Doubleverify Holdings Stock Fair Value – Stephens Initiates Coverage on DoubleVerify Holdings

July 14, 2023

🌥️Trending News

DOUBLEVERIFY ($NYSE:DV): On Tuesday morning, analysts at Stephens released a research note on DoubleVerify Holdings, as reported by FlyOnTheWall. DoubleVerify Holdings is a digital media measurement and analytics company that provides marketers with the necessary tools to ensure that their ads are viewable, brand-safe, and effective. It provides comprehensive solutions for advertisers, publishers, agencies and networks to protect their digital investments from fraudulent activities and to measure the effectiveness of their campaigns. DoubleVerify’s technology measures viewability, fraud, brand safety, ad-quality, and more across desktop, mobile, and video advertising.

The research note by Stephens initiates coverage of DoubleVerify and provides insight into the company’s products, technology, and competitive positioning in the digital media landscape. With the rapid growth of the digital ad market and increasing demand for more reliable data validation, DoubleVerify is well positioned to take advantage of the opportunities with its holistic solution.

Share Price

On Thursday, Stephens Initiates Coverage on DoubleVerify Holdings stock opened at $41.6 and closed at $40.4, down by 2.3% from its previous closing price of 41.4. DoubleVerify Holdings offers an independent verification platform to measure and enhance the performance of digital marketing campaigns for brands, agencies, and platform partners. It provides solutions to help marketers verify and optimize the quality of their digital media spend, enabling them to measure the effectiveness of their campaigns and maximize their return on advertising spend (ROAS). The company also offers data-driven insights to help marketers understand the impact of their campaigns and identify opportunities to optimize their performance. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Doubleverify Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 478.29 | 50.86 | 10.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Doubleverify Holdings. More…

| Operations | Investing | Financing |

| 118.54 | -39.32 | -4.3 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Doubleverify Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.06k | 161.67 | 5.44 |

Key Ratios Snapshot

Some of the financial key ratios for Doubleverify Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 35.3% | 14.7% | 15.8% |

