Cnx Resources Stock Intrinsic Value – HighTower Advisors LLC Slashes Stake in CNX Resources Co. by 48.8%

June 12, 2023

🌧️Trending News

CNX ($NYSE:CNX) Resources Co. is an energy company with operations primarily in the Appalachian Basin. According to a recent 13F filing, HighTower Advisors LLC, one of its major shareholders, has slashed its stake in the company by 48.8%. Although the exact reason for the sell-off is unknown, it could be indicative of a shift in investor sentiment towards the company, as well as shifting market dynamics. The move could also be attributed to a decrease in confidence in the short-term performance of CNX Resources Co.’s stock.

Analysis – Cnx Resources Stock Intrinsic Value

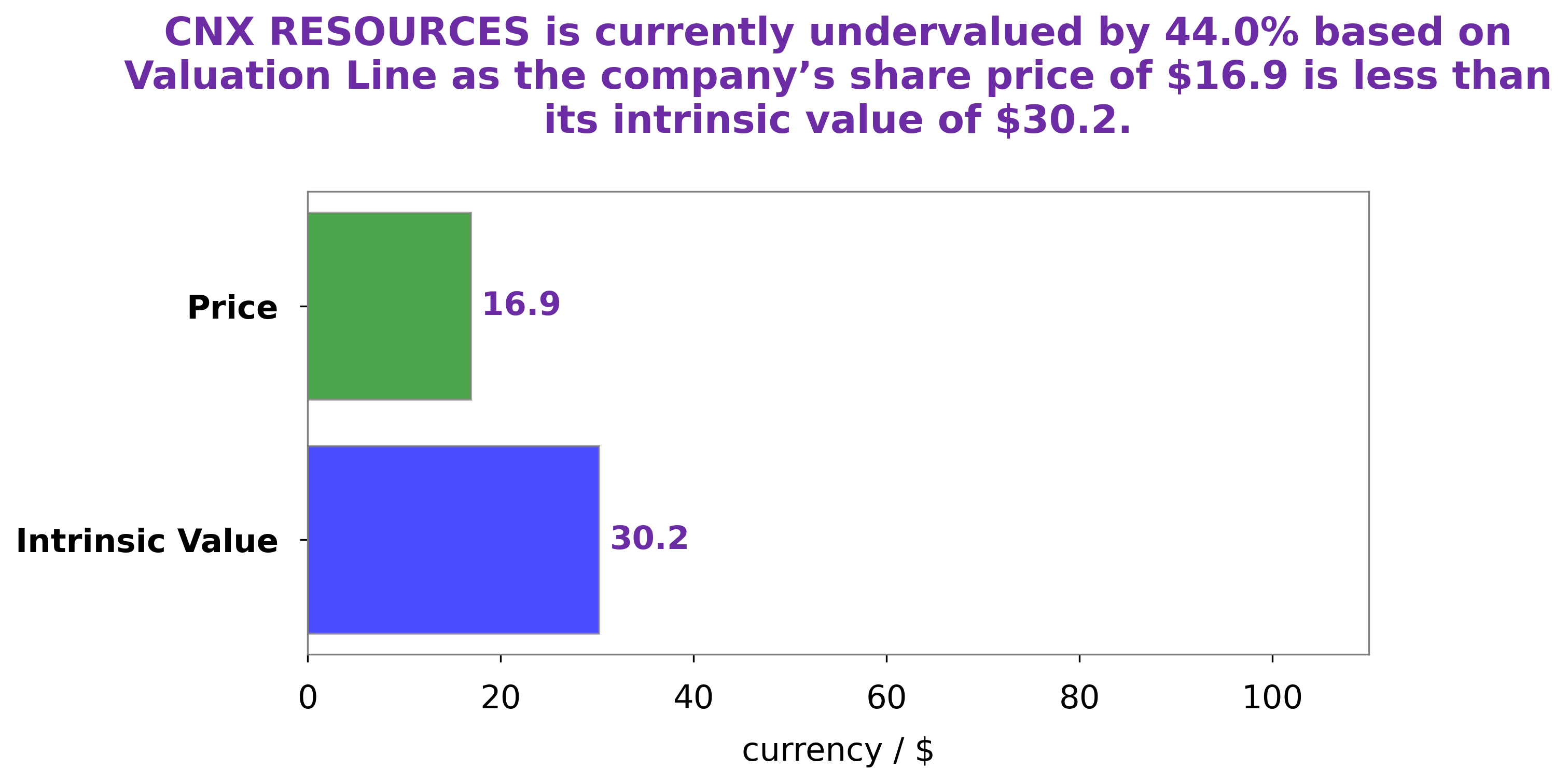

At GoodWhale, we provide financial analysis on CNX RESOURCES. After careful analysis, we have determined the intrinsic value of CNX RESOURCES to be around $30.2, as calculated by our proprietary Valuation Line. This means that the stock is currently undervalued by 44.1%, as it is currently traded at $16.9. As such, there may be potential for investors to benefit from this discrepancy in the future. We advise investors to carefully consider the financials of CNX RESOURCES before making any investments. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cnx Resources. More…

| Total Revenues | Net Income | Net Margin |

| 3.63k | 1.49k | 45.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cnx Resources. More…

| Operations | Investing | Financing |

| 1.15k | -584.91 | -568.22 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cnx Resources. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.34k | 4.77k | 21.24 |

Key Ratios Snapshot

Some of the financial key ratios for Cnx Resources are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 38.2% | 201.1% | 57.9% |

| FCF Margin | ROE | ROA |

| 14.7% | 40.3% | 15.7% |

Peers

The competition between CNX Resources Corp and its competitors is fierce. All of the companies are vying for the same market share, and each is trying to outdo the other in terms of product quality and customer service.

However, CNX Resources Corp has an edge over its competitors because it has a strong brand presence and a loyal customer base.

