Golar Lng Stock Fair Value – its most recent disclosure with the Securities & Exchange Commission

April 22, 2023

Trending News 🌧️

Golar ($NASDAQ:GLNG) LNG Limited is a Bermuda-based, publicly-traded liquefied natural gas (LNG) shipping and storage company. It is an integrated midstream liquefied natural gas (LNG) company, engaged in the transportation, regasification, liquefaction, and trading of LNG. It also provides floating storage and regasification unit (FSRU) services, and is a provider of LNG marine fuels. Natixis Advisors L.P. has recently disclosed its filing with the Securities and Exchange Commission (SEC) which shows that it has reduced its stake in Golar LNG Limited by 1.0%. Although the exact reason for the reduction of the stake was not disclosed, it is believed that Natixis Advisors L.P. may have decided to reallocate its investments elsewhere.

The performance of Golar LNG Limited’s stock has been mixed in recent months as oil and gas prices continue to remain volatile. While the stock price has seen some declines due to the uncertain market conditions, it has still managed to outperform its peers in the industry. Going forward, investors will be watching how Golar LNG Limited fares in the coming months as it seeks to capitalize on the recovery of oil and gas prices.

Price History

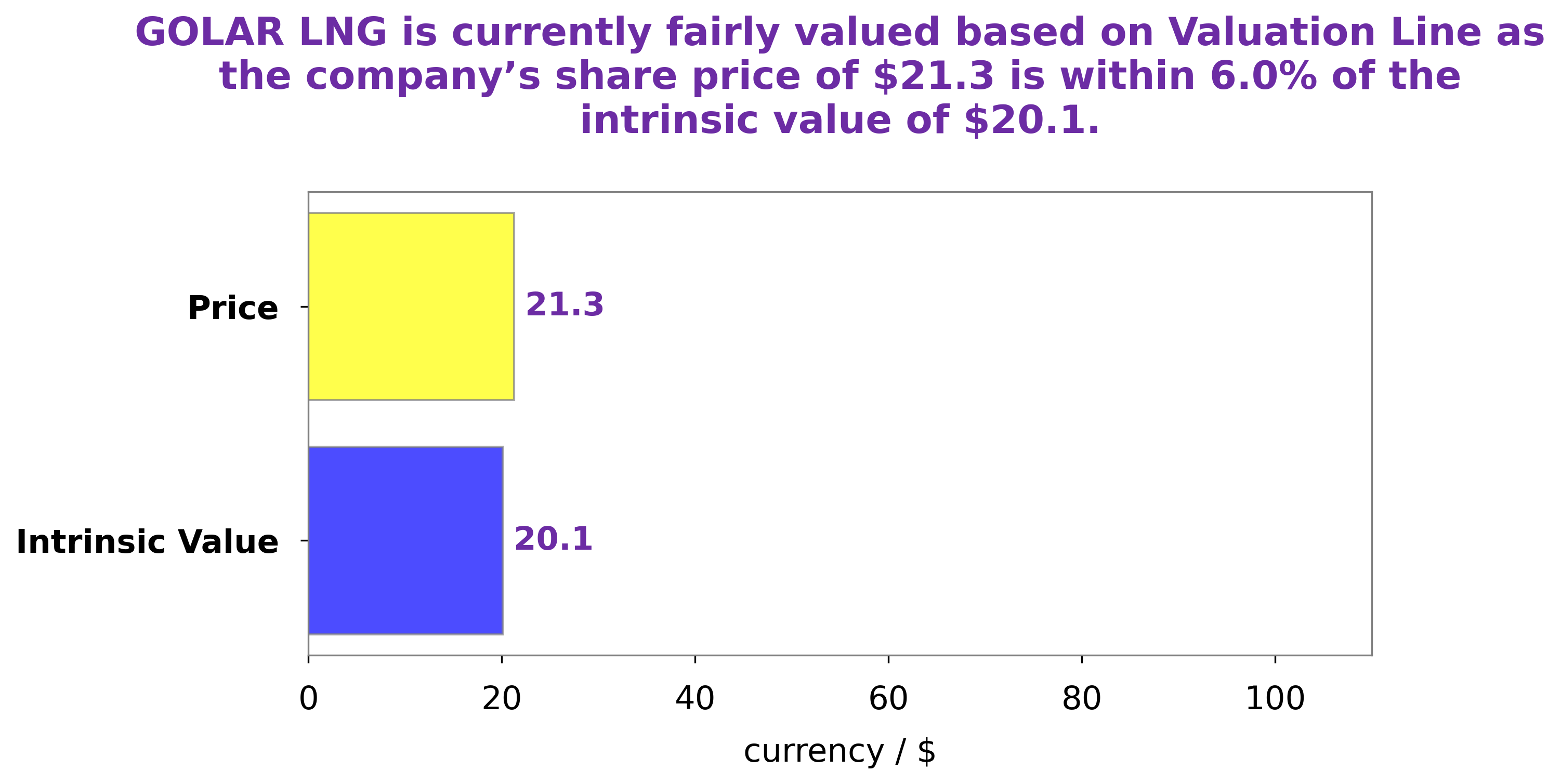

This decrease follows the closing of GOLAR LNG‘s stock at $21.3, down by 0.4% from its last closing price of $21.4. Investors will likely be monitoring GOLAR LNG’s stock closely in order to determine whether the company will be able to maintain its current price level or if a further decrease is on the horizon. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Golar Lng. More…

| Total Revenues | Net Income | Net Margin |

| 267.74 | 787.77 | 115.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Golar Lng. More…

| Operations | Investing | Financing |

| 298.88 | 1.07k | -691.64 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Golar Lng. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.28k | 1.38k | 23.32 |

Key Ratios Snapshot

Some of the financial key ratios for Golar Lng are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -15.8% | -14.9% | 379.5% |

| FCF Margin | ROE | ROA |

| 11.8% | 25.8% | 14.8% |

Analysis – Golar Lng Stock Fair Value

