Dominion Energy Stock Intrinsic Value – Assetmark Boosts Dominion Energy Holdings by 163% Despite Market Volatility

June 12, 2023

☀️Trending News

Dominion Energy ($NYSE:D), Inc. is a Virginia-based energy company that produces and distributes electricity and natural gas to customers throughout the United States. On June 1, 2023, Assetmark Inc., a leading provider of asset management services, announced a 163% increase in its holdings of Dominion Energy, Inc., making it a bold move amidst the current market volatility. This announcement further solidifies Assetmark’s backing of Dominion Energy and its confidence in the company’s future prospects for growth. Dominion Energy has been one of the most resilient stocks during the pandemic-induced market volatility.

Despite the market’s uncertainty over the past few months, Dominion Energy has seen its stock price rise significantly since the start of the year, and this renewed faith from Assetmark is sure to give further credibility to the stock. The increased backing from Assetmark Inc. will no doubt provide additional stability for Dominion Energy’s stock. With further investments into Dominion Energy, it appears that Assetmark is confident in the company’s ability to continue to grow and prosper in this volatile market.

Analysis – Dominion Energy Stock Intrinsic Value

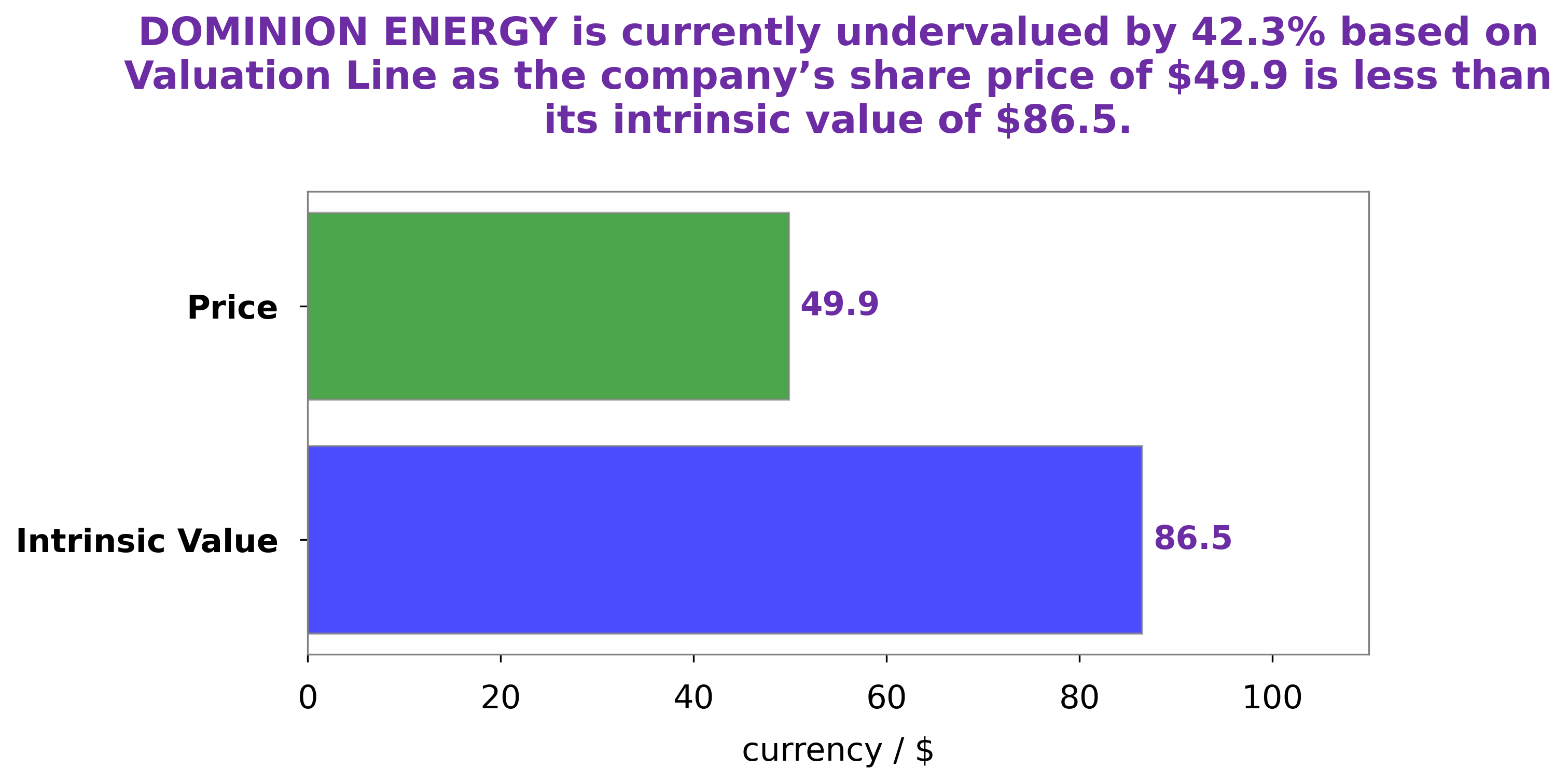

At GoodWhale, we performed a detailed analysis of DOMINION ENERGY‘s fundamentals. We found that the intrinsic value of DOMINION ENERGY’s share is around $86.5, as per our proprietary Valuation Line. This means that the stock is currently trading at $49.9 at the market, undervalued by an impressive 42.3%. This presents an opportunity for investors to buy DOMINION ENERGY shares at a discounted price. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Dominion Energy. More…

| Total Revenues | Net Income | Net Margin |

| 18.15k | 1.19k | 21.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Dominion Energy. More…

| Operations | Investing | Financing |

| 4.96k | -7.14k | 2.09k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Dominion Energy. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 105.33k | 76.97k | 33.92 |

Key Ratios Snapshot

Some of the financial key ratios for Dominion Energy are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.8% | -1.7% | 25.8% |

| FCF Margin | ROE | ROA |

| -16.7% | 10.4% | 2.8% |

Peers

