Entegris Intrinsic Value – ENTEGRIS: Waiting to See What Changes the Future Brings

April 26, 2023

Trending News 🌥️

ENTEGRIS ($NASDAQ:ENTG) is a leading global provider of advanced materials and process solutions for the semiconductor and other high-tech industries. The company is committed to creating and delivering innovative products and services that enable its customers to achieve the highest levels of performance and productivity. While the future of the industry remains uncertain, Entegris is waiting to see what changes the future brings. Entegris has long been recognized as a leader in advanced materials, process solutions and reliability, and is renowned for its commitment to innovation, quality, customer service and sustainability. Entegris engineers and manufactures innovative products, including protective packaging, coatings, and other advanced materials, to help optimize the performance of today’s most advanced technologies.

The company’s products are used in a variety of industries, including semiconductors, flat panel displays, medical devices, automotive, consumer electronics and aerospace. As the industry continues to evolve, Entegris is ready to embrace change and adapt to the challenges of the future. Its portfolio of products and services will help customers stay competitive and remain successful in an ever-changing market. With its dedication to innovation and customer service, Entegris is positioned to be an integral part of any future developments in the industry.

Market Price

ENTEGRIS, a specialty materials company with operations that cross the globe, opened its trading day on Monday with stock at $73.2 and closed at $72.9, down by 0.1% from the previous closing price of 73.0. Despite the slight dip, analysts remain optimistic about the future of ENTEGRIS and what it may bring. ENTEGRIS has been grappling with changes in the market, such as increased competition and a shift toward renewable energy, to say nothing of the challenges posed by the coronavirus pandemic.

The company is taking steps to stay ahead of these trends, but investors are still waiting to see what the future holds for ENTEGRIS and its stock. With no clear consensus on whether or not ENTEGRIS will be able to weather the storm, only time will tell how the company fares in the coming months and years. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Entegris. More…

| Total Revenues | Net Income | Net Margin |

| 3.28k | 208.92 | 7.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Entegris. More…

| Operations | Investing | Financing |

| 352.28 | -4.95k | 4.77k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Entegris. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 10.14k | 6.92k | 21.58 |

Key Ratios Snapshot

Some of the financial key ratios for Entegris are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 27.3% | 26.1% | 14.0% |

