Eastman Chemical Intrinsic Stock Value – Eastman Chemical Co. Stock Falls Behind Competitors on Wednesday

October 4, 2024

🌥️Trending News

Eastman Chemical ($NYSE:EMN) Co. is a global specialty chemical company that provides a wide range of products and services to various industries, including transportation, building and construction, consumer goods, and healthcare. The company’s stock is listed on the New York Stock Exchange under the ticker symbol EMN. On Wednesday, Eastman Chemical Co. stock experienced a decline in its share price, falling behind its competitors in the market. This unexpected drop in stock performance came as a surprise to investors and analysts, who had high expectations for the company’s performance. One of the key factors that contributed to Eastman Chemical’s stock underperformance was the overall market sentiment. On Wednesday, the stock market as a whole experienced a downturn due to concerns over inflation and rising interest rates. This negative sentiment has affected many companies, including Eastman Chemical, causing their stocks to underperform. Another possible reason for Eastman Chemical’s lagging stock performance could be attributed to the company’s recent financial results. In its most recent earnings report, the company missed analyst expectations, reporting lower than expected revenue and earnings. This could have led investors to lose confidence in the company and caused them to sell off their shares.

Additionally, Eastman Chemical’s competitors in the chemical industry may have outperformed the company on Wednesday, further widening the gap between their stock performances. This could be due to various reasons, such as better financial results, positive market sentiment towards their products or services, or other industry-specific factors. Despite this dip in stock performance, Eastman Chemical Co. remains a strong and stable company with a diverse portfolio of products and a global presence. The company has a proven track record of delivering strong financial results and has consistently demonstrated its ability to adapt to changing market conditions. Overall, while Eastman Chemical Co. may have fallen behind its competitors on Wednesday, it is important to view this in the larger context of market fluctuations and not as a reflection of the company’s overall strength and potential. With its solid business foundation and ongoing efforts to drive growth and innovation, Eastman Chemical Co. is well-positioned to continue delivering value to its shareholders in the long run.

Stock Price

On Thursday, EASTMAN CHEMICAL stock opened at $109.47 and closed at $107.93, marking a decrease of 2.02% from the previous closing price of $110.15. This decline places the stock behind its competitors and highlights a potential concern for investors. The dip in EASTMAN CHEMICAL’s stock price can be attributed to a combination of factors, including a lackluster performance in the overall market and potentially disappointing financial results. The company’s competitors may have outperformed EASTMAN CHEMICAL in terms of financial performance, leading to a wider gap in stock prices.

Additionally, external factors such as economic conditions and industry trends may have played a role in the decline of EASTMAN CHEMICAL’s stock. As a chemical company, EASTMAN CHEMICAL is heavily impacted by global demand for its products and any shifts in the market can affect its stock price. Investors should pay close attention to the company’s next quarterly earnings report, as it will provide further insight into the financial health and potential challenges facing EASTMAN CHEMICAL. In the meantime, it is important for investors to carefully analyze the company’s performance and make informed decisions about their investments. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Eastman Chemical. More…

| Total Revenues | Net Income | Net Margin |

| 9.21k | 894 | 7.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Eastman Chemical. More…

| Operations | Investing | Financing |

| 1.37k | -432 | -888 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Eastman Chemical. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 14.59k | 9.17k | 45.63 |

Key Ratios Snapshot

Some of the financial key ratios for Eastman Chemical are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.8% | -1.3% | 14.1% |