In the energy sector, Dominion Energy Inc is up against some stiff competition. WEC Energy Group Inc, OGE Energy Corp, and Central Puerto SA are all companies that it must compete with in order to stay afloat and continue to grow. Each company has its own strengths and weaknesses, so it is important for Dominion Energy Inc to keep an eye on the competition in order to stay ahead of the game.

– WEC Energy Group Inc ($NYSE:WEC)

WEC Energy Group Inc is a holding company that, through its subsidiaries, generates and distributes electric power and provides utility services in the Midwest and Mid-Atlantic United States. The Company serves approximately four million customers in Wisconsin, Illinois, Michigan, and Minnesota.

WEC Energy Group Inc has a market cap of 27.02B as of 2022. It has a ROE of 11.61%. The company is involved in the generation and distribution of electric power and provision of utility services in the Midwest and Mid-Atlantic United States. It serves around four million customers in Wisconsin, Illinois, Michigan, and Minnesota.

– OGE Energy Corp ($NYSE:OGE)

Duke Energy Corporation is an American electric power holding company headquartered in Charlotte, North Carolina. The company is the largest utility in the United States with 7.3 million customers in six states. Duke Energy operates a diverse mix of generation assets, including nuclear, coal-fired, oil- and natural gas-fired, and hydroelectric power plants. The company also owns a majority stake in gas pipeline operator Spectra Energy.

– Central Puerto SA ($NYSE:CEPU)

Central Puerto SA is an Argentinean electricity generation company. The company has a market cap of 1.34 billion as of 2022 and a return on equity of 7.42%. Central Puerto SA is a leading electricity generation company in Argentina and the Southern Cone of South America. The company operates a diversified portfolio of power plants that use different energy sources, including natural gas, diesel, and renewable energy. Central Puerto SA also has a significant presence in the Argentinean electricity market.

Summary

Assetmark Inc. has reported a 163% increase in its holdings of Dominion Energy, Inc. This move comes amidst market volatility and is a clear indication of the company’s confidence in the energy giant. The investment reflects an optimistic outlook on the future of Dominion Energy, as the company continues to expand its operations and capitalize on the growing demand for energy. It is likely that Assetmark’s decision to increase its stake in Dominion Energy is based on a thorough analysis of the company’s financial health, operations, and prospects. As such, this move is likely to provide long-term growth and a healthy return on investment for Assetmark.

Recent Posts