Global Payments Stock Fair Value Calculator – JPMorgan Downgrades Global Payments Outlook Due to Lack of Uplifting Catalysts

April 19, 2023

Trending News 🌧️

Global Payments ($NYSE:GPN) Inc. (GPN) is a leading provider of payment technology and software solutions for merchants, financial institutions, and card issuers around the world. The company is known for its comprehensive suite of payment solutions, including mobile payment processing, e-commerce solutions, and merchant acquiring services. Recently, however, JPMorgan has downgraded its outlook for Global Payments due to a lack of uplifting catalysts. JPMorgan analysts believe that the current lack of catalysts to push the stock higher could result in a downwards pressure on the price.

In addition, the analysts point out that the company’s existing business model may be slowing down as new competitors emerge in the market. As a result, JPMorgan has adopted a Neutral stance on Global Payments and does not expect any substantial upside in the near future. Despite the current downgraded outlook, Global Payments remains one of the largest companies in the payments industry and continues to develop innovative solutions. The company is also well positioned to benefit from the increasing demand for digital payments globally and may be able to capitalize on the growing trend towards contactless transactions. Ultimately, only time will tell if Global Payments can overcome the lack of catalysts and break out of this current rut.

Price History

This news came on the same day that GLOBAL PAYMENTS stock opened at $108.9 and closed at $109.1, down by 0.6% from its last closing price of 109.8. The analysts expressed concern that the payment processing company was unlikely to benefit from an uptick in stock market performance or from any other major industry developments in the near future. They also noted that the company’s share price had been trading within a narrow range for the past few months, which could limit any potential upside for the stock. JPMorgan’s downgrade has further highlighted the risks that investors should be aware of when investing in Global Payments.

Although the company has a strong balance sheet and a well-established customer base, the lack of catalysts could make it difficult to capitalize on any potential positive market movements. As such, investors should be cautious when considering an investment in Global Payments, as the lack of uplifting catalysts could make it difficult to realize any meaningful returns. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Global Payments. More…

| Total Revenues | Net Income | Net Margin |

| 8.98k | 111.49 | 8.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Global Payments. More…

| Operations | Investing | Financing |

| 2.24k | -675.54 | -1.38k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Global Payments. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 44.81k | 22.27k | 84.78 |

Key Ratios Snapshot

Some of the financial key ratios for Global Payments are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 22.3% | 28.3% | 7.5% |

