Graco Inc Intrinsic Value – Graco Strengthens Executive Leadership Team with New Appointments

April 7, 2023

Trending News ☀️

Graco Inc ($NYSE:GGG) are a global leader in the development, manufacturing and distribution of highly-engineered systems and components for various industrial and commercial applications. They recently made changes to their executive leadership team, appointing new team members in order to further strengthen their business. He was previously Global Controller at the company and will be taking on the additional responsibilities of overseeing financial planning, reporting, and analysis.

These new appointments are part of Graco’s strategic focus on delivering top-notch products and services to its customers. The company is confident that its newly-strengthened executive leadership team will be a major contributor to its success in the years to come.

Share Price

On Wednesday, GRACO INC announced the strengthening of their executive leadership team with the appointment of two new members. The news sent GRACO INC stock on a downward spiral as it opened at $70.2, only to close at $69.5, a drop of 1.6% from its closing price the day before at 70.7. The newly appointed executives bring with them a wealth of experience and knowledge from their respective industries. GRACO INC is confident that these appointments will help to further enhance its leadership team and provide strong support for the company’s future growth and success.

The appointments also come at a time when the company is looking to expand its operations and enhance its portfolio. With these new appointments, GRACO INC is hoping that they can create a strong foundation for sustainable growth and prosperity in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Graco Inc. More…

| Total Revenues | Net Income | Net Margin |

| 2.14k | 460.64 | 21.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Graco Inc. More…

| Operations | Investing | Financing |

| 377.39 | -226.82 | -434.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Graco Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.44k | 579.25 | 11.09 |

Key Ratios Snapshot

Some of the financial key ratios for Graco Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.2% | 10.5% | 26.9% |

