Garmin Ltd Intrinsic Value Calculator – Garmin Ltd. Shares Rise 1.14% to $107.57 Amid Positive Trading Session for Stock Market

June 24, 2023

☀️Trending News

Garmin Ltd ($NYSE:GRMN).’s stock rose by 1.14%, closing at $107.57 on Tuesday. Garmin Ltd. is a global leader in navigation, communication, and information devices and applications. Garmin Ltd. is headquartered in Schaffhausen, Switzerland and serves customers around the world with innovative products and services designed to make life easier. The company manufactures a variety of GPS-based navigation and information tools that provide precise directions and help users explore the outdoors.

They also offer products such as fitness trackers, watches, and other lifestyle products designed to enhance the experience of their users. In addition to their consumer products, Garmin Ltd. also offers business solutions that help organizations better manage their fleets and simplify fleet operations.

Analysis – Garmin Ltd Intrinsic Value Calculator

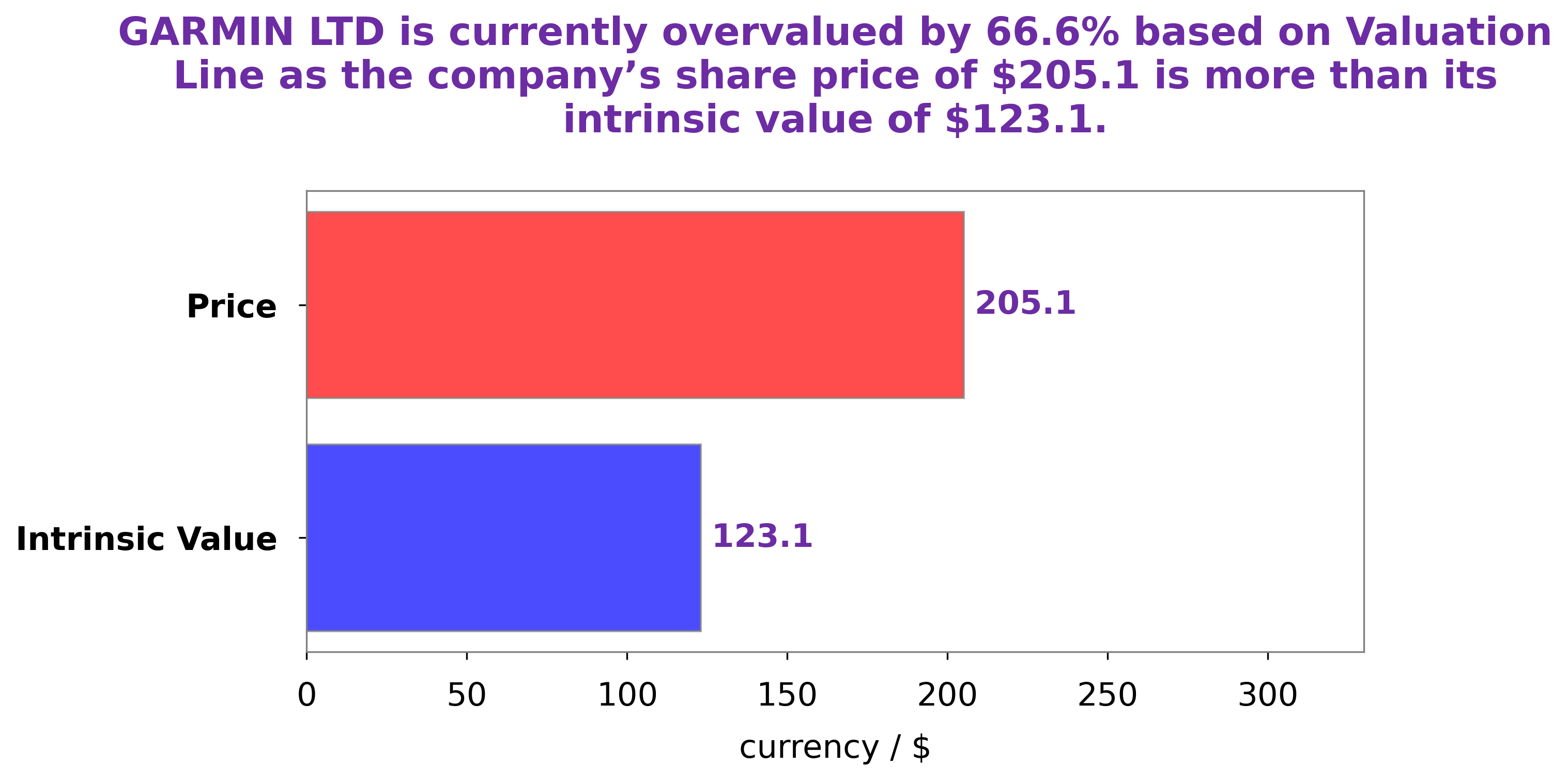

GoodWhale has conducted an analysis of GARMIN LTD‘s financials and our proprietary Valuation Line estimates the intrinsic value of GARMIN LTD share to be around $122.5. Currently, GARMIN LTD stock is trading at $107.6, which makes it a fair price but is still undervalued by 12.2%. Therefore, we believe that GARMIN LTD offers an opportunity for investors to gain an upside. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Garmin Ltd. More…

| Total Revenues | Net Income | Net Margin |

| 4.84k | 964.32 | 19.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Garmin Ltd. More…

| Operations | Investing | Financing |

| 881.84 | -17.14 | -909.59 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Garmin Ltd. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.73k | 1.32k | 33.48 |

Key Ratios Snapshot

Some of the financial key ratios for Garmin Ltd are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.9% | 0.8% | 20.6% |

| FCF Margin | ROE | ROA |

| 13.4% | 9.9% | 8.1% |

Peers

Its competitors include NetApp Inc, Jiangsu Leike Defense Technology Co Ltd, and Red Cat Holdings Inc.

– NetApp Inc ($NASDAQ:NTAP)

NetApp Inc is a American multinational storage and data management company headquartered in Sunnyvale, California. It is a member of the NASDAQ-100 and S&P 500. The company was founded in 1992 with an initial public offering in 1995. NetApp offers a wide range of products and services for enterprise storage, including software-defined storage, flash storage, converged systems, data management, and more. The company has a market cap of $14.66B as of 2022 and a Return on Equity of 100.42%.

– Jiangsu Leike Defense Technology Co Ltd ($SZSE:002413)

Jiangsu Leike Defense Technology Co Ltd is a Chinese company that specializes in the development and manufacture of defense products. The company has a market cap of 6.76B as of 2022 and a Return on Equity of -4.34%. Jiangsu Leike Defense Technology Co Ltd’s products include missiles, armored vehicles, and other defense products. The company is headquartered in Nanjing, China.

– Red Cat Holdings Inc ($NASDAQ:RCAT)

Red Cat Holdings Inc is a development stage company that focuses on acquiring, developing, and commercializing technology in the field of 3D printing. The company was founded in 2013 and is headquartered in Vancouver, Canada.

Red Cat has a market cap of $76.86M as of 2022 and a ROE of -11.27%. The company focuses on acquiring, developing, and commercializing technology in the field of 3D printing.

Summary

Garmin Ltd. had a positive day on Tuesday, with their stock price increasing 1.14% to $107.57. This accompanied a larger trend in the stock market, where the S&P 500 was also up on the day. Investors in Garmin Ltd. should continue to monitor the market and the company’s performance, as well as any news that may affect their investment decisions. Analysts predict that the stock could have further potential for growth in the future.

Recent Posts