| FCF Margin | ROE | ROA |

| 5.9% | 15.2% | 5.6% |

Analysis – Eastman Chemical Intrinsic Stock Value

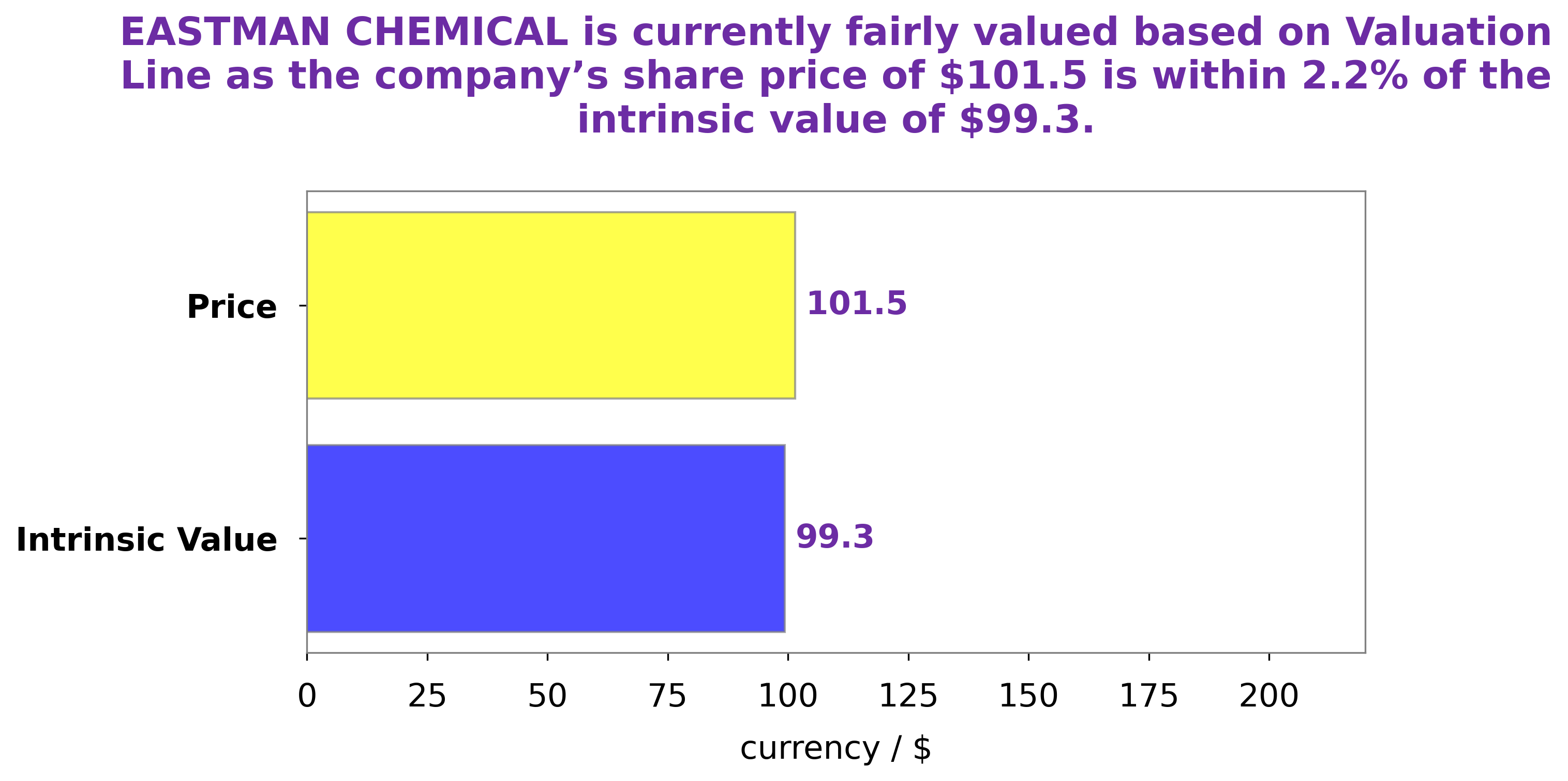

After conducting a thorough assessment of EASTMAN CHEMICAL‘s wellness, it is clear that the company is in a stable state. We have analyzed various aspects such as financial performance, market trends, and industry competition to determine the overall health of the company. One key indicator of EASTMAN CHEMICAL’s wellness is its intrinsic value, which we have calculated to be around $99.3. This is based on our proprietary Valuation Line method, which takes into account various financial factors such as revenue growth, profitability, and cash flow. This suggests that EASTMAN CHEMICAL’s stock has a strong foundation and is likely to continue performing well in the future. In terms of its current market value, EASTMAN CHEMICAL’s stock is currently trading at $107.93. While this may seem like a high price, our analysis shows that it is actually a fair price, overvalued by only 8.7%. This indicates that the stock is not currently overpriced and may still have potential for growth. Overall, our assessment of EASTMAN CHEMICAL’s wellness is positive. The company seems to be in a strong position both financially and in terms of its market value. However, it is important for investors to keep an eye on any changes in the market or industry that may affect the company’s performance in the future. More…

Peers

Eastman Chemical Co is one of the world’s leading producers of chemicals and related products, with manufacturing facilities in over 30 countries. Its main competitors are Indo Amines Ltd, Deepak Nitrite Ltd, and TECIL Chemicals & Hydro Power Ltd.

– Indo Amines Ltd ($BSE:524648)

Indo Amines Ltd is a publicly traded company with a market capitalization of 8.96 billion as of 2022. The company has a return on equity of 16.75%. Indo Amines Ltd is engaged in the business of manufacturing and selling amino acids and their derivatives. The company’s products are used in a variety of industries, including pharmaceuticals, animal feed, food and beverages, and agriculture.

– Deepak Nitrite Ltd ($BSE:506401)

Deepak Nitrite Ltd is an Indian company that manufactures and sells chemicals. The company has a market cap of 305.73B as of 2022 and a Return on Equity of 25.76%. Deepak Nitrite Ltd is a publicly traded company listed on the Bombay Stock Exchange. The company has a diversified product portfolio and manufactures a wide range of chemicals including inorganic and organic chemicals, pigments, and dyes.

Summary

Eastman Chemical Co. stock had a underperformance on Wednesday compared to its competitors. The company’s stock closed at a lower value than its competitors, signaling weaker investor confidence in the company. This could be due to various factors, such as a decline in demand for the company’s products or negative news surrounding the company. It is important for investors to closely monitor the company’s performance and any external factors that may impact its stock value.

Additionally, conducting thorough research and analysis on the company’s financials and market trends can help investors make informed decisions about whether to hold, buy or sell Eastman Chemical Co. stock.

Recent Posts