Conagra Brands Intrinsic Stock Value – Conagra Brands Rises 0.68% to Close at $36.75 on Friday, May 12

May 17, 2023

Trending News 🌥️

On Friday, May 12, Conagra Brands ($NYSE:CAG) Inc. closed at $36.75, a 0.68% increase from its closing price the day before. Conagra Brands Inc. is an American packaged foods company headquartered in Chicago, Illinois. It is one of the largest food companies in North America, engaged in the manufacture and sale of food products such as condiments and sauces, frozen and refrigerated foods, snacks, and desserts. In addition to its portfolio of well-known brands, including Healthy Choice, Hunt’s, Marie Callender’s, Peter Pan, Reddi-wip, Slim Jim, and PAM cooking spray, Conagra also owns the Odom’s Tennessee Pride brand of breakfast sausage. Since then, the stock has been steadily increasing in value and closed at $36.75 on Friday, May 12.

This represents a 0.68% increase in share price from the previous day’s closing price. Conagra Brands has invested heavily in developing its portfolio of products to meet increasing consumer demand for healthier and more sustainable foods. The company also continues to invest in its capabilities to achieve long-term growth and profitability. With positive market sentiment and a robust portfolio of products, Conagra Brands is well-positioned to continue strong performance in the future.

Analysis – Conagra Brands Intrinsic Stock Value

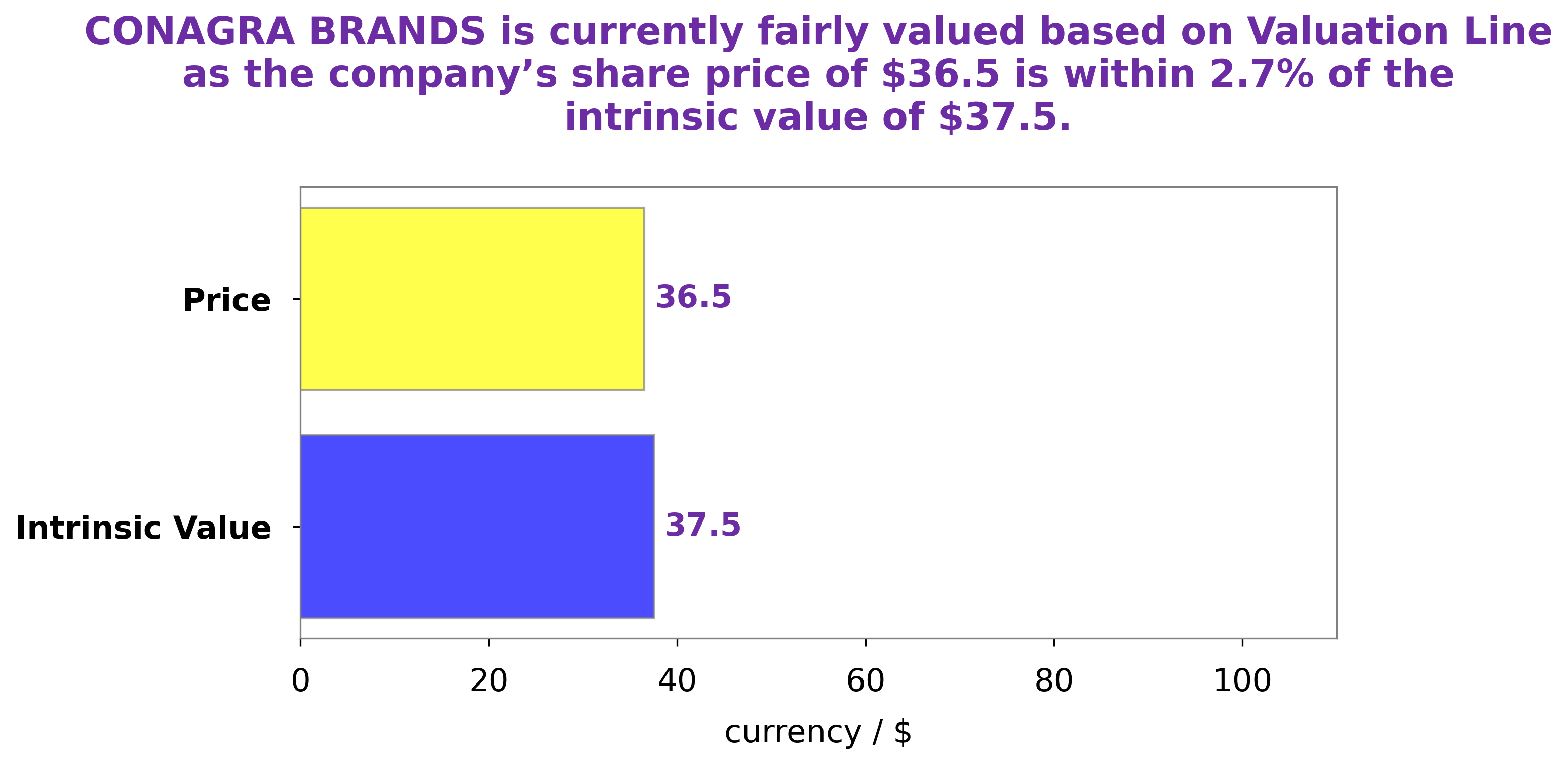

At GoodWhale, we have conducted an in-depth analysis of CONAGRA BRANDS‘s fundamentals. Our proprietary Valuation Line was used to calculate the intrinsic value of CONAGRA BRANDS’ share which came out to be around $37.5. At the time of writing, CONAGRA BRANDS stock is traded at $36.5, a fair price which is slightly undervalued by 2.7%. Therefore we at GoodWhale suggest investors to keep a watch on the stock for possible long term returns. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Conagra Brands. More…

| Total Revenues | Net Income | Net Margin |

| 12.21k | 805 | 6.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Conagra Brands. More…

| Operations | Investing | Financing |

| 1.13k | -352.2 | -785.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Conagra Brands. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 22.45k | 13.52k | 18.18 |

