Federal Signal Stock Intrinsic Value – Yousif Capital Management LLC Reduces Stake in Federal Signal Co. (NYSE:FSS)

March 31, 2023

Trending News 🌥️

Federal Signal ($NYSE:FSS) Co. is a leading provider of products and services to the public safety and the infrastructure industries, based in Oak Brook, IL. The company offers products and services that specialize in sirens, switches, control systems, and communication systems for a variety of applications. The company’s products are used by fire departments, municipalities, government agencies, and private companies around the world. The company’s stock has seen an increase in value over the last few years, making it an attractive choice for investors.

Price History

On Monday, FEDERAL SIGNAL Co. (NYSE:FSS) stock opened at $51.8 and closed at $52.0, representing a 1.3% increase from the previous closing price of $51.3. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Federal Signal. More…

| Total Revenues | Net Income | Net Margin |

| 1.43k | 120.4 | 8.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Federal Signal. More…

| Operations | Investing | Financing |

| 71.8 | -99.7 | 35.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Federal Signal. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.52k | 663.4 | 14.18 |

Key Ratios Snapshot

Some of the financial key ratios for Federal Signal are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.5% | 2.3% | 11.2% |

| FCF Margin | ROE | ROA |

| 1.3% | 11.9% | 6.6% |

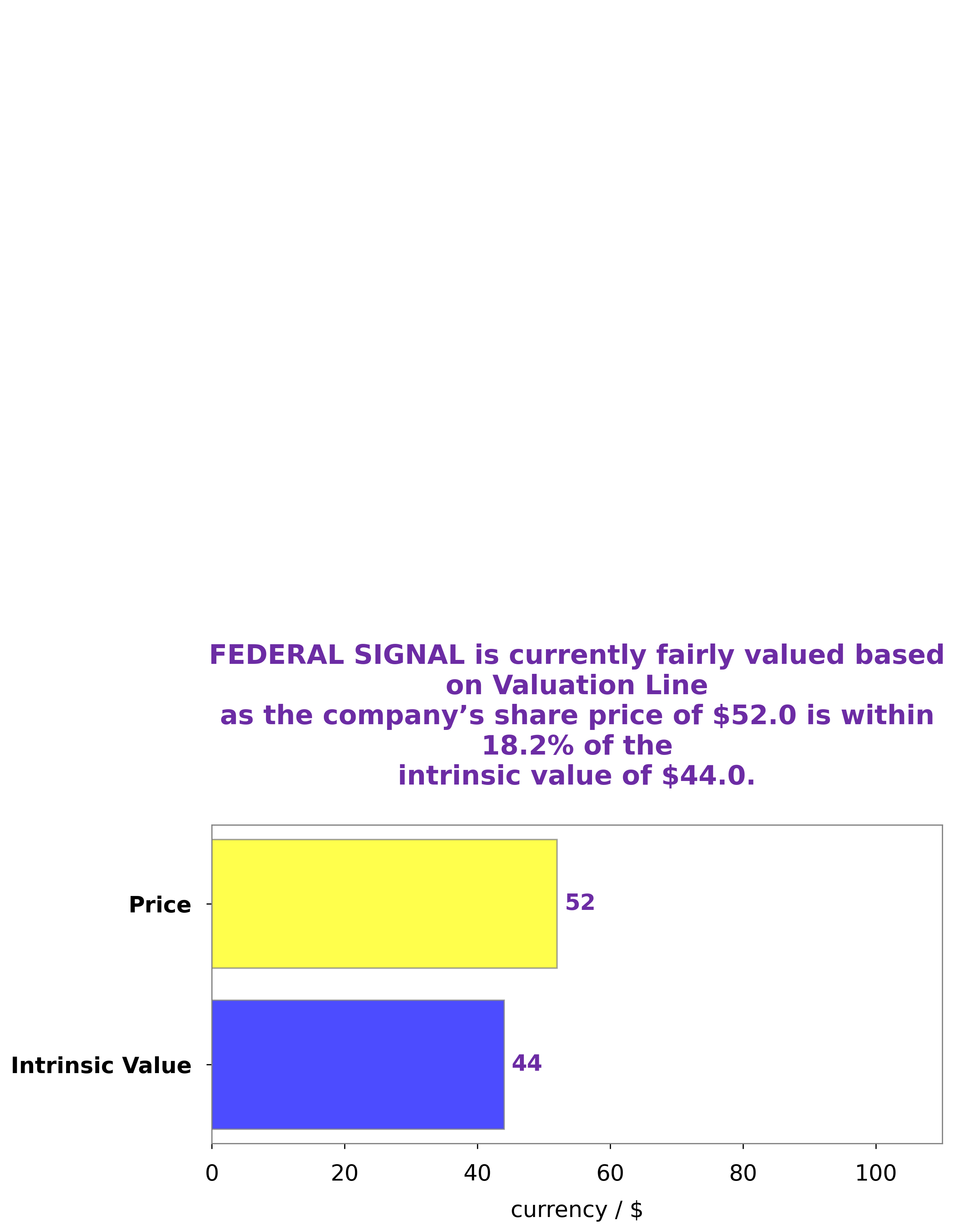

Analysis – Federal Signal Stock Intrinsic Value

At GoodWhale, we have conducted a thorough analysis of FEDERAL SIGNAL‘s fundamentals. Based on our proprietary Valuation Line, we estimate that the fair value of a FEDERAL SIGNAL share is around $44.0. However, at the current market price of $52.0, we consider this stock to be fairly overvalued by 18.1%. Our analysis indicates that investors may want to proceed with caution when considering a purchase of FEDERAL SIGNAL shares at this time. More…

Peers

The company’s products and services include emergency warning and notification systems, security and surveillance products, and fire suppression systems. Federal Signal Corp’s competitors include Shanghai SK Automation Technology Co Ltd, Croma Security Solutions Group PLC, Azkoyen SA, and other global leaders in providing products and services that protect people and property.

– Shanghai SK Automation Technology Co Ltd ($SHSE:688155)

Shanghai SK Automation Technology Co Ltd is a Chinese company that manufactures automated machines and equipment. The company has a market capitalization of 4.92 billion as of 2022 and a return on equity of -3.05%. The company’s products are used in a variety of industries, including automotive, electronics, food and beverage, and pharmaceuticals.

– Croma Security Solutions Group PLC ($LSE:CSSG)

Croma Security Solutions Group PLC is a provider of security solutions. The company offers a range of security products and services, including security systems, security consulting, and security training. The company has a market cap of 9.31M as of 2022 and a Return on Equity of 6.59%. The company’s products and services are used by a variety of clients, including government agencies, businesses, and individuals.

– Azkoyen SA ($LTS:0DOG)

Azkoyen SA is a Spanish manufacturer of vending machines and other related products. The company has a market cap of 149.69M as of 2022 and a Return on Equity of 11.63%. Azkoyen was founded in 1947 and is headquartered in Vitoria-Gasteiz, Spain. The company’s products include vending machines, coffee machines, and water coolers. Azkoyen SA operates in Europe, North America, Asia, and South America.

Summary

This suggests that the company’s recent performance or outlook is not as favorable as it once was. Investors should conduct due diligence when considering investing in FSS, paying attention to the company’s financials and any news or other events that may affect its stock price. Pay special attention to the company’s dividend yield, earnings history, cash flow, debt levels, and other metrics to assess if FSS is a good investment for you. Furthermore, monitor analyst ratings, market sentiment, and market share to ensure that Federal Signal remains an attractive opportunity.

Recent Posts