Clarus Corporation Intrinsic Value Calculation – Clarus Corporation Quarterly Report Anticipated to Make Waves in Financial Markets

April 25, 2023

Trending News 🌥️

The market is abuzz with anticipation as Clarus Corporation ($NASDAQ:CLAR) is set to release its quarterly report. As one of the most successful publicly traded companies, Clarus Corporation has consistently exceeded the expectations of investors, and this quarter is expected to be no different. Clarus Corporation is a leading multinational conglomerate, which has become a driving force behind economic growth in many countries. With a portfolio of innovative products and services that span across multiple industries, Clarus Corporation has seen its stock skyrocket over the past year. Shareholders have been consistently delighted with the company’s performance, making it one of the most successful publicly traded companies.

With such high expectations for the upcoming quarterly report, investors are eager to see how Clarus Corporation will perform in the coming quarter. Analysts have already speculated that the company’s performance could lead to a major surge in its stock value, making it an attractive option for many investors. As they await the upcoming report, investors are sure to be watching Clarus Corporation closely, as any news or developments could have major implications for the market.

Stock Price

Monday marked a significant day in the financial markets as CLARUS CORPORATION released its quarterly report. The stock opened at $9.8 and closed at $9.6, representing a 1.4% decrease from the previous closing price of $9.8. The report was widely anticipated to have a significant impact on the market, and investors are closely monitoring how the markets will react in the coming weeks. CLARUS CORPORATION’s report could potentially create a ripple effect in the financial markets, and many investors are now closely watching the stock performance to determine if their investments may be affected. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Clarus Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 448.11 | -69.78 | 3.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Clarus Corporation. More…

| Operations | Investing | Financing |

| 14.61 | -7.75 | -13.86 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Clarus Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 518.14 | 226.04 | 7.88 |

Key Ratios Snapshot

Some of the financial key ratios for Clarus Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 25.0% | 34.7% | -15.5% |

