Envela Corporation Intrinsic Value Calculation – Envela Corporation Set to Experience 50% EBITDA Increase After Major Expansion, Receives Rating Upgrade

June 7, 2023

☀️Trending News

Envela Corporation ($NYSEAM:ELA) is a publicly traded company that specializes in IT solutions and services. Its products and services are used by businesses of all sizes, ranging from small startups to large multinational corporations. Recently, the company announced an expansion of its operations, which has the potential to increase its earnings before interest, taxes, depreciation, and amortization (EBITDA) by up to 50%. This major expansion is likely to lead to a rating upgrade for the company. The expansion includes adding new technology and processes to increase automation, as well as restructuring its sales and marketing teams in order to further optimize efficiency. Envela’s management team believes that this expansion will help the company better serve its customers and open new avenues for growth. Additionally, the company will be focusing on developing new products and services in order to better meet the needs of its customers. An increase in EBITDA of up to 50% is expected to have a positive impact on Envela’s stock price, as well as improve its credit rating. Analysts believe that this rating upgrade could lead to lower borrowing costs and increased access to debt markets, which could further support the company’s growth.

In addition, it is expected that investors will view the company favorably, given the potential to generate higher returns from their investments. Overall, the expansion announced by Envela Corporation is expected to yield significant benefits for the company. The potential increase in EBITDA and rating upgrade are expected to lead to higher stock prices and improved access to debt markets. This could help the company continue its growth while providing investors with improved returns on their investments.

