Douglas Emmett Stock Intrinsic Value – Eleven Research Firms Give Douglas Emmett, an Average ‘Hold’ Rating

June 12, 2023

🌥️Trending News

Douglas Emmett ($NYSE:DEI), Inc. is a real estate investment trust (REIT) that focuses on owning and operating office and multifamily properties in the United States. The company currently owns and operates a portfolio of over forty million square feet of office and multifamily properties in California and Hawaii. Recently, analysts from eleven research firms have given Douglas Emmett, Inc. an average rating of “Hold”. While some analysts suggest that the stock is weak in terms of growth potential, others argue that the company continues to perform well in terms of occupancy rates and rental income. The recent “Hold” rating is based on the analysis of the company’s financials, its potential for growth, and its competitive position in the REIT industry. Those who have given the stock a “Hold” rating believe that Douglas Emmett, Inc. could benefit from further diversification of its properties, in terms of geographical locations and asset types.

Additionally, analysts have also noted that the REIT’s reliance on financing could become an issue if interest rates rise. Nevertheless, analysts are generally confident in the long-term prospects of the company’s stock.

Stock Price

On Wednesday, Douglas Emmett, Inc., an American real estate investment trust (REIT) with a portfolio of office and multifamily properties in California and Hawaii, saw its stock open at $12.2 and close at $12.8, a 6.2% rise from its previous close of $12.1. This indicates that, while the company has seen positive growth in its stock price, analysts are generally not recommending it as a strong buy or sell option. It remains to be seen whether Douglas Emmett will continue to perform well or if it will be adversely affected by changes in the real estate market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Douglas Emmett. More…

| Total Revenues | Net Income | Net Margin |

| 1.01k | 89.32 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Douglas Emmett. More…

| Operations | Investing | Financing |

| 496.89 | -560.95 | -3 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Douglas Emmett. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.68k | 5.49k | 14.19 |

Key Ratios Snapshot

Some of the financial key ratios for Douglas Emmett are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 23.8% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis – Douglas Emmett Stock Intrinsic Value

