FR Intrinsic Value Calculation – First Majestic Silver Corp. Sees 52-Week High After 2.41 Million Shares Traded in Recent Session

April 22, 2023

Trending News ☀️

First Majestic Silver ($TSX:FR) Corp. is a mining company that produces silver from its operations in Mexico. This number is 22.87% higher than its 52-week low and has a beta of 0.88. The company has a strong financial position, and its share price performance has been very encouraging in the past year. This strong performance can be attributed to the increasing demand for silver and gold, which the company produces and sells.

Despite its current success, many investors are unsure if the stock will remain at this level. There could be volatility in the market in the coming weeks and months, which could affect First Majestic’s share price. Investors will need to keep a close eye on the company to ensure they are making the right decisions with their investments.

Price History

By the end of the session, the stock had declined by 0.5%, closing at CA$9.7. The company’s latest quarterly financial results showed a strong increase in both revenue and earnings, which further boosted investor confidence in the stock. This suggests that the stock could extend its current rally and reach new highs in the coming days. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for FR. More…

| Total Revenues | Net Income | Net Margin |

| 626.85 | -114.28 | -18.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for FR. More…

| Operations | Investing | Financing |

| 18.99 | -213.8 | 113.89 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for FR. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.11k | 698.71 | 5.18 |

Key Ratios Snapshot

Some of the financial key ratios for FR are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 19.3% | -4.6% | -7.7% |

