION’s fundamentals and have come to the conclusion that the fair value of the stock is around HK$1.2. This is estimated with our proprietary Valuation Line, which takes into account the company’s earnings, liquidity, debt, and more. Currently, GT STEEL CONSTRUCTION stock is trading at HK$1.8, which is 47.6% more than our calculated fair value. We advise investors to exercise caution when investing in GT STEEL CONSTRUCTION at this time. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Gt Steel Construction. More…

| Total Revenues | Net Income | Net Margin |

| 9.39 | -6.76 | -72.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Gt Steel Construction. More…

| Operations | Investing | Financing |

| 0.97 | -0.12 | -1.71 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Gt Steel Construction. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 18.01 | 6.86 | 0.03 |

Key Ratios Snapshot

Some of the financial key ratios for Gt Steel Construction are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -43.1% | 31.0% | -70.4% |

| FCF Margin | ROE | ROA |

| 9.0% | -32.9% | -22.9% |

Peers

The competition between GT Steel Construction Group Ltd and its competitors, Tung Ho Steel Enterprise Corp, PT Betonjaya Manunggal Tbk, and VNSTEEL – VICASA JSC, is fierce. Companies in this sector are constantly innovating to stay ahead in the ever-changing market, striving to offer the best products and services to their customers. As the competition intensifies, these four companies continue to push each other to become more efficient and cost-effective.

– Tung Ho Steel Enterprise Corp ($TWSE:2006)

Tung Ho Steel Enterprise Corp is a Taiwanese steel producer and distributor. The company serves the construction, automotive, and appliance markets. As of 2023, the company has a market cap of 45.27B, which makes it one of the largest steel companies in the world. Additionally, the company has a strong Return on Equity of 12.37%, indicating that it is efficiently using its assets to generate profits for investors. Tung Ho Steel Enterprise Corp is well-positioned for future growth and profitability.

– PT Betonjaya Manunggal Tbk ($IDX:BTON)

PT Betonjaya Manunggal Tbk is a leading Indonesian construction and engineering company. It specializes in the construction of infrastructure such as bridges, roads, and ports. The company has a market cap of 288B as of 2023, making it one of the most valuable companies in Indonesia. Its Return on Equity stands at 1.93%, which is impressive considering the size of the company and the fact that ROE is a measure of how efficiently a company utilizes its equity capital to generate profits. This suggests that the company is efficiently utilizing its resources to generate returns for its investors.

Summary

GT Steel Construction Group reported strong first quarter results for the 2023 financial year, with revenues of S$3.60m, representing a 17% year-over-year increase. This was well received by the market, with the stock price rising significantly the same day. Analysts believe this is indicative of the company having a successful year ahead.

The company has seen steady growth in recent quarters, due to increased demand for their services and strong cost management. Going forward, investors should look for further growth and consider the company as an attractive investment opportunity, as its prospects remain bright.

Recent Posts