Generac Holdings Intrinsic Value Calculation – Vontobel Holding Ltd. Cuts Stake in Generac Holdings Shares

October 22, 2024

🌥️Trending News

Generac Holdings ($NYSE:GNRC) Inc. is a leading manufacturer of power generation equipment and solutions for residential, commercial, and industrial markets. The company’s products include home standby and portable generators, as well as automatic transfer switches and solar energy systems. With a growing demand for reliable backup power solutions, Generac has become a top player in the industry, recording consistent revenue growth over the past few years. This move has caught the attention of investors and analysts, who are now closely monitoring the company’s stock performance. The decision to cut its stake in Generac may have been prompted by various factors. One possible reason could be the recent surge in the company’s stock price, which has more than doubled in the past year. With the stock trading at an all-time high, Vontobel may have decided to cash in on its investment and take profits. Another factor could be Vontobel’s desire to diversify its portfolio. As a large asset management company, Vontobel may have deemed it necessary to reduce its exposure to Generac and allocate its funds to other promising investments. This could also be an indication that Vontobel sees limited growth potential for Generac in the near future.

However, it’s essential to note that despite Vontobel’s reduced stake, the company still holds a significant position in Generac Holdings Inc. As one of the largest shareholders, Vontobel remains confident in the company’s long-term prospects and is likely to continue monitoring its performance closely. In conclusion, while Vontobel Holding Ltd.’s decision to cut its stake in Generac Holdings Inc. may have raised some concerns among investors, it’s important to note that the company’s fundamentals remain strong. With a solid market position, a diverse product portfolio, and a growing demand for backup power solutions, Generac is well-positioned for future growth.

Market Price

On Monday, it was reported that Vontobel Holding Ltd., a Swiss investment management company, had reduced its stake in Generac Holdings Inc. The stock of Generac Holdings, a leading manufacturer of power generation equipment, opened at $167.43 and closed at $166.75 on the same day. This marks a decrease of 0.32% from the previous closing price of $167.28. This move by Vontobel Holding Ltd. can be seen as a shift in their investment strategy, as they previously held a larger stake in Generac Holdings Inc. The exact amount of the reduction has not been disclosed, but it is significant enough to be reported by financial news outlets. The decrease in Generac Holdings’ stock price on Monday could be attributed to this news, as investors may have reacted to the reduction in stake by Vontobel Holding Ltd. The company also raised its full-year guidance due to continued demand for its products.

It is unclear at this time why Vontobel Holding Ltd. has chosen to reduce its stake in Generac Holdings Inc. Some analysts speculate that it could be due to profit-taking, as the stock has had a significant run-up in the past year. Others believe that Vontobel Holding Ltd. may be reallocating their investments to other opportunities. Despite this stake reduction, Generac Holdings remains a strong player in the power generation equipment industry and has shown resilience in the face of economic challenges. It will be interesting to see how the market responds to this news and if it will have any long-term impact on the company’s stock performance. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Generac Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 4.02k | 214.61 | 5.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Generac Holdings. More…

| Operations | Investing | Financing |

| 521.67 | -178.06 | -277.14 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Generac Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.09k | 2.74k | 38.91 |

Key Ratios Snapshot

Some of the financial key ratios for Generac Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.4% | -6.9% | 9.6% |