| FCF Margin | ROE | ROA |

| 1.4% | -13.2% | -8.4% |

Analysis – Clarus Corporation Intrinsic Value Calculation

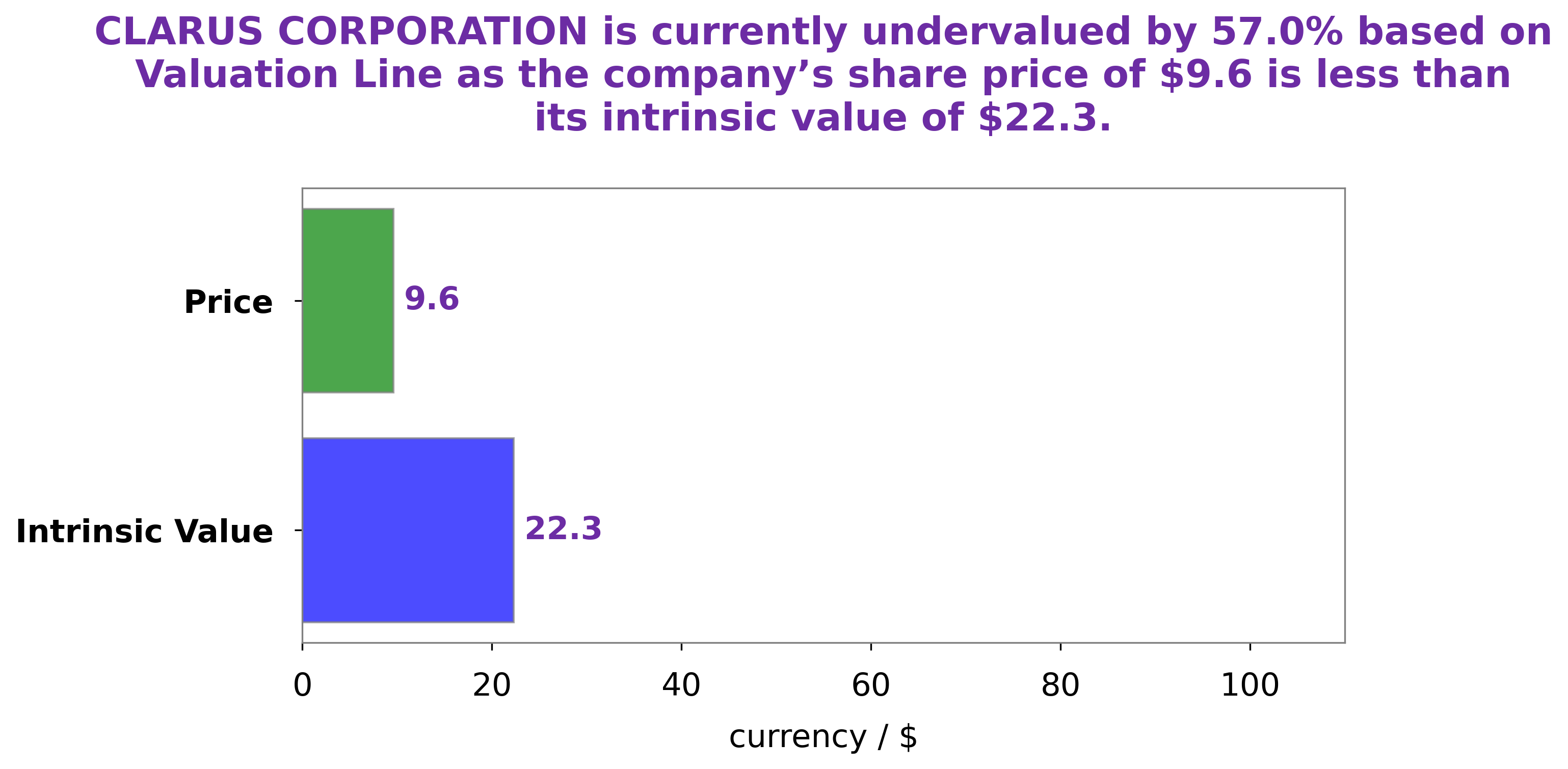

At GoodWhale, we analyzed the financials of CLARUS CORPORATION and determined that the intrinsic value of its share is around $22.3. This was calculated using our proprietary Valuation Line. This presents an opportunity for investors to add quality shares to their portfolios at a substantial discount. More…

Peers

The competition in the global musical instruments market is expected to intensify in the coming years as leading companies such as Yamaha Corporation, Johnson Health Tech Co. Ltd., and Rapala VMC Corporation battle for market share. The competition among these companies is likely to be driven by factors such as product innovation, marketing campaigns, and expansion into new geographic markets.

– Yamaha Corp ($TSE:7951)

Yamaha Corporation is a Japanese multinational corporation and conglomerate with a wide range of products and services, predominantly musical instruments, electronics, motorcycles, power sports equipment, and other motorized products.

The company has a market capitalization of 955.5 billion as of 2022 and a return on equity of 7.25%. Yamaha’s products are marketed under a variety of brand names, including Yamaha, Line 6, Steinberg, and Yamaha Pro Audio. The company also operates a number of subsidiaries, including Yamaha Music Education, Yamaha Motor Company, and Yamaha Golf-Car Company.

– Johnson Health Tech Co Ltd ($TWSE:1736)

Johnson Health Tech Co Ltd has a market cap of 22.03B as of 2022, a Return on Equity of -2.12%. The company is a leading manufacturer and distributor of fitness equipment and related products. Its products include treadmills, ellipticals, exercise bikes, strength training equipment, and home gyms. The company operates in over 100 countries and has a strong presence in the United States, Europe, and Asia.

– Rapala VMC Corp ($OTCPK:RPNMF)

Rapala VMC Corporation is a Finnish manufacturer of fishing lures, hooks, and other fishing tackle. The company has a market capitalization of 165.26 million as of 2022 and a return on equity of 7.98%. Rapala VMC Corporation is a leading provider of fishing products and services worldwide. The company’s products are sold in over 140 countries. Rapala VMC Corporation’s products include fishing lures, hooks, line, and other fishing tackle. The company also manufactures and sells fishing rods, reels, and other fishing equipment.

Summary

Investors are eagerly anticipating the quarterly report from Clarus Corporation, as speculation has been building about the company’s financial performance. Analysts have been studying the company’s past results and tracking indicators such as insider trading activity, stock performance, and analyst ratings to determine their expectations for the report. Many are expecting strong results, as Clarus has been expanding their operations and increasing their market share.

Investors should be aware of potential pitfalls and always exercise due diligence when making investments. Overall, Clarus appears to be a well-positioned company with increasing potential for future growth.

Recent Posts