Dover Corporation Stock Fair Value – Dover Corp. a Potential Investment Opportunity Despite Negative Leading Indicator

May 20, 2023

Trending News ☀️

Dover Corporation ($NYSE:DOV) is a publicly traded company that has been an attractive investment opportunity for many investors throughout its history.

However, the company’s current outlook has been hindered by one concerning leading indicator. Despite this, careful evaluation of the company’s fundamentals reveal that it could be a viable option for investors looking for a longer-term return on their investments. Despite its strong fundamentals, Dover Corporation’s leading indicator has been raising flags in the market. Specifically, the company’s stock price has dropped significantly in the past year, causing concern among investors. However, a closer look at the company’s financials reveals that this could be an opportunity for those looking for a long-term investment. Dover Corporation has experienced steady revenue growth, increasing profits, and low levels of debt, all of which make it a viable option for investors looking for stable returns. Ultimately, while the leading indicator of Dover Corporation suggests caution in investing, careful evaluation of the company’s fundamentals reveals that it could be a potentially attractive investment opportunity for those willing to take on some risk. With its sizable global presence and strong financial position, Dover Corporation could be an attractive option for those seeking a longer-term return on their investments.

Stock Price

On Thursday, DOVER CORPORATION stock opened at $139.6 and closed at $140.8, indicating a 0.7% increase from the previous day’s close of 139.8. Despite this small increase, investors may be looking at DOVER CORPORATION as a potentially profitable investment opportunity. This is despite the fact that there are currently some negative leading indicators pointing to potential problems for the company. Despite this negative outlook, investors may find the long-term value in DOVER CORPORATION attractive. The company has a long history of increasing profits, and its revenue has grown steadily over the past several years. This has been bolstered by strong growth in their core markets, and an increase in demand for their products and services.

Additionally, the company has a wide array of products and services offering customers with a variety of options for their needs. Furthermore, DOVER CORPORATION has a strong commitment to financial performance and sustainability. They have implemented a variety of initiatives to ensure their operations are efficient and cost effective. These initiatives have enabled the company to reduce their debt while also increasing their cash reserves and overall profitability. Overall, despite the negative leading indicators, investors may find that DOVER CORPORATION presents an attractive investment opportunity with its long-term value potential. With its impressive record of revenue growth, a wide array of products and services, and focus on financial performance and sustainability, the company may be an attractive option for investors looking to benefit from long-term growth potential. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Dover Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 8.54k | 1.07k | 12.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Dover Corporation. More…

| Operations | Investing | Financing |

| 1.02k | -537.52 | -491.63 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Dover Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 10.8k | 6.34k | 31.91 |

Key Ratios Snapshot

Some of the financial key ratios for Dover Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.5% | 10.6% | 16.7% |