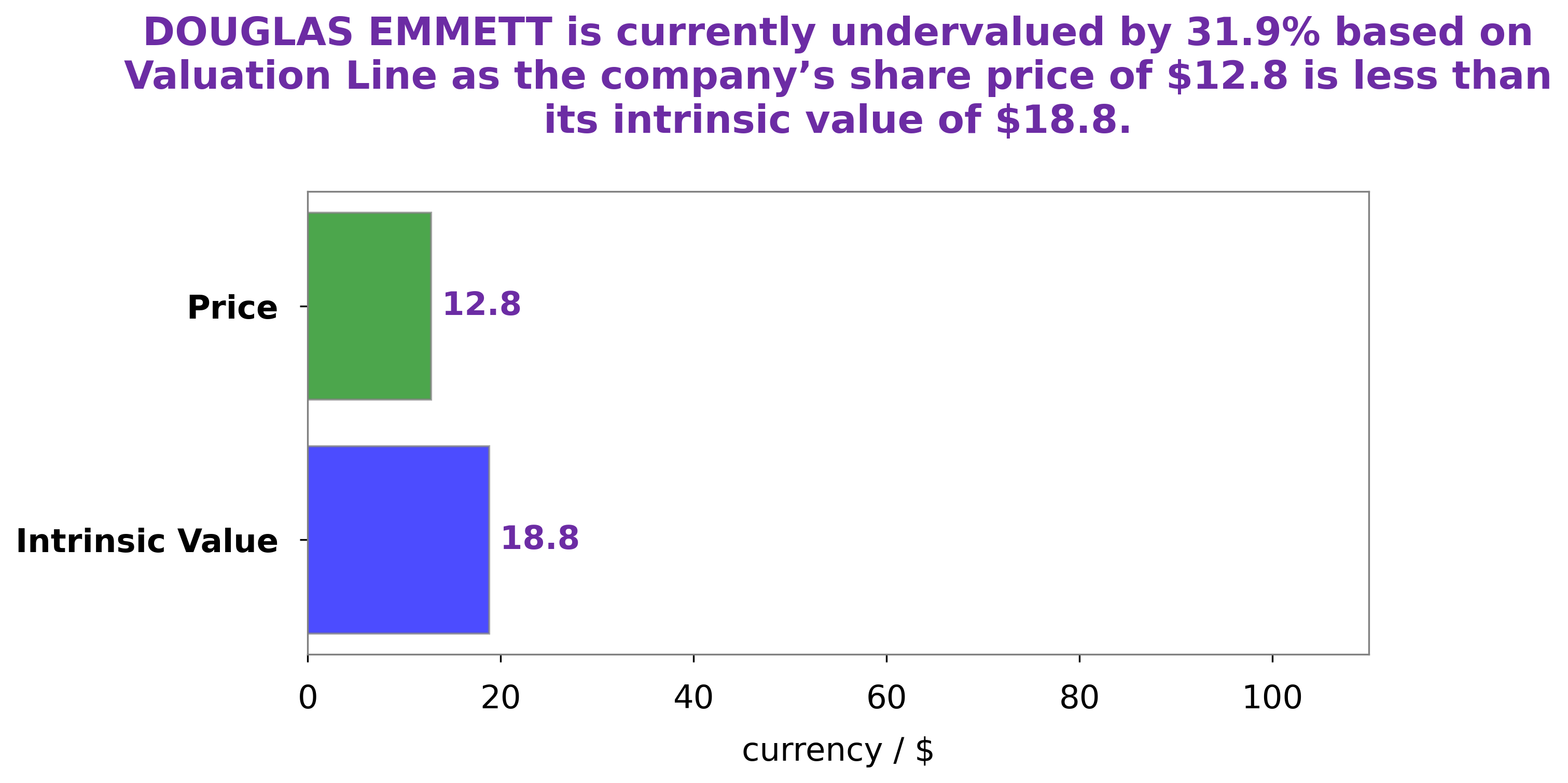

At GoodWhale, we conducted an analysis of DOUGLAS EMMETT‘s wellbeing and found the fair value of their share to be around $18.8. This figure was calculated using our proprietary Valuation Line. Currently, DOUGLAS EMMETT’s stock is trading at $12.8, which we believe is undervalued by 32.1%. This discrepancy between fair value and current stock value presents an opportunity for investors to acquire DOUGLAS EMMETT stock at a discounted rate. More…

Peers

The company’s properties are located in California and Hawaii. As of December 31, 2016, the company owned 89 office properties comprising 13,632,000 square feet and 97 multifamily properties comprising 18,816 units. The company was founded in 1971 and is headquartered in Santa Monica, California. Brandywine Realty Trust is a real estate investment trust that owns, operates, and develops real estate properties in the United States. As of December 31, 2016, the company owned 106 properties comprising 28,049,000 square feet. The company was founded in 1986 and is headquartered in Radnor, Pennsylvania. Equity Commonwealth is a real estate investment trust that owns and operates office properties in the United States. As of December 31, 2016, the company owned 39 office properties comprising 16,066,000 square feet. The company was founded in 2010 and is headquartered in Chicago, Illinois. Hudson Pacific Properties, Inc. is a real estate investment trust that owns, operates, and acquires office and studio properties in the United States. As of December 31, 2016, the company owned 55 properties comprising 16,676,000 square feet. The company was founded in 2006 and is headquartered in Los Angeles, California.

– Brandywine Realty Trust ($NYSE:BDN)

Brandywine Realty Trust is a publicly traded real estate investment trust (REIT) that owns, leases, and manages office and industrial properties in the United States. As of December 31, 2020, the company owned or had an interest in 269 properties totaling approximately 56 million square feet of office, industrial, and retail space.

The company’s market capitalization is $1.12 billion as of 2022.

– Equity Commonwealth ($NYSE:EQC)

As of 2022, Equity Commonwealth has a market cap of 2.89B. The company is a real estate investment trust (REIT) that owns, operates, and develops office and industrial properties. Equity Commonwealth’s portfolio consists of approximately 150 properties totaling approximately 31 million square feet. The company’s properties are located in the United States, Australia, and the United Kingdom.

– Hudson Pacific Properties Inc ($NYSE:HPP)

Hudson Pacific Properties Inc. is a real estate investment trust that owns, operates, and develops office and studio properties in the United States. As of December 31, 2020, the company owned or operated approximately 38 million square feet of office and studio space, including 12 million square feet of development projects in various stages of completion. Hudson Pacific Properties Inc. is headquartered in Los Angeles, California.

Summary

Douglas Emmett, Inc. is a real estate investment trust that primarily specializes in office and multifamily properties in the United States. Eleven research firms have given the stock an average “Hold” rating. Despite this, the stock price has recently moved up. Investing in Douglas Emmett, Inc. requires careful analysis of the company’s financials and a thorough understanding of the market.

Potential investors should take into account factors such as current market conditions, the company’s dividend yield, its financial performance, and any risks associated with investing in the company. Ultimately, it is important to weigh all these factors before making an investment decision.

Recent Posts