Expedia Group Intrinsic Value Calculator – Expedia Group Prices Offer Protection Against Economic Downturn Risks

May 13, 2023

Trending News 🌧️

The Expedia Group ($NASDAQ:EXPE) is a leading online travel company that offers a variety of services and products for travelers. Its current prices provide a cushion of protection from potential economic risks due to the recession and other market uncertainties. The company’s broad portfolio of travel brands enables it to tap into different types of travelers and capitalize on regional differences in prices, giving it a competitive advantage. Expedia Group has a long-term strategy that focuses on using technology to improve the customer experience and drive revenue growth. This includes introducing innovative features such as virtual reality, intelligent search and personalization capabilities to give customers more control over their booking processes.

Additionally, the group has recently made strategic acquisitions, such as HomeAway, in order to expand its offerings and establish a more diverse portfolio. The Expedia Group’s low prices also offer significant protection against economic risks due to the recession. The company’s broad portfolio of travel brands gives it the ability to tap into different parts of the market, allowing it to adjust prices in different regions and remain competitive. Furthermore, the company’s focus on using technology to improve customer experience, combined with low prices, provides a defensive layer against recessions and other market uncertainties. The company’s diversified portfolio of travel brands, combined with its focus on technology, gives it an advantage over competitors and enables it to remain competitive even in times of market uncertainty. Additionally, its low prices provide significant protection against risks due to the recession, allowing customers to save money while still enjoying quality services.

Share Price

On Friday, their stock opened at a price of $91.3 and closed down 1.9% at $89.4, falling from its prior closing price of $91.2. With their low prices and wide range of travel options, they can help customers save money even in unpredictable economic times. Furthermore, their expansive network of hotels, airlines and rental cars is certain to keep business booming despite economic fluctuations. As Expedia Group continues to grow and diversify, it offers investors a reliable source of security against any potential economic downturn. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Expedia Group. More…

| Total Revenues | Net Income | Net Margin |

| 12.08k | 329 | 4.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Expedia Group. More…

| Operations | Investing | Financing |

| 3.61k | -788 | -2.4k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Expedia Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 24.99k | 21.7k | 12.25 |

Key Ratios Snapshot

Some of the financial key ratios for Expedia Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.2% | 18.2% | 7.8% |