Key Ratios Snapshot

Some of the financial key ratios for Conagra Brands are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.6% | -3.5% | 10.4% |

| FCF Margin | ROE | ROA |

| 6.2% | 9.2% | 3.5% |

Peers

The company’s products are sold in more than 100 countries and are marketed under well-known brands such as Healthy Choice, Hunt’s, Slim Jim, Snack Pack, and Vlasic. Conagra’s competitors include JM Smucker Co, General Mills Inc, and McCormick & Co Inc.

– JM Smucker Co ($NYSE:SJM)

The J. M. Smucker Company has a market capitalization of $15.57 billion as of 2022 and a return on equity of 7.19%. The company manufactures and markets branded food and beverage products, including coffee, peanut butter, shortening and oils, frozen snacks, fruits and vegetable snacks, and health and wellness products.

– General Mills Inc ($NYSE:GIS)

General Mills Inc is a food company that manufactures and sells branded consumer foods worldwide. The company has a market cap of 48.09B as of 2022 and a Return on Equity of 20.18%. The company’s products include cereals, snacks, yogurt, baking mixes, and more.

– McCormick & Co Inc ($NYSE:MKC)

McCormick & Co Inc is a food company that manufactures, markets, and distributes spices, seasoning mixes, condiments, and other flavoring products. The company has a market cap of 22.46B as of 2022 and a return on equity of 13.21%. The company’s products are sold in over 180 countries and territories.

Summary

Conagra Brands Inc. is a food and agriculture company that offers a variety of products to consumers. The stock price of Conagra Brands Inc. has been steadily increasing in recent months, closing at $36.75 on Friday, May 12. This represents a 0.68% increase from the previous day’s closing price. Investors should consider Conagra Brands Inc. as a potential investment opportunity due to its strong performance in the stock market and its growing presence in the food and agricultural industry.

Furthermore, with a strong balance sheet and product portfolio, Conagra Brands Inc. is positioned to continue delivering strong financial results. Overall, Conagra Brands Inc. appears to be a good investment for investors looking for a diversified and stable portfolio.

Recent Posts