| FCF Margin | ROE | ROA |

| -31.7% | -2.2% | -1.4% |

Analysis – FR Intrinsic Value Calculation

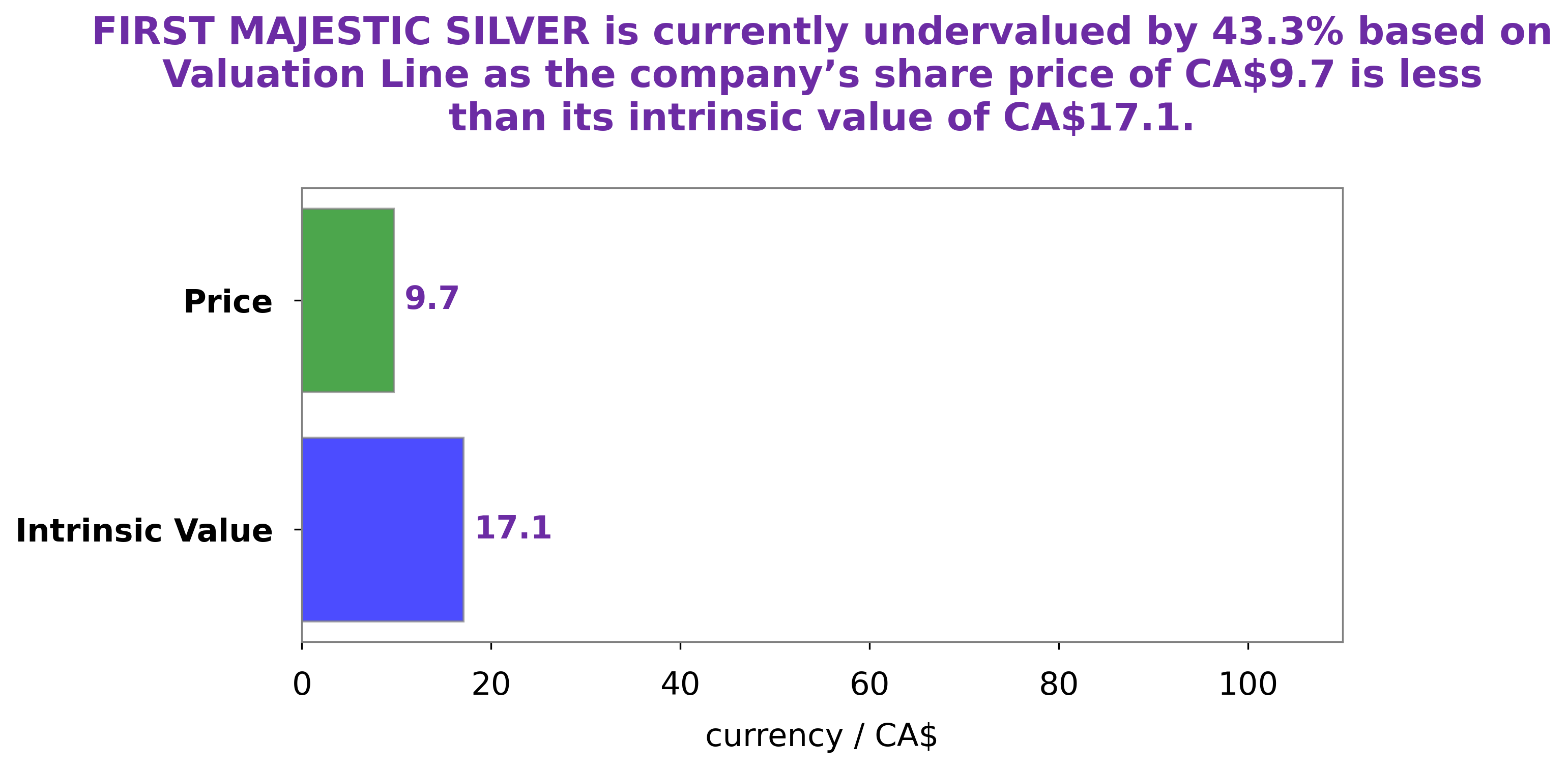

At GoodWhale, we have been analyzing the fundamentals of FIRST MAJESTIC SILVER and have arrived at the conclusion that its intrinsic value is around CA$17.1. This was calculated through our proprietary Valuation Line. We have observed that FIRST MAJESTIC SILVER stock is currently trading at only CA$9.7, which is a 43.4% undervaluation of its true worth. As a result, we believe that it may be a good opportunity for investors seeking a potential return on their capital. More…

Peers

Its competitors are Fortuna Silver Mines Inc, Pan American Silver Corp, and Kuya Silver Corp.

– Fortuna Silver Mines Inc ($TSX:FVI)

Fortuna Silver Mines Inc is a Canadian precious metals mining company with operations in Mexico and Peru. The company has a market capitalization of $1.05 billion and a return on equity of 4.66%. Fortuna Silver Mines is focused on the production of silver and gold. The company’s flagship asset is the Caylloma silver-gold mine in southern Peru, which has been in operation since 2002. Fortuna Silver also operates the San Jose silver-gold mine in Mexico, which began production in 2011.

– Pan American Silver Corp ($TSX:PAAS)

Pan American Silver Corp is a silver mining company with operations in Mexico, Peru, Bolivia, and Argentina. It has a market cap of 4.41B as of 2022 and a Return on Equity of 0.95%. The company produces silver, gold, lead, and zinc.

– Kuya Silver Corp ($OTCPK:KUYAF)

The company’s market cap is 15.53M as of 2022 and ROE is -27.34%. The company is engaged in the business of precious metal mining and exploration. It has a portfolio of properties in the United States, Canada and Mexico. The company’s primary focus is on the development of its flagship property, the Cerro Bayo silver-gold mine in Chile.

Summary

First Majestic Silver Corp. has seen a considerable increase in its share price over the past year, currently standing 22.87% above its 52-week low. Trading activity has been high, with 2.41 million shares changing hands in recent sessions. Analysts generally suggest investors look for strength of fundamentals, financials and management when evaluating companies, as well as looking at market sentiment and supply and demand conditions.

Investors should also keep an eye on the company’s cash flow, debt levels and earnings outlooks before making an investment decision. With a long-term investment approach, investors should monitor the stock market environment to gauge how long the stock will remain above its 52-week low.

Recent Posts