CPT Stock Fair Value – CFRA Upgrades Camden Property Trust to Buy After Recent Stock Dip

April 1, 2023

Trending News ☀️

Camden Property Trust ($NYSE:CPT) (NYSE: CPT) recently received a major endorsement when CFRA upgraded their stock rating to a “Buy”. This upgrade follows on the heels of the stock’s dip from its 52-week high. CPT is a real estate firm that specializes in the ownership, development, acquisition, and management of multifamily apartment communities. Camden Property Trust seeks to enhance the value of their apartments through both physical improvements and efficient operations.

The company has also maintained consistent occupancy levels for their properties across the United States, which shows that their apartments remain in demand. CFRA’s buy rating reflects their confidence in CPT’s ability to continue to deliver strong returns for its investors. With a recent stock dip, CPT represents an attractive buying opportunity for investors looking to capitalize on a solid real estate firm.

Market Price

CAMDEN stock opened at $102.9 and closed at $103.2, up by 0.6% from the prior closing price of 102.6. Analysts view the recent stock dip as an opportunity to capitalize on CAMDEN’s strong fundamentals and long-term growth potential. They believe that the company is well-positioned to capitalize on the current favorable real estate market conditions and expect that their current strategies will generate string returns for investors. With its portfolio of apartment communities and strong financial condition, CAMDEN is well-equipped to continue growing in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for CPT. More…

| Total Revenues | Net Income | Net Margin |

| 1.42k | 652.62 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for CPT. More…

| Operations | Investing | Financing |

| 744.71 | -1.46k | 109.93 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for CPT. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.33k | 4.27k | 46.82 |

Key Ratios Snapshot

Some of the financial key ratios for CPT are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 18.4% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis – CPT Stock Fair Value

