Consolidated Water Stock Fair Value – Consolidated Water to Construct Desalination Plant in Hawaii for $204M

June 12, 2023

🌥️Trending News

Consolidated Water ($NASDAQ:CWCO), a well-known water supply and services company, has agreed to a $204 million deal to construct a water desalination plant in Hawaii. This is just one of many projects Consolidated Water has undertaken over the years to provide clean, safe drinking water to communities around the world.

Additionally, the plant will also serve as a backup source for other islands in the area. Consolidated Water has an established track record when it comes to water projects and is widely recognized as a leader in providing quality water solutions. It has worked on numerous desalination projects in many countries, including the United Arab Emirates, Mexico, and Cuba. These projects have helped reduce water scarcity and improve water quality, making them important contributions to local communities. The company’s stock has been steadily increasing since news of the project in Hawaii was announced, signaling strong investor confidence in the success of the project. If the project is successful, Consolidated Water stands to gain significant profits and could justify additional investments in similar projects around the world.

Price History

The project will cost a total of $204 million, and the company’s stock reacted positively in response to the news. The stock opened at $20.1 and closed at $20.2, up 0.5% from last closing price of $20.0. This positive news and the associated market reaction indicate confidence in the company’s operations and its ability to successfully complete the project. The desalination plant is expected to provide an important new source of freshwater for Hawaii’s residents, while boosting the long-term profitability of CONSOLIDATED WATER. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Consolidated Water. More…

| Total Revenues | Net Income | Net Margin |

| 107.42 | 7.94 | 9.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Consolidated Water. More…

| Operations | Investing | Financing |

| 22.06 | -8.05 | -6.32 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Consolidated Water. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 201.61 | 33.19 | 10.41 |

Key Ratios Snapshot

Some of the financial key ratios for Consolidated Water are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.0% | 6.2% | 11.1% |