Analysis – Envela Corporation Intrinsic Value Calculation

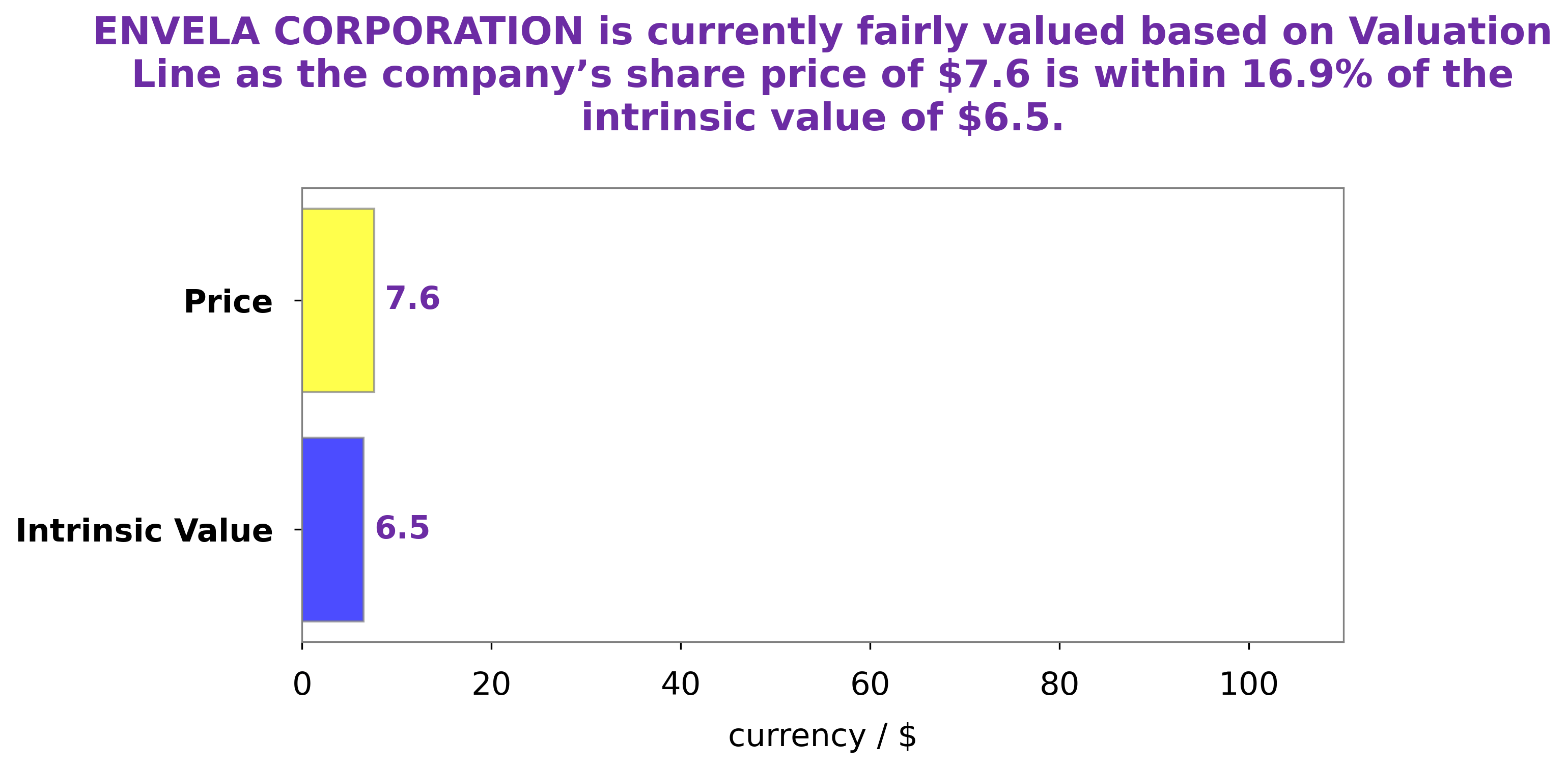

At GoodWhale, we’ve analyzed the financials of ENVELA CORPORATION and used our proprietary Valuation Line to calculate the intrinsic value of ENVELA CORPORATION’s share. We’ve established that the intrinsic value is close to $6.5. Currently, the stock is traded at $7.6, which is overvalued by 17.1%. In other words, the fair price of the stock should be around the $6.5 figure. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Envela Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 183.66 | 15.57 | 8.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Envela Corporation. More…

| Operations | Investing | Financing |

| 9.59 | 0.43 | -1.16 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Envela Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 73.74 | 27.9 | 1.7 |

Key Ratios Snapshot

Some of the financial key ratios for Envela Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 26.0% | 51.0% | 8.4% |

| FCF Margin | ROE | ROA |

| 5.1% | 21.6% | 13.1% |

Peers

Envela Corp is one of the leading companies in the market, providing innovative solutions for businesses and consumers. It faces stiff competition from the likes of Philippos Nakas SA, K’S Holdings Corp, and Kid Brands Inc., all of which are established companies in the industry. Despite this competition, Envela Corp has consistently managed to keep up with the latest developments in the market and gain a competitive edge over its rivals.

– Philippos Nakas SA ($LTS:0NPS)

KK’S Holdings Corp is a leading global conglomerate that specializes in a broad range of industries, from energy to retail. The company has seen a strong rise in its market capitalization over the years, reaching a market cap of 213.14B as of 2022. This impressive value reflects the company’s robust and diversified portfolio, as well as its strong performance on the stock market. Additionally, the company has an impressive Return on Equity (ROE) of 8.15%, which demonstrates the efficient management of its assets and the company’s commitment to delivering returns to its shareholders.

– K’S Holdings Corp ($TSE:8282)

Kid Brands Inc is a leading global designer, marketer, and distributor of infant and juvenile consumer products. It has a market capitalization of 24.36k as of 2022, reflecting the value placed on the company’s performance and growth prospects. The company’s Return on Equity (ROE) stands at 520.64%, which is significantly higher than the industry average. This indicates that the company has generated more earnings from its equity investments than its peers. Kid Brands Inc’s strong financial performance and attractive valuation makes it an attractive investment for investors looking for growth opportunities.

Summary

Envela Corporation, a publicly traded company, recently experienced major expansion which is expected to significantly boost its EBITDA by around 50%. This development has led to an upgrade of the company’s stock rating, and has caused the price of its stock to increase the same day. It is likely that such expansion will bring considerable financial opportunities for investors, potentially yielding high returns and gains.

However, it is important for potential investors to conduct their own research into the company’s financials and current operations before making any decisions. By doing so, they can assess the long-term prospects of Envela Corporation and make an informed investing choice.

Recent Posts