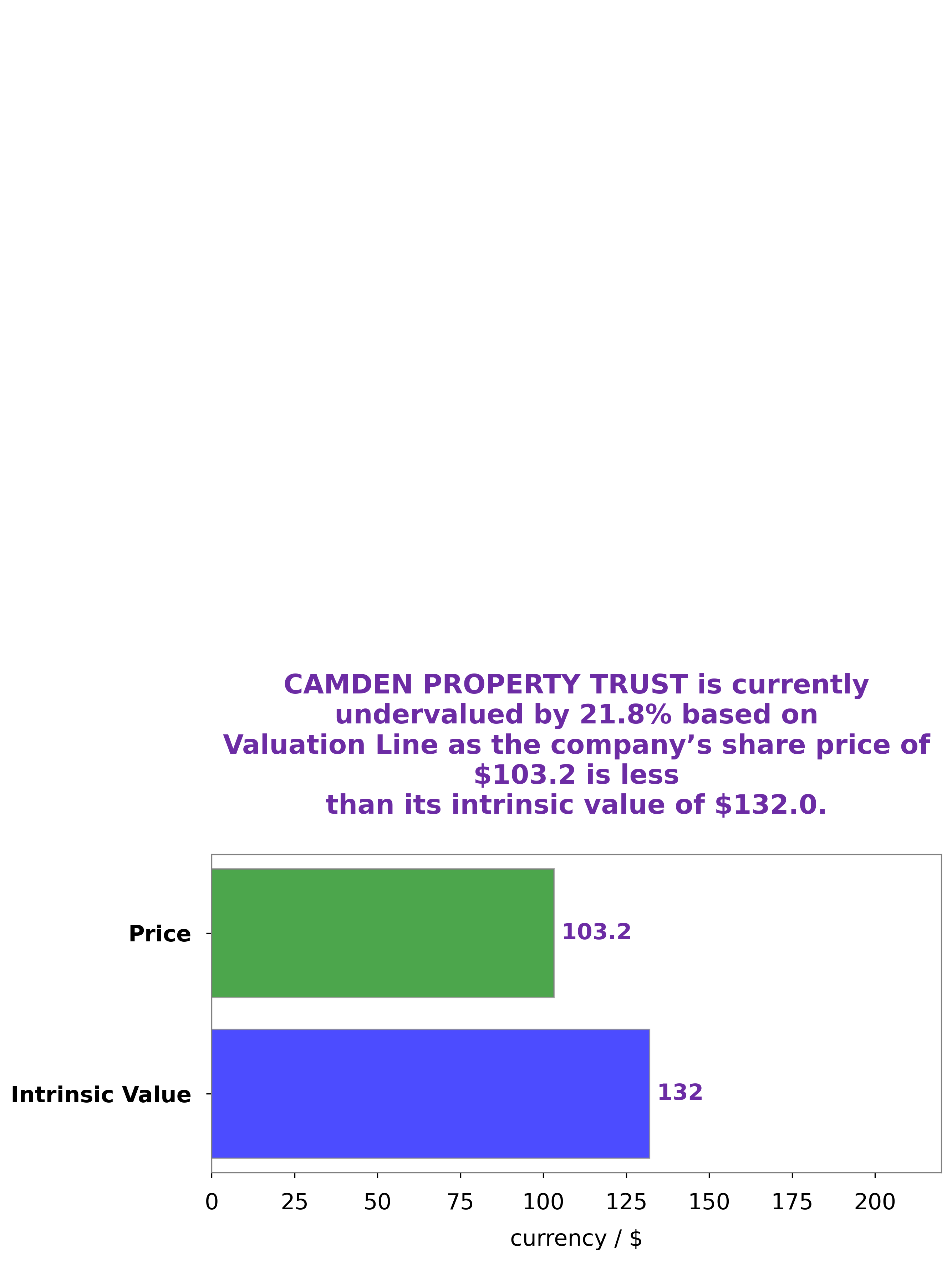

At GoodWhale, we have analyzed CAMDEN PROPERTY TRUST’s wellbeing, and have come to the conclusion that its intrinsic value is around $132.0. This figure is determined by our proprietary Valuation Line. Currently, CAMDEN PROPERTY TRUST stock is traded at $103.2, making it undervalued by 21.8%. We have assessed the company’s performance and determined that it is a good investment opportunity. More…

Peers

Camden Property Trust is one of the leading publicly-traded Real Estate Investment Trusts (REITs) in the United States, specializing in multifamily communities. It competes with other similar REITs such as Sun Communities Inc., Boardwalk Real Estate Investment Trust and Canadian Apartment Properties Real Estate Investment Trust. All of these companies are dedicated to acquiring, developing, managing and disposing of multifamily communities.

– Sun Communities Inc ($NYSE:SUI)

Sun Communities Inc is a real estate investment trust that specializes in the ownership, operation, and development of manufactured housing and recreational vehicle communities. As of 2022, the company has a market cap of 17.63 billion, indicating its large size and high market value. Sun Communities Inc is the leading owner and operator of manufactured housing communities and RV resorts in North America and has over 400 properties located throughout the United States and Canada. The company’s portfolio consists of approximately 150,000 developed sites and more than 20,000 undeveloped sites. Sun Communities Inc has experienced solid growth since its inception and continues to be a leader in the industry.

– Boardwalk Real Estate Investment Trust ($TSX:BEI.UN)

Boardwalk Real Estate Investment Trust is a real estate investment trust that owns and operates multi-family residential properties in Canada. Its market cap of 2.53B as of 2022 reflects its strong business model, healthy balance sheet, and solid financial performance. Boardwalk has a diversified portfolio of properties located in major urban centers across the country, including Calgary, Toronto, Ottawa, and Montreal. Its portfolio consists of over 35,000 residential units and more than 2.6M square feet of commercial space. The company is well-positioned to grow its market cap and profitability in the years to come as the demand for high-quality rental accommodations in Canada continues to increase.

– Canadian Apartment Properties Real Estate Investment Trust ($TSX:CAR.UN)

Canadian Apartment Properties Real Estate Investment Trust (CAPREIT) is a leading real estate investment trust in Canada, specializing in the acquisition, ownership and management of multi-residential rental properties. With a market cap of 7.42B in 2022, CAPREIT is one of Canada’s largest real estate investment trusts and has a portfolio of almost 50,000 residential units including apartments, townhomes, and manufactured home communities located in and around major cities in Canada and Ireland. CAPREIT’s business model focuses on maximizing value for its unitholders through organic growth and strategic acquisitions. The company is committed to responsible management of its properties and tenants, and has a long-term focus on providing secure and affordable housing in attractive locations.

Summary

CFRA recently upgraded Camden Property Trust from Hold to Buy. This positive outlook came after the stock had dipped from its 52-week high, creating an opportunity for investors to acquire shares at a discounted price. Analysts cited Camden’s strong balance sheet and solid dividend yield as reasons for the upgrade.

They believe that due to the company’s diverse portfolio of properties consisting of apartments and townhomes, Camden is well positioned to benefit from improving macroeconomic conditions. Therefore, CFRA sees Camden Property Trust as a good option for investors looking to capitalize on an attractive entry point.

Recent Posts