| FCF Margin | ROE | ROA |

| 12.9% | 4.6% | 3.7% |

Analysis – Consolidated Water Stock Fair Value

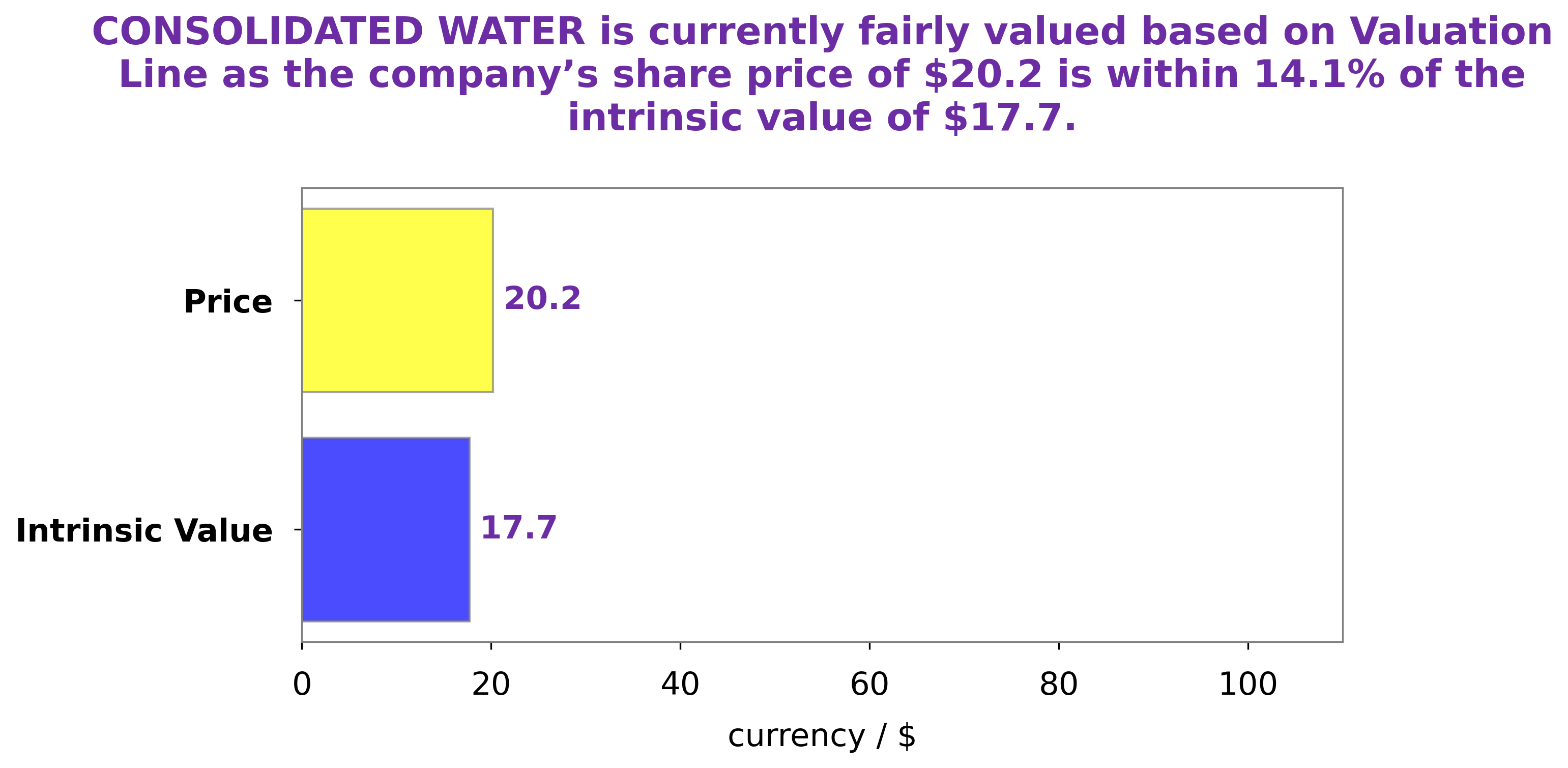

At GoodWhale, we have analyzed the financials of CONSOLIDATED WATER and used our proprietary Valuation Line to determine its fair value. The estimated fair price of a CONSOLIDATED WATER stock is around $17.7. However, the stock is currently trading at $20.2, which is a fair price that is overvalued by 14.1%. More…

Peers

The water industry is highly competitive, with companies vying for market share. In this report, we will compare the three main competitors in the water industry: Consolidated Water Co Ltd, Pure Cycle Corp, Eastern Water Resources Development and Management PCL, and Thu Duc Water. We will provide an overview of each company, their financial performance, and their competitive advantages and disadvantages.

– Pure Cycle Corp ($NASDAQ:PCYO)

Cycle Corp is engaged in the business of providing water and wastewater solutions to residential, commercial, and industrial customers in the United States. The company’s products and services include water and wastewater treatment systems, reverse osmosis systems, water softeners, and bottled water. It also provides engineering, construction, and maintenance services for water and wastewater treatment facilities.

– Eastern Water Resources Development and Management PCL ($SET:EASTW)

Eastern Water Resources Development and Management Public Company Limited (EASTWATER) is a Thailand-based company engaged in the water resources development and management. The Company operates three business segments: domestic water supply business, which provides tap water to residential and commercial customers in Phra Pradaeng District, Samut Prakan Province; wastewater management business, which treats wastewater from residential and commercial customers in Phra Pradaeng District, Samut Prakan Province; and other businesses, which include the provision of consultancy services on water resources development and management. Its domestic water supply business includes the development of water resources, construction of water treatment plants and water pipelines, as well as operation and maintenance of water treatment plants and water pipelines. Through its wastewater management business, the Company provides wastewater collection services and develops wastewater treatment plants.

Summary

Consolidated Water Co. Ltd. has recently announced an agreement to build a water desalination plant in Hawaii, estimated to cost $204 million. The project is being supported by the Hawaii Department of Land and Natural Resources and is expected to provide a much-needed water solution to the state. This is an important investment for Consolidated Water as it will help the company expand its presence in an area with high potential for increased demand.

The project is expected to be complete by 2022, with the company expecting to benefit from the increased access to potable water. Overall, this move represents a positive step forward for Consolidated Water and should help grow the company’s profile in the region.

Recent Posts