| FCF Margin | ROE | ROA |

| 16.6% | 5.3% | 4.4% |

Analysis – Doubleverify Holdings Stock Fair Value

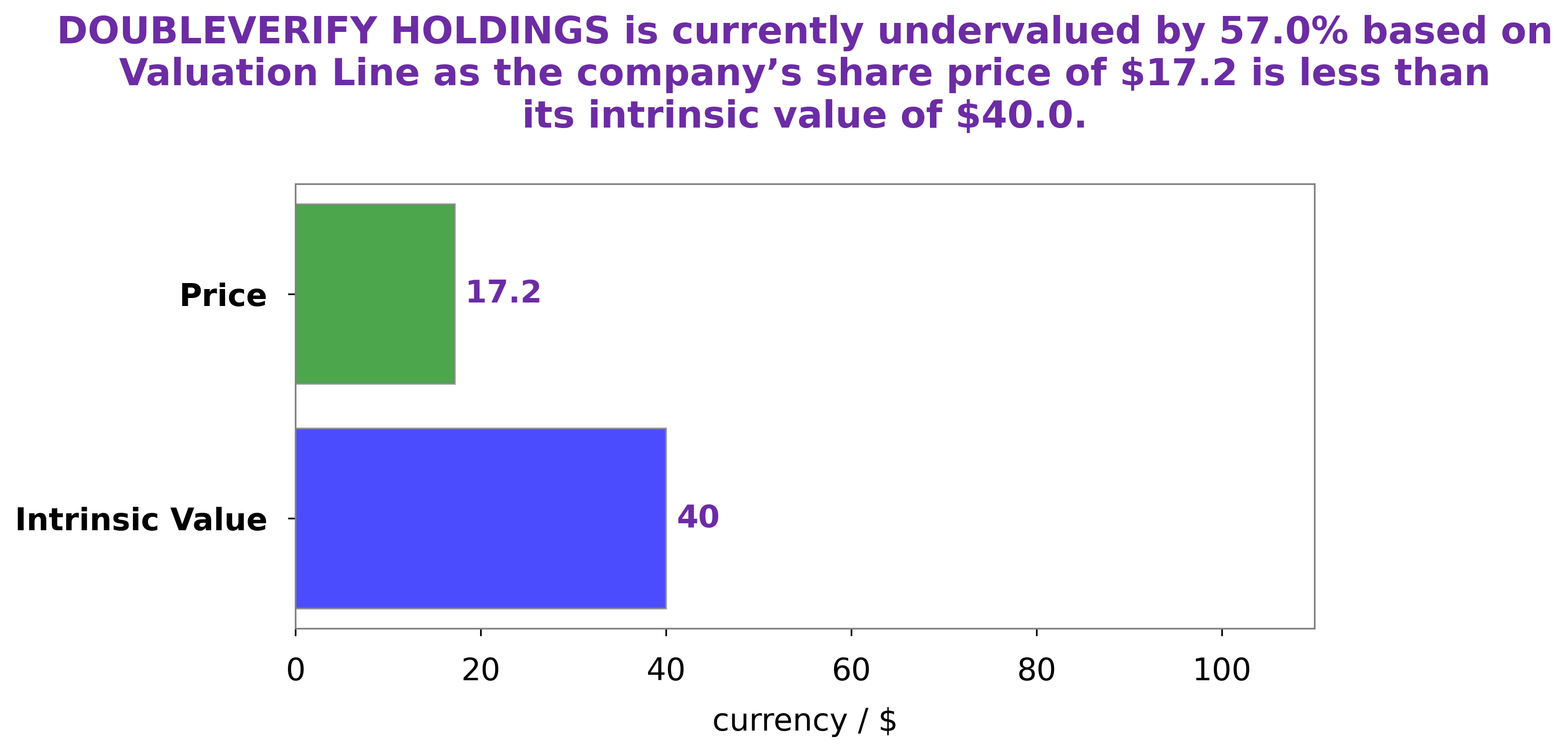

At GoodWhale, we have conducted an analysis of DOUBLEVERIFY HOLDINGS‘s wellbeing. After performing our proprietary Valuation Line, we determined the fair value of the DOUBLEVERIFY HOLDINGS share to be approximately $36.0. However, on the market, DOUBLEVERIFY HOLDINGS is currently trading at $40.4 – a fair price that is overvalued by 12.1%. More…

Peers

The competition in the digital advertising verification industry is heating up with DoubleVerify Holdings Inc taking on established players such as X-Factor Communications Holdings Inc, Fabasoft AG, and Marin Software Inc. All these companies are vying for a share of the rapidly growing market with each offering its own unique solution to the problem of ad fraud. While DoubleVerify has been able to gain a foothold in the industry, it remains to be seen if it can maintain its momentum in the face of stiff competition.

– X-Factor Communications Holdings Inc ($OTCPK:XFCH)

X-Factor Communications Holdings Inc is a publicly traded company with a market capitalization of 948.25k as of 2022. The company’s return on equity, a measure of profitability, was 101.44% for the same year. X-Factor Communications Holdings Inc is engaged in the provision of telecommunications services.

– Fabasoft AG ($LTS:0IWU)

Fabasoft AG is a software company that develops and sells software for businesses and organizations. The company has a market cap of 202.84 million as of 2022 and a return on equity of 25.9%. The company’s products are used by businesses and organizations around the world to manage their documents, files, and other information.

– Marin Software Inc ($NASDAQ:MRIN)

Marin Software is a provider of cross-channel, enterprise marketing software for digital marketers. The company’s software enables advertisers and agencies to measure, manage, and optimize online marketing campaigns. Marin’s technology platform powers marketing campaigns across display, search, social, and mobile platforms. The company’s software is used by some of the world’s largest brands, including Allstate, Microsoft, and Oracle.

Summary

Investment analysts at Stephens initiated coverage on DoubleVerify Holdings (DV) with a ‘Buy’ rating. According to the research note, the company is poised to benefit from its leading position in the digital advertising verification market. The analysts believe that the firm’s innovations in digital measurement and fraud protection will help it gain market share and drive revenue growth. They also highlighted how management is well-positioned to capitalize on opportunities with its experience in digital advertising and technology.

They also noted that DoubleVerify has various partnerships with leading digital ad exchanges, networks, and platforms. As such, they recommend investors to buy DV shares for long-term capital appreciation.

Recent Posts