| FCF Margin | ROE | ROA |

| 9.4% | 20.3% | 8.2% |

Analysis – Dover Corporation Stock Fair Value

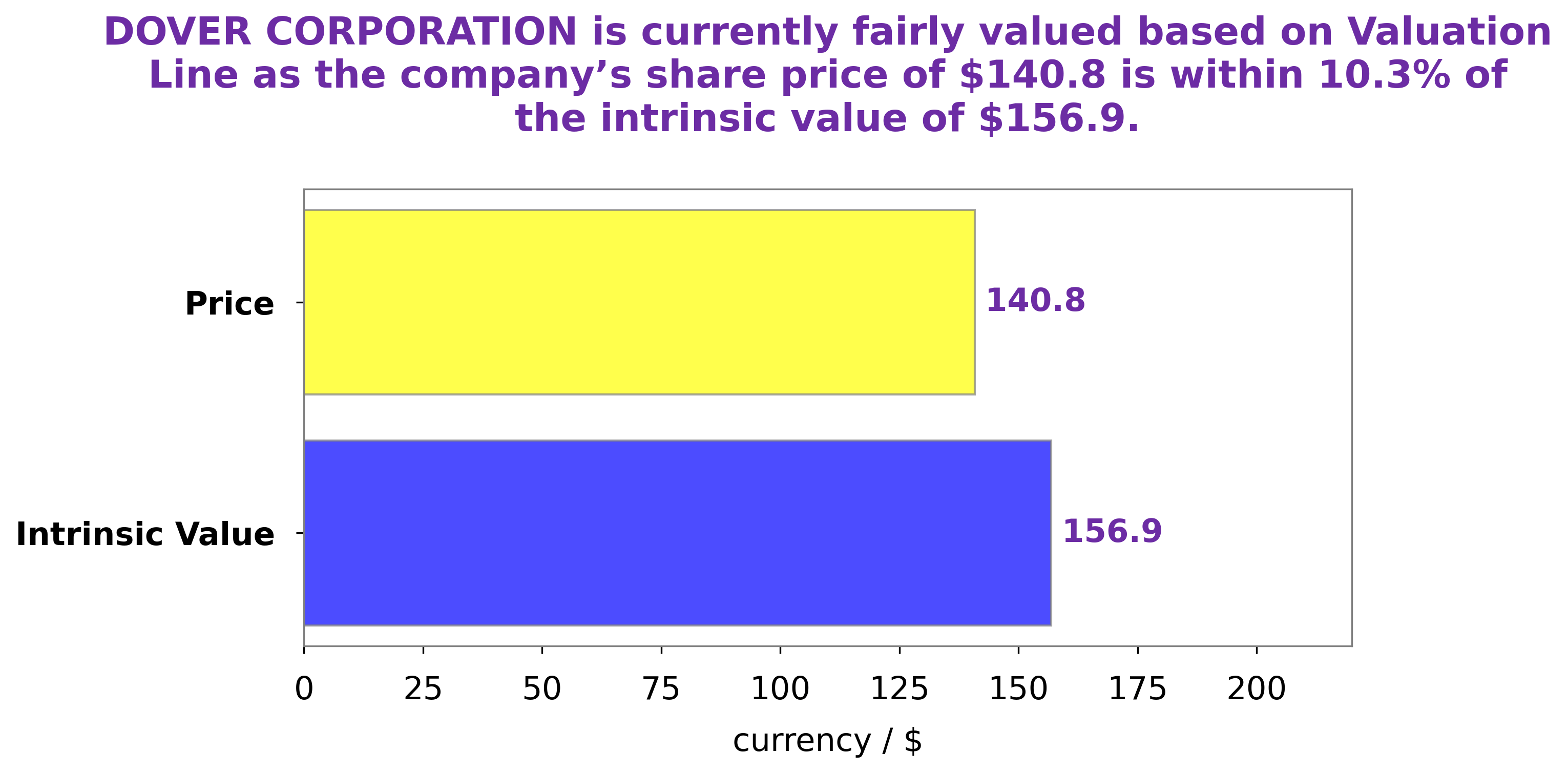

At GoodWhale, we have conducted an analysis of DOVER CORPORATION‘s financials. Our proprietary Valuation Line has determined that the fair value of DOVER CORPORATION shares is approximately $156.9. Currently, DOVER CORPORATION stock is being traded at $140.8, which is a fair price that is undervalued by 10.3%. Therefore, now presents a great opportunity for potential investors to buy the stock and benefit from the potential upside. More…

Peers

The company has been in business for over 100 years and has a history of competitive rivalry with other companies in its industry. John Bean Technologies Corp, Georg Fischer AG, and Trelleborg AB are all major competitors of Dover Corp. Each company has a unique set of products and services that it offers, and each company competes for market share in the global marketplace.

– John Bean Technologies Corp ($NYSE:JBT)

John Bean Technologies Corporation provides technology solutions for the food processing and air transportation industries worldwide. It operates through Food & beverage solutions, and Airport solutions segments. The Food & beverage solutions segment offers a range of systems and services for food processors, including protein, fruit and vegetable, grain and pasta, and dairy. This segment also provides solutions for the brewing industry. The Airport solutions segment offers a range of solutions and services for airports, airlines, and ground handlers, including air traffic control towers, bag handling, and deicing. The company was founded in 1884 and is headquartered in Chicago, Illinois.

– Georg Fischer AG ($LTS:0QP4)

Georg Fischer AG is a Switzerland-based holding company engaged in the industrial sector. The Company operates through three business segments. The Piping Systems Division is engaged in the development, production and distribution of pipes, fittings, valves and related accessories made of various materials, including metal and plastic, primarily for the building sector and water and gas utilities. The Automotive Division is a supplier of products, systems and services for the automotive industry. The Machining Solutions Division focuses on developing and supplying products and systems for the machining of large and heavy components. The Company operates in over 30 countries worldwide.

– Trelleborg AB ($LTS:0NL3)

Trelleborg AB is a Swedish multinational conglomerate that develops, manufactures, and sells products for a variety of industries including automotive, aircraft, construction, oil and gas, and more. The company has a market cap of 58.94B as of 2022 and a Return on Equity of 10.04%. Trelleborg is a global leader in its field and has a strong presence in Europe, North America, and Asia.

Summary

Dover Corporation is an industrial conglomerate with a diverse portfolio of businesses. Investors may find the company attractive due to its strong fundamentals and potential to generate attractive returns.

However, one key leading indicator for Dover’s overall performance points in the opposite direction. Specifically, the company’s order backlog has been contracting for the past several quarters, indicating that future revenues could be at risk. As such, investors should assess the company’s entire financial picture before proceeding with any investments. Dover Corporation’s current stock price and dividend yield may also be factors to consider in the decision-making process.

Recent Posts