| FCF Margin | ROE | ROA |

| 8.2% | 19.7% | 14.8% |

Analysis – Graco Inc Intrinsic Value

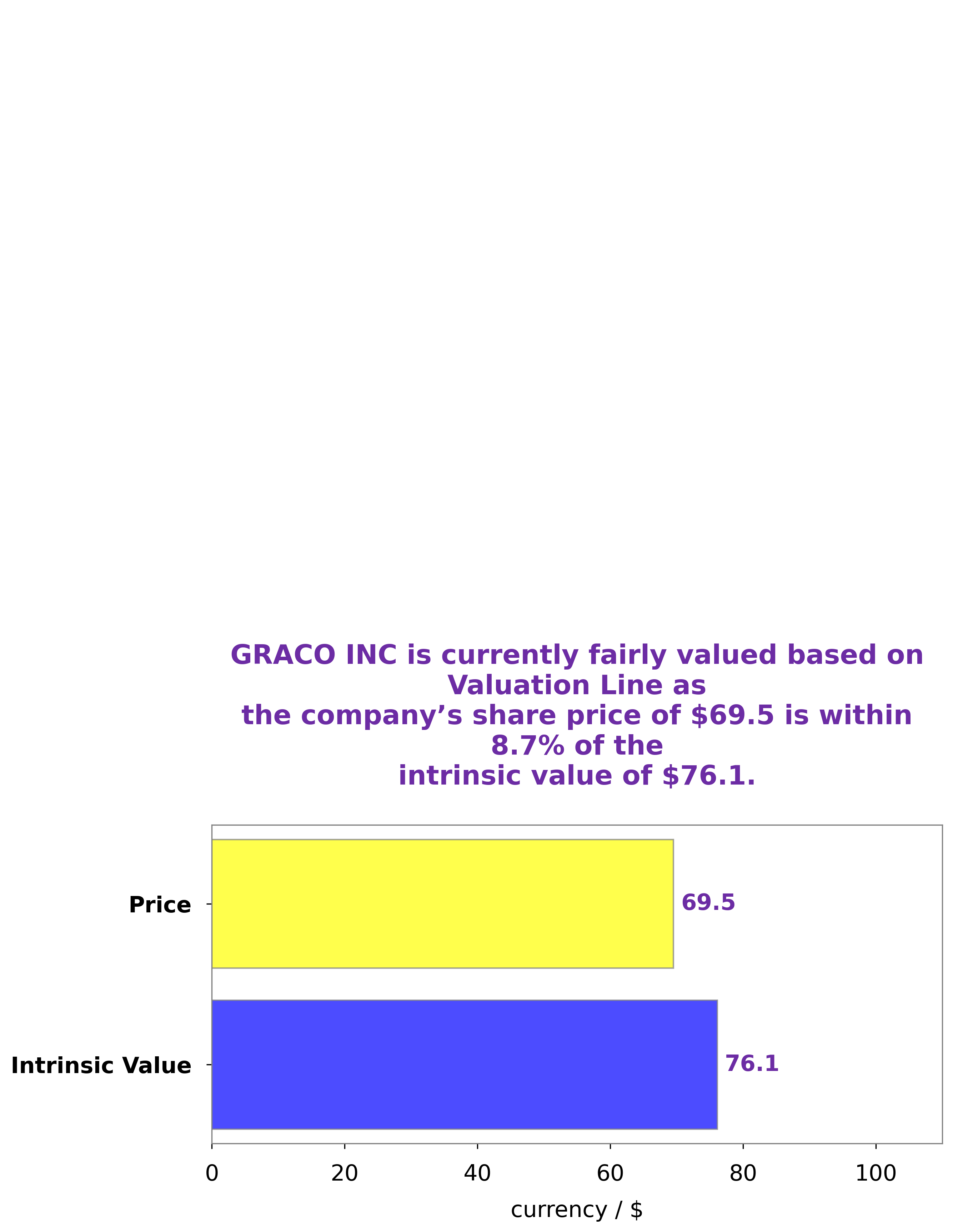

GoodWhale analysed GRACO INC‘s fundamentals and found that the intrinsic value of its share is around $76.1. This was calculated using our proprietary Valuation Line, which applies several indicators to analyse the company’s financials. Right now, the stock is traded at $69.5 – this is a fair price and represents an 8.7% discount to the intrinsic value. Therefore, GRACO INC stock is undervalued and could be a good buy for investors looking for a good return in the long term. More…

Peers

The company’s products include pumps, valves, proportioners, injectors, and DispenseMate systems. Graco’s competitors include Nordson Corp, Manitou BF SA, and Crane Co.

– Nordson Corp ($NASDAQ:NDSN)

Nordson Corp is a market leader in providing technology-based solutions for industrial and consumer markets worldwide. The company has a market cap of 12.1B as of 2022 and a Return on Equity of 18.05%. Nordson provides a broad range of products and solutions for adhesives, coatings, sealants, and other materials processing applications. The company’s products are used in a variety of industries, including automotive, aerospace, electronics, medical devices, and consumer goods. Nordson has a strong global presence, with over 60 manufacturing facilities and sales and service offices in more than 30 countries.

– Manitou BF SA ($LTS:0NDA)

Manitou BF SA is a French company that manufactures and markets construction equipment. The company has a market cap of 769.05M as of 2022 and a Return on Equity of 7.65%. Manitou BF SA’s products include excavators, loaders, and backhoes. The company sells its products through a network of dealers and distributors in Europe, North America, South America, Asia, and Africa.

– Crane Co ($NYSE:CR)

Crane Co. is a global manufacturer of engineered industrial products. The Company operates in four segments: Fluid Handling, Payment & Merchandising Technologies, Aerospace & Electronics and Engineered Materials. Fluid Handling segment designs, manufactures and markets a broad range of engineered industrial products. Payment & Merchandising Technologies segment provides technology solutions for the self-service retail market. Aerospace & Electronics segment provides critical components and systems for the aerospace and defense industries, and Engineered Materials segment provides highly engineered products for energy markets and other industrial applications. Crane Co. was founded in 1855 and is headquartered in Stamford, Connecticut.

Summary

Graco Inc. has recently announced changes to its executive leadership team. These changes include appointing a new President and Chief Operating Officer, as well as two other executives in the company’s commercial leadership team. Investors may be interested in these changes, as the new executive team could bring about positive changes for the company’s financials. Graco is a global leader in manufacturing and sales of fluid handling systems and components.

With this new executive team, Graco is aiming to increase its focus on innovation, customer service, and efficiency. Investors should keep an eye on how this team performs, as it can bring renewed success to the company.

Recent Posts