Eastman Chemical Stock Fair Value Calculator – Eastman Chemical Co. Stock Soars in 2023, Outperforming Market on Strong Trading Day.

March 30, 2023

Trending News ☀️

On a strong trading day, Eastman Chemical ($NYSE:EMN) Co.’s stock soared higher than the rest of the market. Investors cheered the performance of Eastman Chemical Co. and drove the price up to its highest point in years. The company has been steadily increasing in value since 2023 and this latest uptick only solidified its success. With a strong presence in the chemical industry, Eastman Chemical Co. has made a name for itself as a reliable supplier of innovative products that offer excellent value to their customers. Eastman is known for its commitment to sustainability, creating products designed to reduce environmental impacts and improve performance.

The outperformance of Eastman’s stock compared to the rest of the market reflects investor confidence in the company’s long-term prospects for growth. With its strong portfolio of innovative products, value-driven approach, and commitment to sustainability, Eastman Chemical Co. is well-positioned for continued success in the future. The company looks set to remain a leader in the industry and a reliable source of returns for investors.

Market Price

On Monday, Eastman Chemical Co. experienced a positive trading day, with their stock opening at $80.8 and closing at $80.6, up by 1.3% from the last closing price of 79.6. This strong performance was met with mostly positive media coverage at the time of writing. This stock soar can be attributed to the solid performance of Eastman Chemical Co. over the past several months. Investors have been cautiously optimistic about the future of the company and this strong performance is seen as a sign of the company’s continuing success in the years to come. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Eastman Chemical. More…

| Total Revenues | Net Income | Net Margin |

| 10.58k | 793 | 8.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Eastman Chemical. More…

| Operations | Investing | Financing |

| 975 | 392 | -1.32k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Eastman Chemical. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 14.67k | 9.43k | 43.38 |

Key Ratios Snapshot

Some of the financial key ratios for Eastman Chemical are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.5% | -4.3% | 11.0% |

