Consolidated Water Stock Fair Value – Consolidated Water Co. Ltd. (NASDAQ:CWCO) Short Interest Drops Significantly in March

April 6, 2023

Trending News ☀️

Consolidated Water ($NASDAQ:CWCO) Co. Ltd. According to data released by Nasdaq, short interest in the company decreased by 5.1%. Consolidated Water Co. Ltd is a leader in the production of purified water and water-related services. With operations in seven countries, it is a public company that is listed on the NASDAQ stock exchange. It has a diversified customer base, including major resorts, public water utilities, and multinational companies.

The company also operates and manages desalination plants and water distribution systems in the Bahamas, Belize, the Cayman Islands, and other Caribbean locations. Its products and services range from retail bottled water to industrial-scale desalination solutions. The company has a long-term strategy of growth and expansion and is committed to providing high-quality products and services to its customers.

Market Price

(NASDAQ:CWCO). The stock opened at $16.4 and closed at $16.3, a decrease of 0.9% from the last closing price of $16.4. This comes as significant news as it marks a major drop in short interest for the company. Over the course of March, short interest for Consolidated Water dropped significantly, indicating the stock is gaining traction among investors.

This has led to renewed confidence in the company’s performance and outlook for the future. With this decrease in short interest, investors are likely to take a closer look at CONSOLIDATED WATER, giving them a more comprehensive view of the company’s future potential. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Consolidated Water. More…

| Total Revenues | Net Income | Net Margin |

| 94.1 | 5.84 | 8.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Consolidated Water. More…

| Operations | Investing | Financing |

| 21.33 | -4.98 | -6.3 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Consolidated Water. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 193.01 | 25.24 | 10.2 |

Key Ratios Snapshot

Some of the financial key ratios for Consolidated Water are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.0% | 1.3% | 10.4% |