– HighPeak Energy Inc ($NASDAQ:HPK)

HighPeak Energy Inc is a Canadian oil and gas company with a market cap of 2.44B as of 2022. The company has a Return on Equity of 14.7%. HighPeak Energy is engaged in the exploration, development and production of oil and natural gas in the Western Canadian Sedimentary Basin.

– Earthstone Energy Inc ($NYSE:ESTE)

Stone Energy is an oil and gas exploration and production company with operations primarily in the Gulf of Mexico. The company was founded in 1993 and is headquartered in Lafayette, Louisiana.

As of 2022, Stone Energy has a market capitalization of 1.6 billion dollars and a return on equity of 18.64%. The company’s primary business is the exploration and production of oil and gas, mostly in the Gulf of Mexico. Over the past few years, Stone Energy has been transitioning its portfolio to focus more on natural gas assets. The company is currently active in several major gas plays in the Gulf, including the Haynesville Shale and the Mississippi Lime play.

– Carbon Energy Corp ($OTCPK:CRBO)

Carbon Energy Corp is a Canadian oil and gas company with a market cap of 20.76k as of 2022. The company has a Return on Equity of -36.04%. Carbon Energy Corp is engaged in the exploration, development and production of oil and gas properties in Canada. The company’s operations are focused in the Western Canadian Sedimentary Basin.

Summary

CNX Resources is an American energy company engaged in the exploration and production of natural gas, oil, and natural gas liquids. HighTower Advisors LLC recently reduced their position in CNX Resources by 48.8% in the fourth quarter, suggesting that the company may no longer be a viable investment opportunity. Investors should conduct their own research into the company before investing, taking into consideration its financial history, risks, competition, and potential return on investment. Fundamental analysis should also be used to determine if the company is a good fit for an individual investor’s portfolio.

Additionally, technical analysis should be used to identify trends and long-term price movements. By combining both analysis methods, investors will be able to make more informed decisions regarding CNX Resources.

Recent Posts