Curtiss-Wright Acquires Keronite For $35M

November 17, 2022

Trending News 🌥️

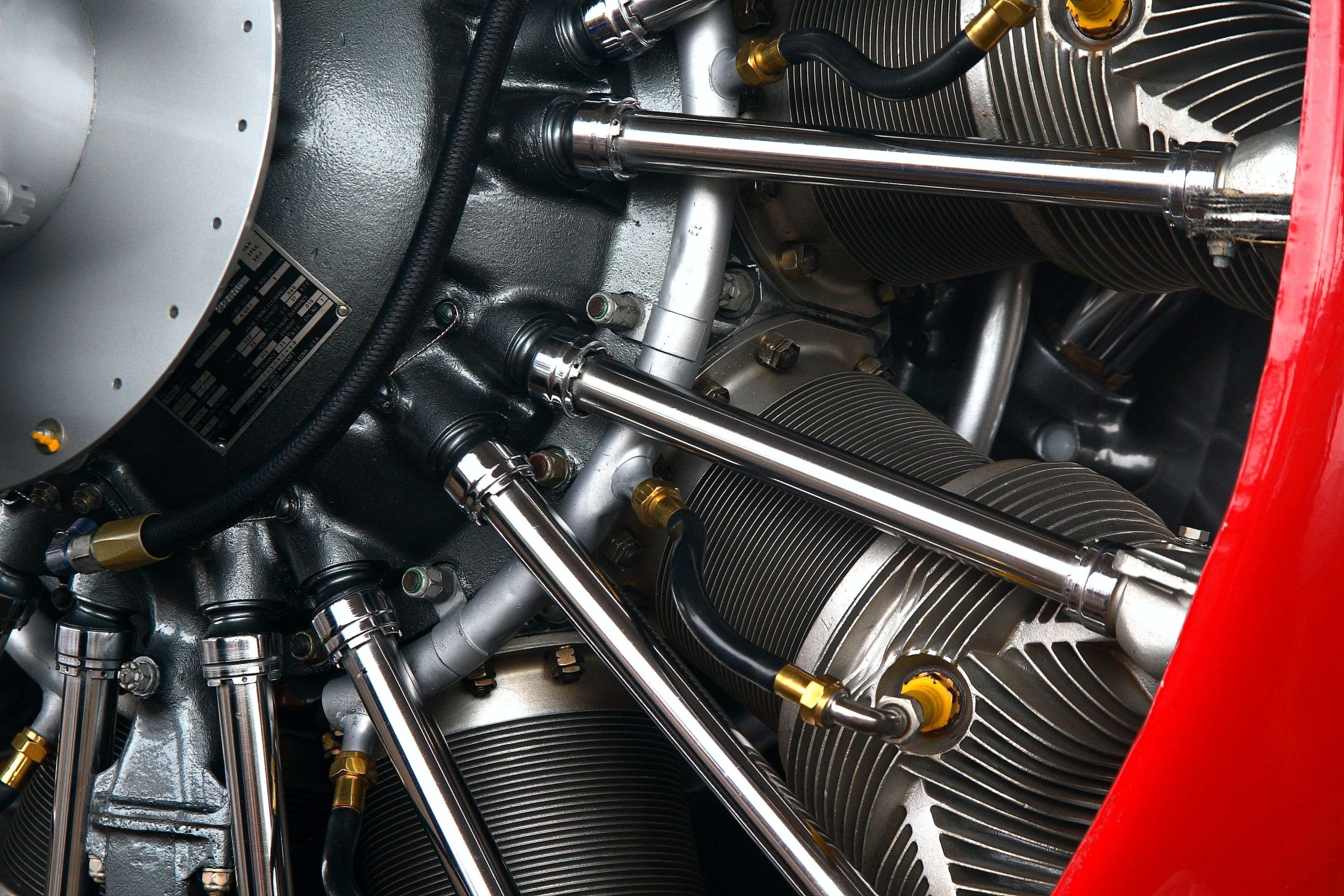

Curtiss-wright Corporation Stock Intrinsic Value – CURTISS-WRIGHT ($NYSE:CW): Curtiss-Wright Corporation is a publicly traded company that focuses on engineering, manufacturing, and services for the commercial, industrial, and defense markets. The company operates through three segments: Commercial/Industrial, Defense, and Power. On Wednesday, Curtiss-Wright announced that it had acquired Keronite, based in Cambridge, U.K., for $35M in cash.

Keronite is a pioneer in the surface treatment of aluminum alloys, which is used in a variety of applications such as aerospace, automotive, and electronics. The acquisition will expand Curtiss-Wright’s surface treatment capabilities and allow the company to enter into new markets.

Stock Price

On Wednesday, CURTISS-WRIGHT CORPORATION stock opened at $175.3 and closed at $174.4, down by 0.4% from previous closing price of 175.2. The company announced that it had acquired Keronite, a UK-based company that specializes in surface treatment technologies, for $35 million. Keronite’s surface treatment technology is used in a variety of industries, including aerospace, automotive, and medical.

The acquisition will allow Curtiss-Wright to expand its surface treatment capabilities and better serve its global customer base. Curtiss-Wright is a leading provider of highly engineered products and services to the aerospace, defense, and industrial markets.

VI Analysis – Curtiss-wright Corporation Stock Intrinsic Value

Curtiss-Wright Corporation is a diversified company that provides highly engineered products and services to the aerospace, defense, and other industrial markets. The company’s fundamentals reflect its long term potential, making it a good investment for the long run. The intrinsic value of Curtiss-Wright Corporation shares is around $95.8, calculated by VI Line. Now Curtiss-Wright Corporation stock is traded at $174.4, overvalued by 82%.

VI Peers

Its competitors include Circor International Inc, Altra Industrial Motion Corp, Parker Hannifin Corp.

– Circor International Inc ($NYSE:CIR)

Circor International, Inc. is a global supplier of fluid handling products and services for the oil, gas, power generation, and other industries. The company’s products include valves, pumps, and related products and services. Circor International, Inc. was founded in 1987 and is headquartered in Burlington, Massachusetts.

– Altra Industrial Motion Corp ($NASDAQ:AIMC)

Altria Industrial Motion Corp is a publicly traded company that manufactures and sells a variety of industrial products. The company has a market capitalization of 3.77 billion as of 2022 and a return on equity of 3.22%. Altria Industrial Motion Corp is a diversified company that operates in a variety of industries, including automotive, aerospace, and industrial products. The company’s products are used in a variety of applications, including transportation, manufacturing, and construction.

– Parker Hannifin Corp ($NYSE:PH)

Parker Hannifin is a diversified industrial manufacturer that specializes in motion and control technologies. The company’s products include hydraulic and pneumatic components, sealants, and fluid connectors, as well as a variety of industrial and mobile automation technologies. Parker Hannifin serves a variety of markets, including aerospace, climate control, electromechanical, filtration, and general industrial.

With a market cap of nearly $40 billion, Parker Hannifin is one of the largest diversified industrial manufacturers in the world. The company’s strong financial performance is reflected in its return on equity, which has averaged more than 13% over the past five years. Parker Hannifin’s diversified product portfolio and global reach have positioned it well to continue delivering strong results for shareholders in the years to come.

Summary

Investing in Curtiss-Wright Corporation may appeal to investors seeking exposure to a diversified company with a long history of success. The company has a strong balance sheet and a track record of consistent profitability.

Recent Posts