| FCF Margin | ROE | ROA |

| 3.3% | 13.8% | 5.0% |

Analysis – Eastman Chemical Stock Fair Value Calculator

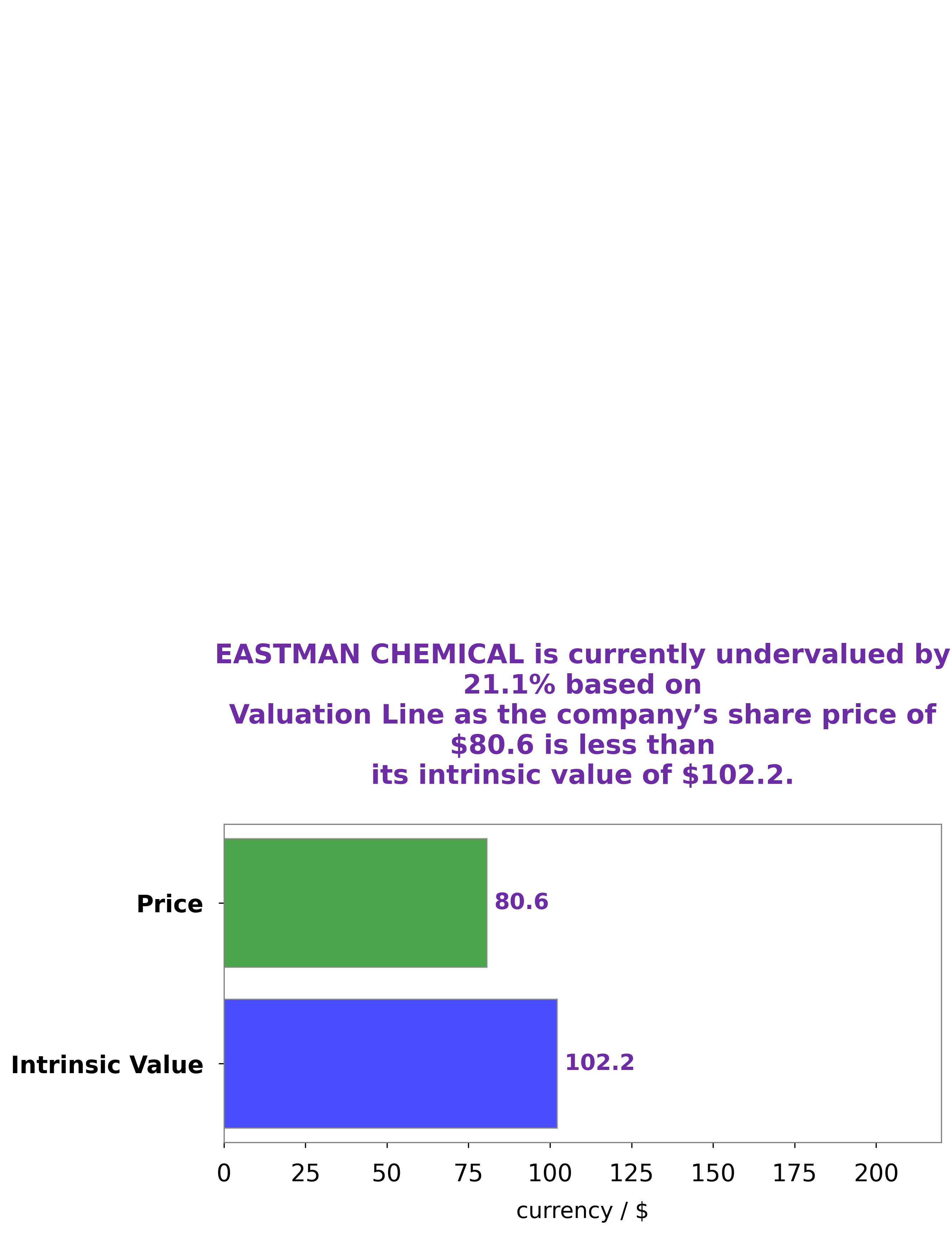

At GoodWhale, we have examined the financials of EASTMAN CHEMICAL and analyzed them with our proprietary Valuation Line. Based on our calculations, the fair value of EASTMAN CHEMICAL share is around $102.2. However, the stock is currently being traded at $80.6, implying a 21.1% undervaluation of the stock. More…

Peers

Eastman Chemical Co is one of the world’s leading producers of chemicals and related products, with manufacturing facilities in over 30 countries. Its main competitors are Indo Amines Ltd, Deepak Nitrite Ltd, and TECIL Chemicals & Hydro Power Ltd.

– Indo Amines Ltd ($BSE:524648)

Indo Amines Ltd is a publicly traded company with a market capitalization of 8.96 billion as of 2022. The company has a return on equity of 16.75%. Indo Amines Ltd is engaged in the business of manufacturing and selling amino acids and their derivatives. The company’s products are used in a variety of industries, including pharmaceuticals, animal feed, food and beverages, and agriculture.

– Deepak Nitrite Ltd ($BSE:506401)

Deepak Nitrite Ltd is an Indian company that manufactures and sells chemicals. The company has a market cap of 305.73B as of 2022 and a Return on Equity of 25.76%. Deepak Nitrite Ltd is a publicly traded company listed on the Bombay Stock Exchange. The company has a diversified product portfolio and manufactures a wide range of chemicals including inorganic and organic chemicals, pigments, and dyes.

Summary

Eastman Chemical Company (EAST) has seen its stock surge in 2023, performing significantly better than the broader markets. Analysts attribute the impressive gains to strong trading activity, as well as upbeat media coverage of its business operations. Currently, investors are optimistic about the company’s prospects, citing new product launches and expansion into new markets as potential catalysts for further growth. Given the current outlook and the stock’s recent performance, investors may want to consider adding EAST to their portfolio.

Additionally, potential investors should continue to monitor the company’s financials and developments in the competitive landscape to ensure that their investment is properly diversified.

Recent Posts