Diodes Incorporated Intrinsic Value – Diodes Incorporated Introduces High-Efficiency Buck Converters for Versatile POL Design Solutions

April 21, 2023

Trending News ☀️

Diodes Incorporated ($NASDAQ:DIOD), a global leading manufacturer of discrete semiconductor, application-specific integrated circuit (ASIC), and system-on-chip (SoC) products, has recently launched a new series of synchronous buck converters to support efficient and versatile power-over-load (POL) design solutions. The portfolio is designed to offer continuous output current ratings of 5A and 8A, enabling customers to optimize their designs for their respective application needs. The new POL design solutions from Diodes Incorporated offer the wide voltage range input capability that is required in a wide range of applications. This feature allows designers to easily configure their design for the optimal current rating, enabling them to maximize the efficiency of their system.

In addition, the new product range from Diodes Incorporated also provides a wide range of features that enable designers to more accurately tune the dynamic response of the system for improved efficiency and protection. The product range from Diodes Incorporated is designed to provide customers with the flexibility and scalability needed to meet their respective design requirements. In addition, these products are also highly reliable, offering increased reliability and cost savings compared to traditional solutions. With the introduction of these new POL design solutions, Diodes Incorporated continues to be a leader in the power industry, providing customers with innovative, cost-effective solutions that enable them to meet their design objectives.

Share Price

On Thursday, DIODES INCORPORATED announced the introduction of their latest High-Efficiency Buck Converters that are designed to provide versatile power-over-long (POL) design solutions. This new product is expected to meet the needs of a quickly evolving market and offer reliable, cost-effective solutions. The company’s stock opened at $83.6 and closed at $84.2, a drop of 0.1% from the previous closing price of $84.4. Despite this small decline, the new product has attracted significant interest from investors and industry professionals alike.

They also feature adjustable output voltage, current limit protection, and thermal shutdown. These features make the new product an ideal choice for applications such as industrial automation, medical instrumentation and consumer electronics. Overall, DIODES INCORPORATED’s new High-Efficiency Buck Converters are set to revolutionize the POL design solutions market and help the company continue its growth in the coming years. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Diodes Incorporated. More…

| Total Revenues | Net Income | Net Margin |

| 2k | 331.28 | 17.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Diodes Incorporated. More…

| Operations | Investing | Financing |

| 392.5 | -265.26 | -125.71 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Diodes Incorporated. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.29k | 705.39 | 33.29 |

Key Ratios Snapshot

Some of the financial key ratios for Diodes Incorporated are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.0% | 31.9% | 20.2% |