GoodWhale has conducted a fundamental evaluation of GOLAR LNG‘s financials and operations. The analysis revealed that the intrinsic value of GOLAR LNG share is around $20.1, obtained via GoodWhale’s proprietary Valuation Line. This valuation is lower than the current market price of GOLAR LNG stock at $21.3, meaning that the share is currently overvalued by 6.1%. More…

Peers

The competition between Golar LNG Ltd and its competitors is fierce. Each company is vying for a share of the market and customers. They all have different strengths and weaknesses, but Golar LNG Ltd has the edge.

– Fluxys Belgium SA ($LTS:0Q7U)

Fluxys Belgium SA is a leading gas infrastructure company in Belgium. The company has a market capitalization of 2.23 billion as of 2022 and a return on equity of 14.4%. Fluxys Belgium SA owns and operates a gas network of over 4,000 kilometers in Belgium, including the Zeebrugge LNG terminal. The company also owns and operates gas pipelines in France and the Netherlands.

– Genesis Energy LP ($NYSE:GEL)

Genesis Energy LP is a publicly traded limited partnership that engages in the midstream energy business in the United States. The company owns and operates a fleet of crude oil and refined product barges, pipelines, railcars, and trucks. It also owns and operates terminal facilities and a refinery. The company was founded in 1985 and is headquartered in Houston, Texas.

– EnLink Midstream LLC ($NYSE:ENLC)

EnLink Midstream LLC is a company that owns, operates, and develops midstream energy infrastructure in the United States. The company has a market cap of $5.72 billion as of 2022 and a return on equity of 26.4%. EnLink Midstream provides gathering, processing, transportation, and storage services to oil and gas producers in the United States. The company was founded in 2014 and is headquartered in Dallas, Texas.

Summary

Golar LNG Limited is a company that specializes in the development and operation of liquefied natural gas projects. Recently, Natixis Advisors L.P. trimmed its position in Golar LNG by 1.0% in the fourth quarter. Investors should analyze Golar LNG carefully before investing, as it involves a higher risk than other investments due to its exposure to market volatility and the potential for global macroeconomic shifts. Investors should pay particular attention to the company’s financials, management strength, competitive position, and regulatory environment.

They should also consider the potential risks and opportunities presented by technological advances in the field. By researching and understanding the dynamics of the industry, investors can make informed decisions and maximize their returns.

Recent Posts