| FCF Margin | ROE | ROA |

| 9.8% | 10.3% | 4.8% |

Analysis – Generac Holdings Intrinsic Value Calculation

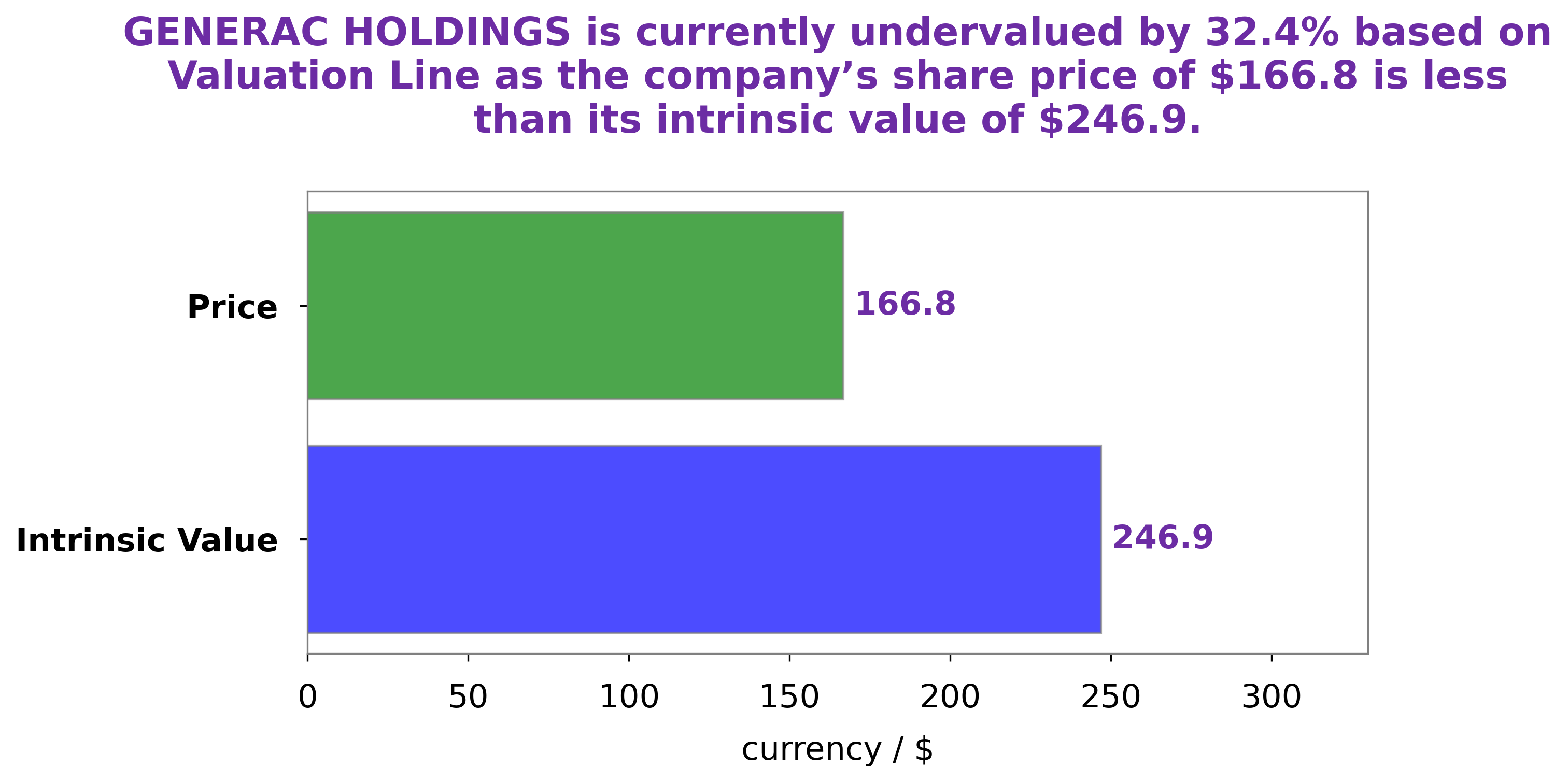

As an analyst at GoodWhale, I have thoroughly researched the fundamentals of GENERAC HOLDINGS and have come to the conclusion that it is a strong company with great potential for growth. One of the key factors that I looked at when evaluating GENERAC HOLDINGS was its financial health. Based on our analysis, we found that the company has a solid balance sheet, with healthy revenue and earnings growth over the past few years. This indicates that the company is well-managed and has a strong foundation for future success. In terms of valuation, our proprietary Valuation Line revealed that the fair value of GENERAC HOLDINGS’ share is approximately $246.9. This means that the current stock price of $166.75 is undervalued by 32.5%. This presents a great opportunity for investors looking to add a strong company to their portfolio at a discounted price. Furthermore, GENERAC HOLDINGS operates in the growing market of backup power solutions, which is expected to continue expanding due to increasing demand for reliable power sources. This positions the company well for future growth and potentially higher stock prices. As always, investors should conduct their own research and consult with a financial advisor before making any investment decisions. More…

Peers

In the market for standby generators, Generac Holdings Inc is up against some stiff competition from the likes of Musashi Co Ltd, Taihai Manoir Nuclear Equipment Co Ltd, and Weg SA.

However, the company has managed to stay ahead of the pack thanks to its innovative products and efficient manufacturing processes.

– Musashi Co Ltd ($TSE:7521)

As of 2022, Musashi Co Ltd has a market cap of 9.64B and a Return on Equity of 5.68%. The company manufactures and sells automotive parts, including engine valves, pistons, and crankshafts. It also provides engineering services.

– Taihai Manoir Nuclear Equipment Co Ltd ($SZSE:002366)

The company has a market capitalization of 4.67 billion as of 2022 and a return on equity of 697.02%. It is a manufacturer of nuclear equipment and supplies. The company’s products include reactors, nuclear fuel, nuclear power plant equipment, and nuclear waste disposal products.

– Weg SA ($OTCPK:WEGZY)

Weg SA is a Brazilian company that manufactures electric motors and generators. It has a market cap of 27.73B as of 2022 and a Return on Equity of 21.06%. The company is headquartered in Jaraguá do Sul, Santa Catarina, and has over 30,000 employees. Weg SA is one of the largest manufacturers of electric motors and generators in the world.

Summary

Vontobel Holding Ltd. has decreased its stake in Generac Holdings Inc., according to recent reports. This move suggests that the investment firm may be cautious about the company’s future performance and potential risks. Generac Holdings Inc. is a well-known manufacturer of power generation and energy storage systems, but its stock has been facing volatility in recent months.

This could be due to concerns about the company’s financials and potential competition in the market. Vontobel’s decision to reduce its position in the company may signal a lack of confidence in Generac’s ability to continue growing and generating returns for investors.

Recent Posts