| FCF Margin | ROE | ROA |

| 18.1% | 1.9% | 0.9% |

Analysis – Global Payments Stock Fair Value Calculator

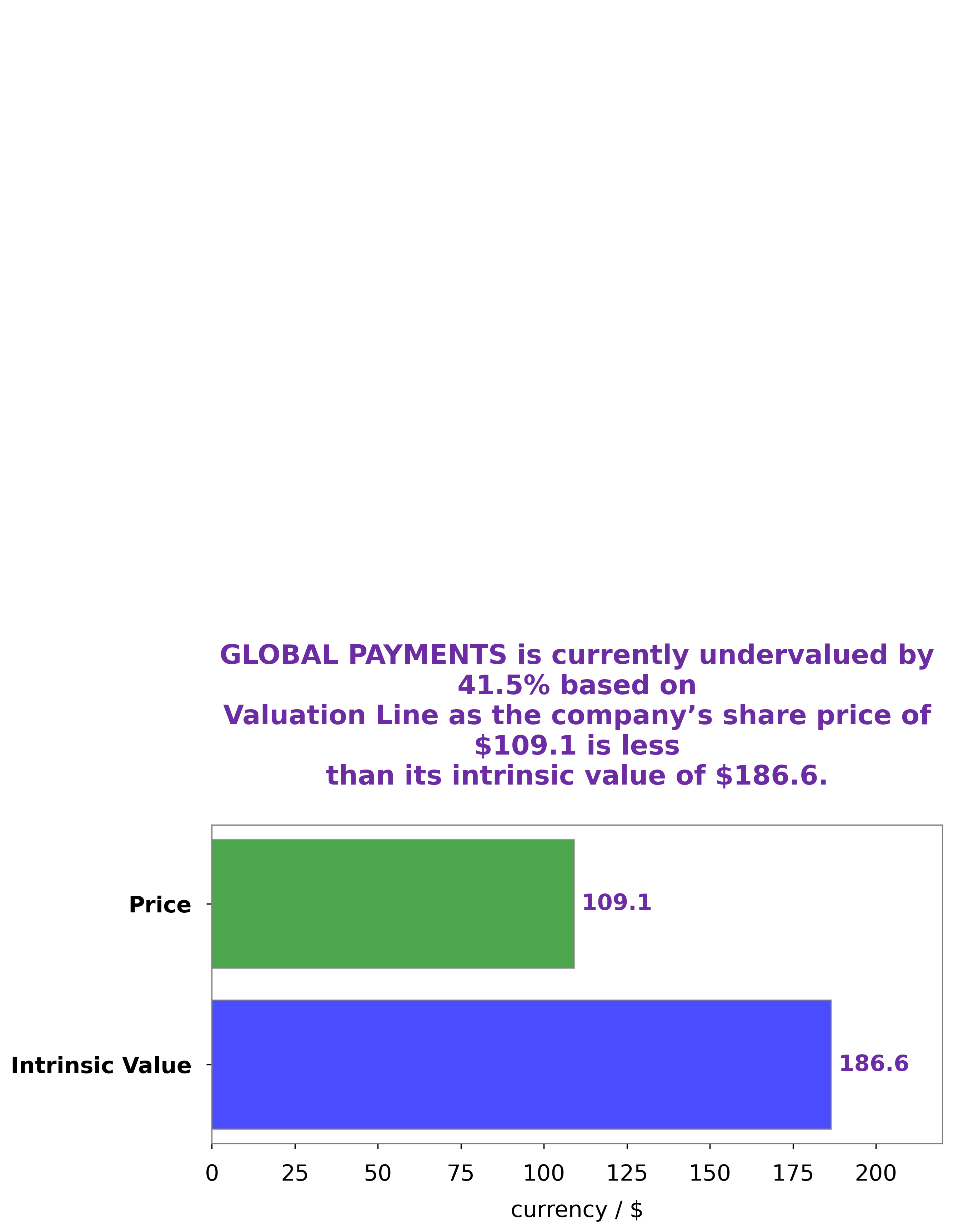

At GoodWhale, our team of experienced financial analysts has conducted an analysis of GLOBAL PAYMENTS‘ financials. Based on our proprietary Valuation Line method, we have determined that the fair value of GLOBAL PAYMENTS shares is around $186.6. Taking into consideration the current stock price of $109.1, we can see that GLOBAL PAYMENTS is currently undervalued by 41.5%. This presents an excellent opportunity to invest in GLOBAL PAYMENTS, as it offers a highly attractive return. More…

Peers

The company operates in three segments: Merchant Services, Issuer Solutions and Card Services. Global Payments Inc’s main competitors are The Brink’s Co, Thomson Reuters Corp and BLS International Services Ltd.

– The Brink’s Co ($NYSE:BCO)

Brink’s Company is a provider of security and logistics services. The company operates in more than 50 countries and employs over 70,000 people. The company has a market cap of 2.85B as of 2022 and a ROE of 97.45%. Brink’s provides a broad range of services including cash management, ATM servicing, armored car transportation, and security solutions for businesses and governments.

– Thomson Reuters Corp ($TSX:TRI)

Thomson Reuters Corp is a large Canadian multinational media and information company with a market cap of 67.4 billion as of 2022. It has a wide range of businesses including news, information and analytics, and tax and accounting software. Its return on equity was 7.59% in 2020.

– BLS International Services Ltd ($BSE:540073)

BLS International Services Ltd is a market leader in the provision of outsourced visa and passport processing services. The company has a strong focus on customer service and has a proven track record in the delivery of high quality services. BLS International Services Ltd has a market capitalisation of 68.62B as of 2022 and a return on equity of 13.87%. The company offers a wide range of services including visa processing, passport processing, identity management and biometric services.

Summary

Global Payments is a financial technology company providing payment and digital commerce solutions to merchants and consumers. Investment analysis has shown that JPMorgan currently has a neutral rating on Global Payments stock, citing a lack of catalysts and downward pressures on the stock. Analysts suggest that investors should proceed with caution when considering Global Payments as an investment option and be aware that the stock may be volatile. They recommend monitoring the company’s progress and financial performance for any new developments or catalysts.

In addition, analysts highlight the risks posed by competitive dynamics and macroeconomic conditions in the industry.

Recent Posts