Enfusion Stock Fair Value Calculator – Dan Groman of Enfusion, Sells 15048 Shares in Wednesday Transaction

May 20, 2023

Trending News ☀️

Enfusion ($NYSE:ENFN), Inc. is a technology company specializing in comprehensive software solutions for the financial services industry. The sale of the shares is an important moment for the company, as it will provide additional capital to fund future expansion and innovation. The move to sell these shares reflects the confidence that Groman and Enfusion have in their products and services. By selling shares, they are ensuring that they can continue to develop their products and services without having to depend on external financing.

This allows them to focus on their core business and continue to provide excellent service to their clients. It shows that Groman and the executive team believe in the company’s long-term potential and are willing to take the necessary steps to ensure its success. With the additional capital injection, Enfusion is well-positioned to take advantage of future opportunities and further its mission of providing advanced technology solutions for the financial services industry.

Share Price

Dan Groman, the founder and CEO of Enfusion, Inc., sold 15048 of his company’s shares in a Wednesday transaction. This news was made public two days before, on Monday, when ENFUSION stock opened at $8.0 and closed at $7.9, a decrease of 2.4% from last closing price of $8.1. In addition to Dan Groman, many other company executives and insiders have reduced their holdings of ENFUSION stock in recent months. This news may have contributed to the pullback in share price this week. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Enfusion. More…

| Total Revenues | Net Income | Net Margin |

| 157.18 | 2.54 | 1.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Enfusion. More…

| Operations | Investing | Financing |

| 19.18 | -7.31 | -13.51 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Enfusion. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 121.49 | 22.35 | 0.86 |

Key Ratios Snapshot

Some of the financial key ratios for Enfusion are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 36.6% | – | 3.2% |