| FCF Margin | ROE | ROA |

| 23.7% | 28.6% | 2.4% |

Analysis – Expedia Group Intrinsic Value Calculator

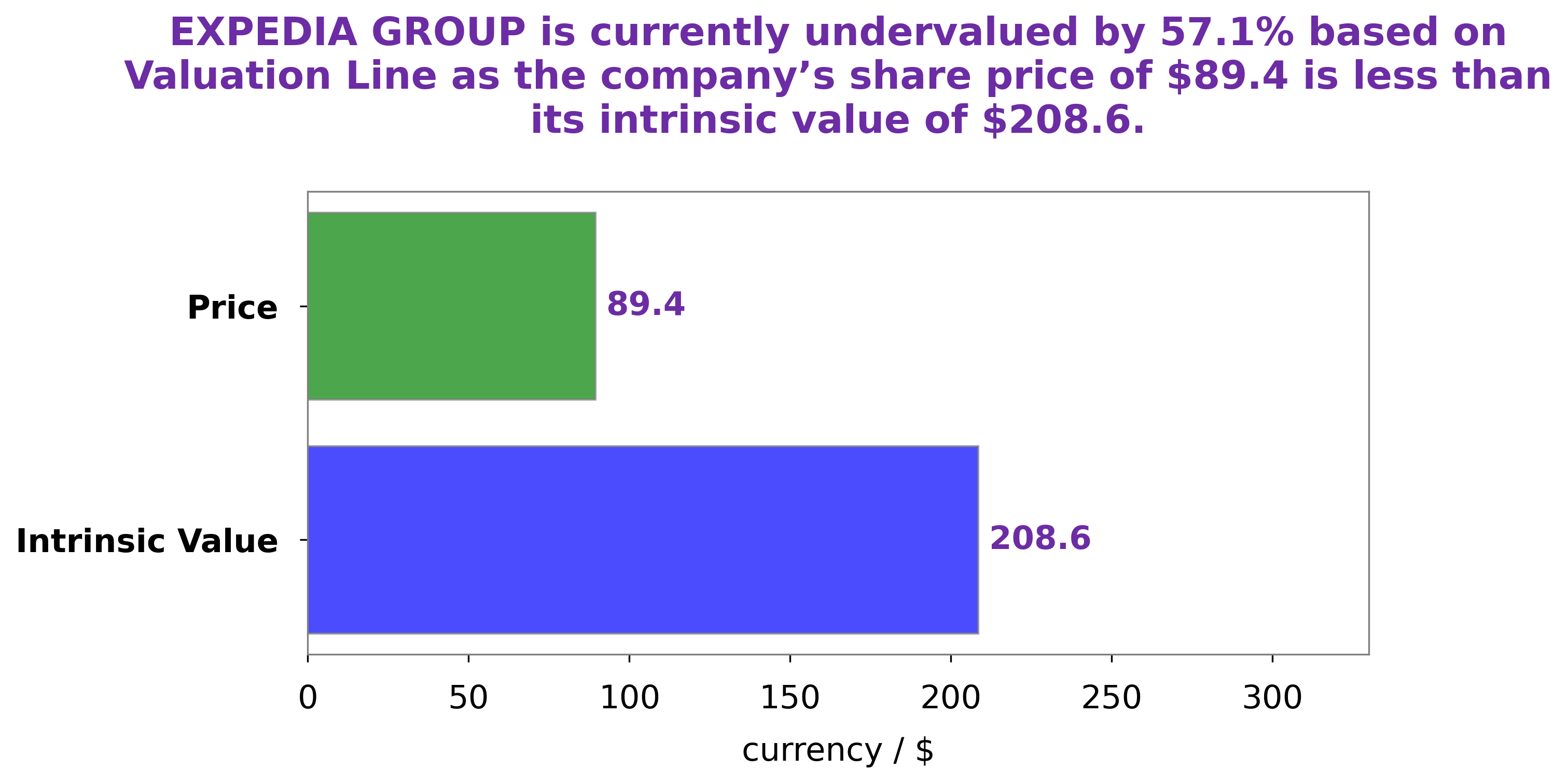

At GoodWhale, we have conducted a thorough analysis of EXPEDIA GROUP’s fundamental performance. After carefully examining all the figures, we have arrived at a fair value of $208.6 for the company’s shares. This was calculated using our proprietary Valuation Line tool. Currently, EXPEDIA GROUP’s shares are trading at just $89.4 – this is a significant undervaluation of 57.1%. In other words, any investor looking to buy shares in this company could currently be making a very strong return on investment. More…

Peers

Expedia Group Inc is one of the world’s largest online travel companies, with a portfolio that includes some of the best-known brands in the industry. Its main competitors are Booking Holdings Inc, Adventure Inc, and Despegar.com Corp. All three companies are leaders in the online travel space, and each has a different focus.

– Booking Holdings Inc ($NASDAQ:BKNG)

Booking Holdings Inc is a online travel company that owns and operates a portfolio of travel brands. The company’s mission is to make it easy for everyone to experience the world. The company’s brands include Booking.com, Priceline.com, Agoda.com, Kayak.com, Rentalcars.com, and OpenTable. The company operates in over 200 countries and employs over 17,000 people.

– Adventure Inc ($TSE:6030)

Adventure Inc is a publicly traded company that operates in the adventure travel industry. The company is headquartered in Vancouver, Canada and was founded in 1971. The company offers a variety of adventure travel products and services including adventure tours, adventure travel packages, and adventure travel insurance. The company has a market cap of 80.18B as of 2022 and a Return on Equity of 13.93%.

– Despegar.com Corp ($NYSE:DESP)

Despegar.com Corp is an online travel company that offers a range of travel products and services, including air tickets, hotel rooms, vacation packages, and car rentals. The company operates in Argentina, Brazil, Chile, Colombia, Ecuador, Mexico, Peru, and Uruguay. As of 2022, Despegar.com had a market cap of 407.36M and a ROE of 95.41%.

Summary

EXPEDIA GROUP is an attractive investment, as its current stock prices offer a margin of safety against recessionary risks. Analysts believe that due to their strong balance sheet and cash reserves, it is well positioned to navigate through any potential difficulties arising from the current economic climate. The company’s diversified business model, which covers all aspects of the travel industry, makes it an appealing choice for investors looking for long-term growth and stability.

Furthermore, its ability to rapidly adapt to shifting consumer preferences by investing in technology and data-driven solutions has enabled it to remain competitive in the volatile travel industry. Consequently, it is expected to continue to generate attractive returns for shareholders.

Recent Posts