| FCF Margin | ROE | ROA |

| -3.5% | 9.1% | 2.8% |

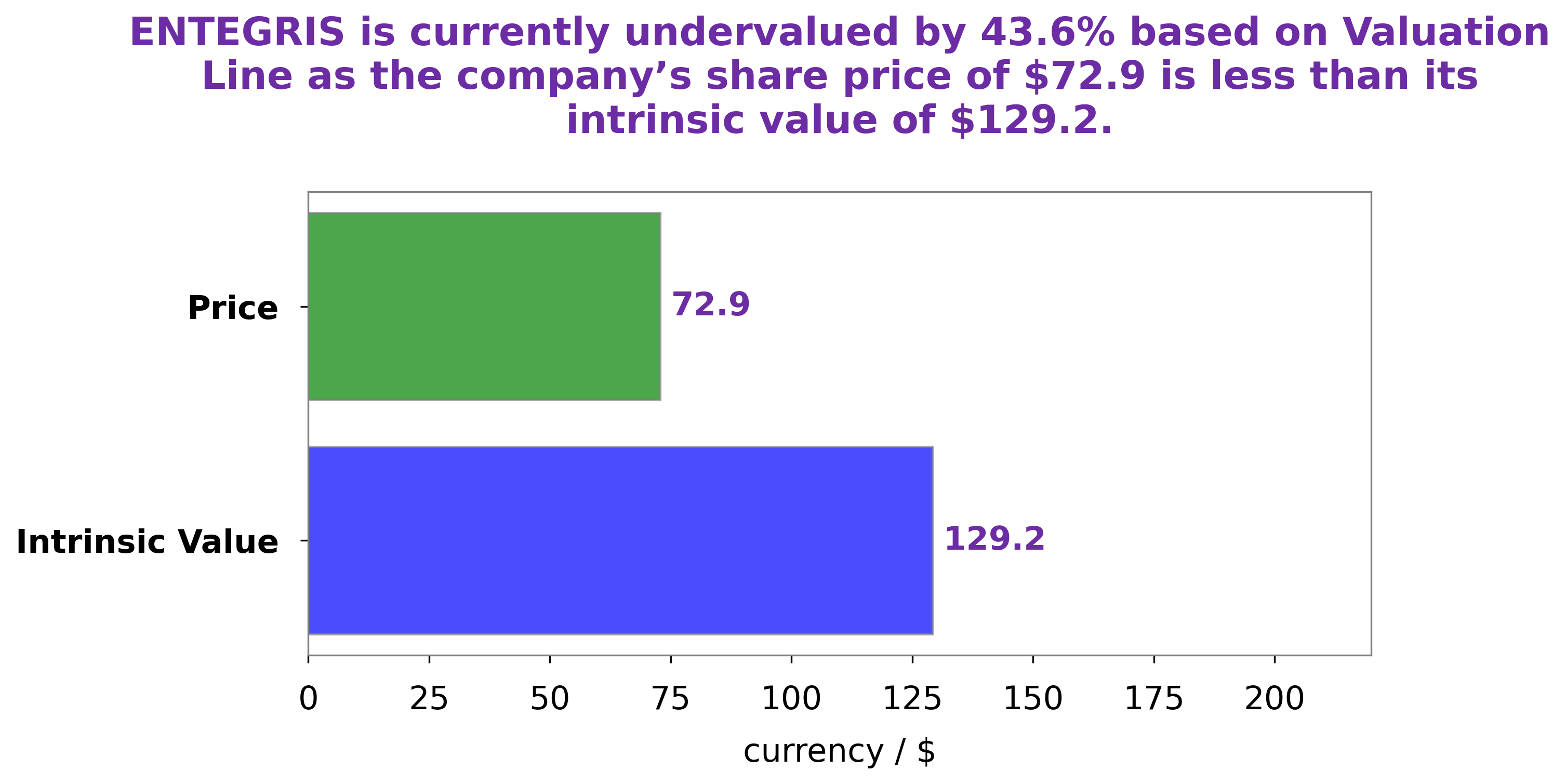

Analysis – Entegris Intrinsic Value

At GoodWhale, we have conducted an analysis of ENTEGRIS‘s wellbeing and have come to an intrinsic value of around $129.2, determined by our proprietary Valuation Line. This figure demonstrates that the current market price of ENTEGRIS stock, which is currently trading at $72.9, is severely undervalued by 43.6%. This presents a compelling opportunity for investors who are looking for a company that has high potential for growth and value creation. In order for investors to take full advantage of this undervalued opportunity, they must act quickly in order to capture it before the market corrects itself. More…

Peers

Entegris, Inc. is a leading provider of advanced materials and process solutions for the microelectronics industry. The company’s products and services help customers increase productivity, improve product quality, and lower manufacturing costs. Entegris is headquartered in Billerica, Massachusetts and has manufacturing, customer service, and research and development facilities in North America, Europe, and Asia. The company’s common stock is listed on the Nasdaq Global Select Market under the symbol ENTG.

Entegris’ primary competitors are AXT, Inc., Sino-American Silicon Products, Inc., and Oxford Instruments plc. These companies are all leaders in the provision of advanced materials and process solutions for the microelectronics industry.

– AXT Inc ($NASDAQ:AXTI)

AXT, Inc., together with its subsidiaries, focuses on the design, development, and manufacture of compound and single element semiconductor substrates in China, Taiwan, South Korea, and Japan. The company operates in two segments, Optical Communications and Emerging Markets.

– Sino-American Silicon Products Inc ($TPEX:5483)

Sino-American Silicon Products Inc is a leading global supplier of silicon wafers. The company has a market cap of 71.23B as of 2022 and a ROE of 30.39%. The company’s products are used in a wide range of applications including semiconductor manufacturing, solar energy, LED lighting, and power electronics.

– Oxford Instruments PLC ($LSE:OXIG)

Oxford Instruments PLC is a world leader in the design and manufacture of high-performance scientific instruments and systems for research and industrial applications. Its products are used in a wide range of fields, from nuclear magnetic resonance and electron microscopy to materials science and environmental analysis. The company has a market capitalization of 1.08 billion as of 2022 and a return on equity of 13.3%. Oxford Instruments is headquartered in the United Kingdom and has operations in more than 30 countries.

Summary

Investing in ENTEGRIS might be a risky proposition currently, as the company has experienced a drop in its stock prices in recent months. That said, the company has a strong portfolio of products and services, with the majority of its revenue coming from specialty fluids management and advanced materials handling solutions. With its established customer base and global reach, ENTEGRIS could be in a good position to take advantage of any potential pricing shifts in the industry.

Furthermore, the company is taking steps to reduce expenses and drive efficiency, which could help stabilize its finances in the long run. All these factors indicate that despite current uncertainties, there is potential for long-term growth in the stock.

Recent Posts