| FCF Margin | ROE | ROA |

| 7.5% | 4.9% | 2.6% |

Analysis – Enfusion Stock Fair Value Calculator

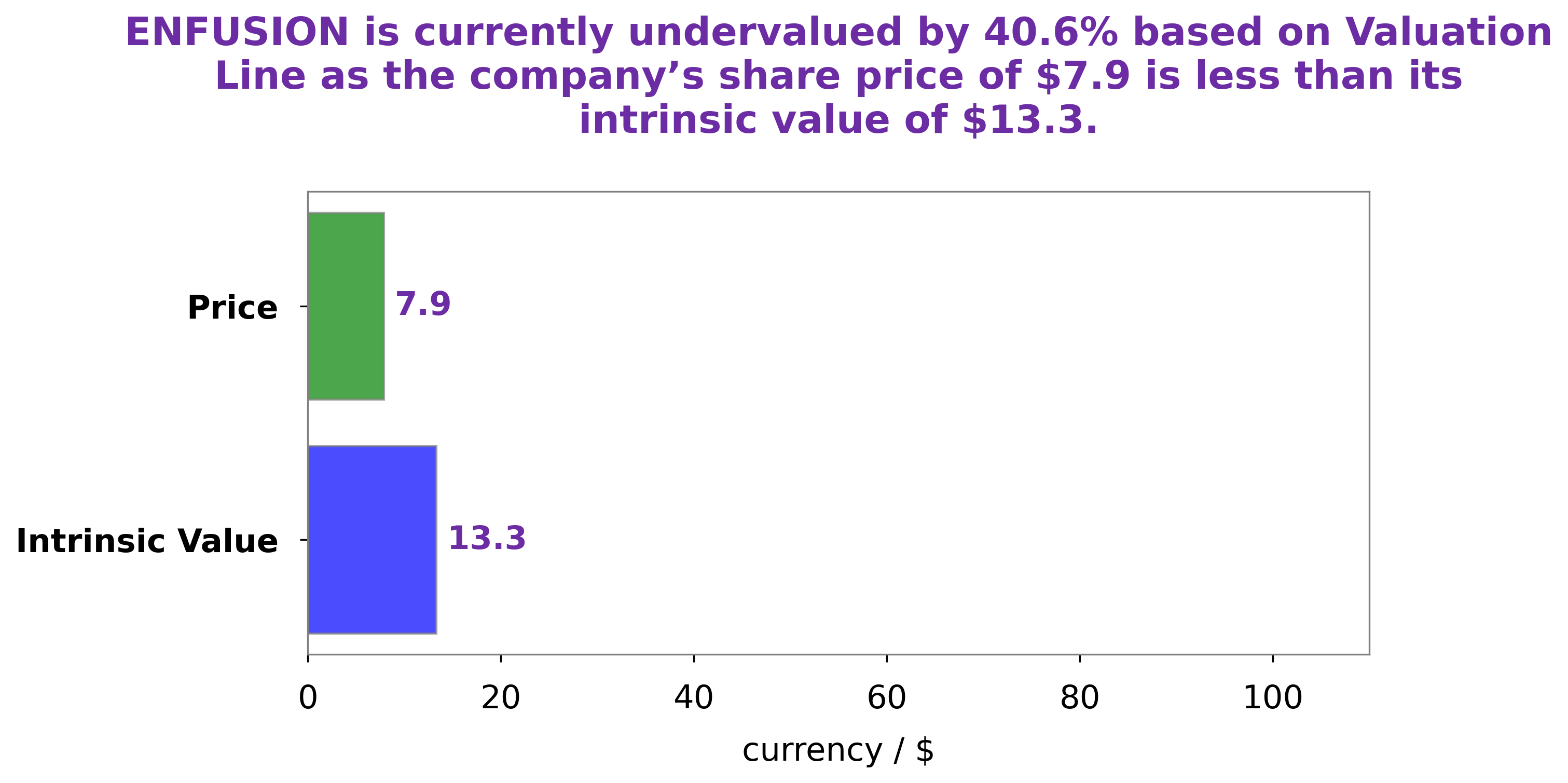

At GoodWhale, we recently conducted an analysis of ENFUSION‘s wellbeing and our proprietary Valuation Line determined that the fair value of ENFUSION share is around $13.3. Currently, ENFUSION stock is traded at $7.9, which is undervalued by a significant 40.5%. We believe that this presents a great investment opportunity and suggest that potential investors conduct their own research to determine if investing in ENFUSION is the right decision for them. More…

Peers

In the business world, there is always competition. Enfusion Inc is no exception. Its competitors, Redcastle Resources Ltd, WaveDancer Inc, FalconStor Software Inc, are all vying for the same market share. Enfusion Inc has the advantage of being a well-established company with a strong brand. Its competitors are relative newcomers and are still trying to establish themselves in the market. Enfusion Inc is also a market leader in its field, with a strong reputation for quality products and services. Its competitors are still trying to catch up.

– Redcastle Resources Ltd ($ASX:RC1)

Redcastle Resources Ltd is a Canadian mineral exploration company with a focus on gold and copper projects in North America. The company has a market capitalization of 4.92 million as of 2022 and a return on equity of -15.38%. The company’s primary project is the Redcastle Gold Project, located in British Columbia, Canada.

– WaveDancer Inc ($NASDAQ:WAVD)

WaveDancer Inc is a publicly traded company with a market capitalization of 17.49 million as of 2022. The company has a return on equity of -28.79%. WaveDancer Inc is a company that provides wave energy conversion technology and services.

– FalconStor Software Inc ($OTCPK:FALC)

FalconStor Software, Inc. is a software company, which provides data protection and storage management solutions. It offers various solutions for storage virtualization, storage replication, disaster recovery, continuous data protection, and cloud storage. The company was founded by ReiJane Huai and James J. Donovan in October 2000 and is headquartered in Austin, TX.

Summary

Enfusion Inc. has recently seen a major shift in its stock, with CTO Dan Groman selling 15048 shares. This is a notable move for the company, as it could be interpreted to suggest that Groman believes the value of Enfusion’s stock is likely to decrease in the near future. However, potential investors should keep in mind that the stock could still offer good returns if the company continues to grow and develop. It would be wise to pay close attention to the company’s financials, management, market trends, and other relevant factors before investing in Enfusion stock.

Recent Posts