| FCF Margin | ROE | ROA |

| 9.0% | 17.4% | 11.0% |

Analysis – Diodes Incorporated Intrinsic Value

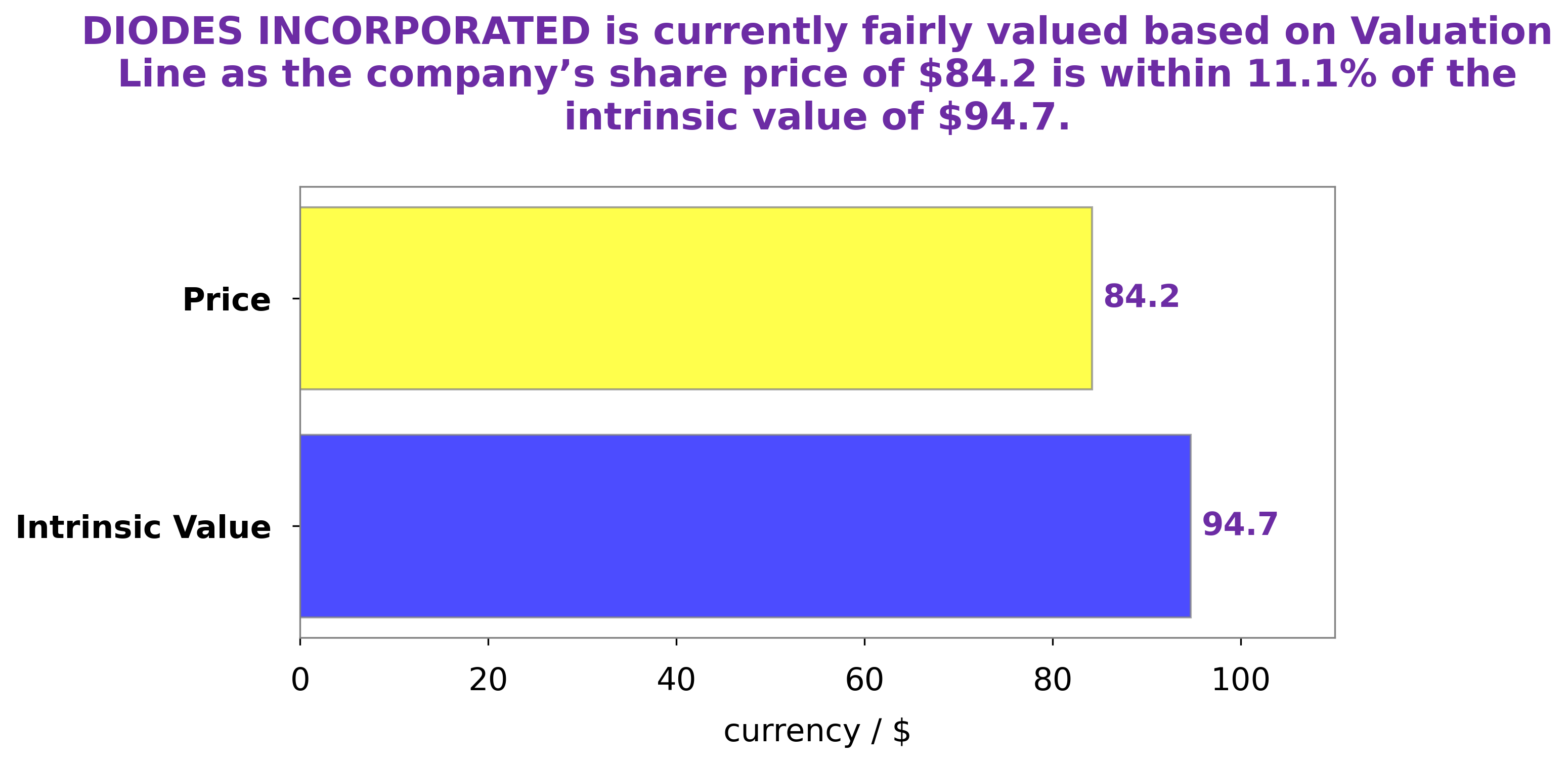

GoodWhale has recently completed an analysis of DIODES INCORPORATED‘s financials. After detailed calculations through our proprietary Valuation Line, we have determined that the fair value of DIODES INCORPORATED shares currently stands at $94.7. However, at the time of writing, DIODES INCORPORATED stock is being traded at a price of $84.2. This indicates that the stock is currently undervalued by 11.1%, providing investors with a possible opportunity to benefit from market inefficiencies. More…

Peers

Diodes Inc is in competition with Vishay Intertechnology Inc, Microchip Technology Inc, Aixtron SE. All of these companies are in the business of manufacturing semiconductor products.

– Vishay Intertechnology Inc ($NYSE:VSH)

Vishay Intertechnology is a leading manufacturer of discrete semiconductors and passive components. The company’s products include diodes, MOSFETs, thyristors, optoelectronic components, and power ICs. Vishay Intertechnology’s products are used in a wide range of end-markets, including automotive, computing, consumer electronics, industrial, and communications. The company has a strong market position in many of its product categories and is a leading supplier of power semiconductors, MOSFETs, and diodes. Vishay Intertechnology has a diversified customer base and a global footprint. The company’s products are sold to original equipment manufacturers, distributors, and contract manufacturers.

– Microchip Technology Inc ($NASDAQ:MCHP)

Microchip Technology Inc is a company that provides microcontroller, mixed-signal, analog and Flash-IP solutions. They have a market cap of 36.04B as of 2022 and a ROE of 25.66%. The company has over 8,000 employees and serves over 125,000 customers in more than 70 countries.

– Aixtron SE ($OTCPK:AIIXY)

Aixtron SE is a publicly traded German company that manufactures and sells deposition equipment used in the semiconductor industry. The company has a market capitalization of 2.86 billion euros as of 2022 and a return on equity of 10.97%. Aixtron is a leading provider of deposition equipment and services for the semiconductor industry, with a focus on new and emerging technologies. The company has a strong presence in Asia, Europe, and North America.

Summary

Diodes Incorporated has recently released high-efficiency buck converters, enabling a wide range of power supply design versatility. With output current ratings of 5A and 8A, investors should consider the potential benefits of investing in Diodes Incorporated. This company has a strong portfolio of innovative products, wide-ranging scalability, and advanced technology that could potentially offer growth opportunities and strengthen investor returns in the long run.

Recent Posts