| FCF Margin | ROE | ROA |

| 14.7% | 3.8% | 3.2% |

Analysis – Consolidated Water Stock Fair Value

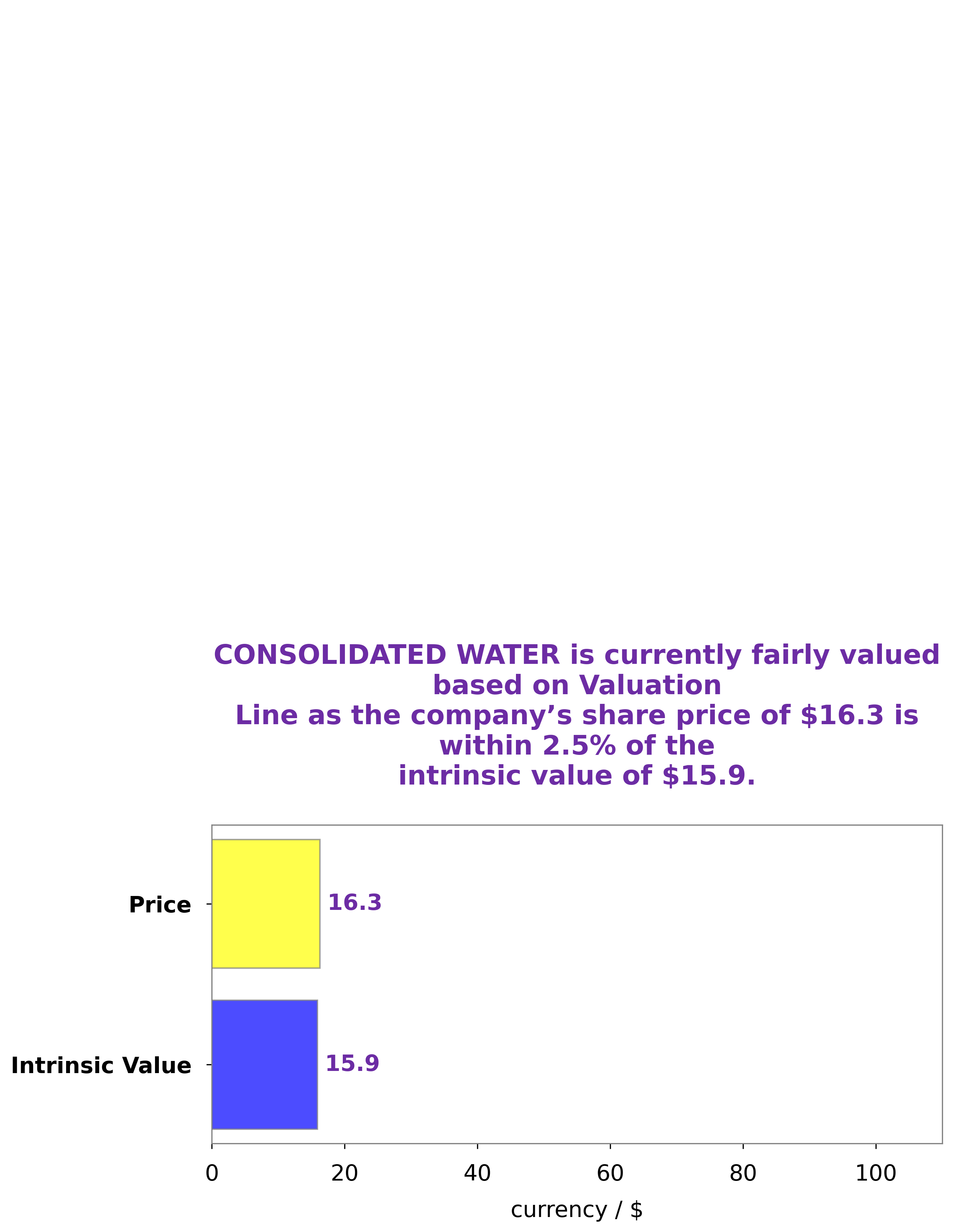

At GoodWhale, we specialize in analyzing financials of companies to make accurate predictions of stock values and to provide investors with an unbiased opinion. After carefully reviewing the financials of CONSOLIDATED WATER, we have come to the conclusion that its fair value is around $15.9. To reach this conclusion, we used our proprietary Valuation Line tool. This tool takes into account numerous factors such as financial ratios, market dynamics, and economic forecasts. Currently, CONSOLIDATED WATER’s stock is trading for $16.3, indicating it is slightly overvalued by 2.8%. We believe that this is a good opportunity for investors looking to buy in at a reasonable price. More…

Peers

The water industry is highly competitive, with companies vying for market share. In this report, we will compare the three main competitors in the water industry: Consolidated Water Co Ltd, Pure Cycle Corp, Eastern Water Resources Development and Management PCL, and Thu Duc Water. We will provide an overview of each company, their financial performance, and their competitive advantages and disadvantages.

– Pure Cycle Corp ($NASDAQ:PCYO)

Cycle Corp is engaged in the business of providing water and wastewater solutions to residential, commercial, and industrial customers in the United States. The company’s products and services include water and wastewater treatment systems, reverse osmosis systems, water softeners, and bottled water. It also provides engineering, construction, and maintenance services for water and wastewater treatment facilities.

– Eastern Water Resources Development and Management PCL ($SET:EASTW)

Eastern Water Resources Development and Management Public Company Limited (EASTWATER) is a Thailand-based company engaged in the water resources development and management. The Company operates three business segments: domestic water supply business, which provides tap water to residential and commercial customers in Phra Pradaeng District, Samut Prakan Province; wastewater management business, which treats wastewater from residential and commercial customers in Phra Pradaeng District, Samut Prakan Province; and other businesses, which include the provision of consultancy services on water resources development and management. Its domestic water supply business includes the development of water resources, construction of water treatment plants and water pipelines, as well as operation and maintenance of water treatment plants and water pipelines. Through its wastewater management business, the Company provides wastewater collection services and develops wastewater treatment plants.

Summary

Consolidated Water Co. Ltd.

Recent Posts