CHH Intrinsic Value Calculator – Hedgeye Suggests Choice Hotels International as a New Short Idea

May 20, 2023

Trending News 🌥️

Hedgeye, a leading financial services firm, has recently suggested Choice Hotels International ($NYSE:CHH) as a new short idea. This is a timely suggestion, as the company has seen a strong performance in the past few years. The company’s portfolio of brands include Comfort Inn, Comfort Suites, Quality, Sleep Inn, Clarion, Cambria, MainStay Suites, Suburban Extended Stay Hotel, Econo Lodge, Rodeway Inn, and Ascend Hotel Collection. With such an expansive portfolio of brands, Choice Hotels International looks to be well positioned to capitalize on the growth of the global hospitality industry. The company has seen robust growth over the past few years, and its financials have been well-managed.

In addition, Choice Hotels International has made strategic investments in technology and customer experience initiatives that have improved the overall customer experience and helped drive revenue growth. Given the company’s strong financials and growth prospects, Hedgeye has suggested that investors consider taking a closer look at Choice Hotels International as a potential short idea. With its expansive portfolio of brands and well-managed financials, Choice Hotels International looks to be well-positioned to capitalize on the continued growth of the global hospitality industry.

Stock Price

On Thursday, CHOICE HOTELS INTERNATIONAL (CHH) faced a small decline of 0.5% in its stock price, closing at $122.4 after opening at the same price. This was a slight decrease from the prior closing price of $123.0. Hedgeye, a financial research and analysis firm, suggested the company as a new short idea. The suggestion of this stock as a new short idea is based on their analysis of the company’s financials, which showed that the stock is likely to underperform in the near future.

Hedgeye also noted that Choice Hotels International’s revenue growth has been lagging behind the industry average over the past few quarters. As such, investors may want to consider the potential risks associated with shorting CHH. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for CHH. More…

| Total Revenues | Net Income | Net Margin |

| 1.48k | 315.75 | 20.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for CHH. More…

| Operations | Investing | Financing |

| 315.17 | -449.43 | -360.92 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for CHH. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.11k | 2.06k | 0.92 |

Key Ratios Snapshot

Some of the financial key ratios for CHH are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.8% | 10.7% | 31.3% |

| FCF Margin | ROE | ROA |

| 15.5% | 287.0% | 13.7% |

Analysis – CHH Intrinsic Value Calculator

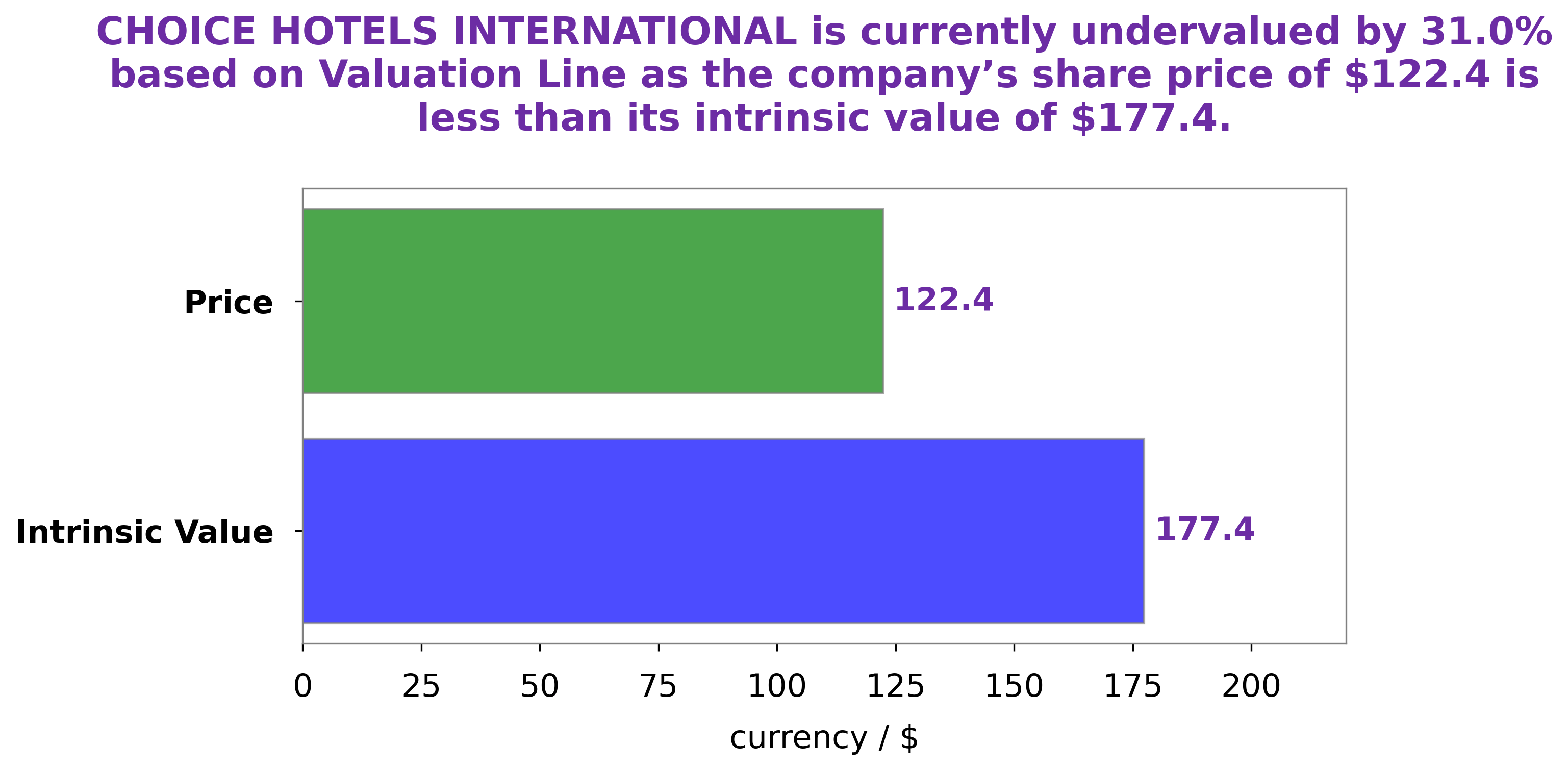

At GoodWhale, we have conducted an analysis of the fundamentals of CHOICE HOTELS INTERNATIONAL. We have used our proprietary Valuation Line to calculate a fair value of approximately $177.4 for the stock. This figure suggests that the current market price of $122.4 is undervalued by 31.0%. Therefore, we believe that CHOICE HOTELS INTERNATIONAL is currently a good buying opportunity as the stock is trading below its fair value. We suggest that investors consider this stock while assessing their portfolio. More…

Peers

Choice Hotels International, Inc. is one of the world’s largest hotel companies. With over 6,300 hotels across more than 35 countries and territories, Choice Hotels International offers a wide variety of lodging options to suit any need. Wyndham Hotels & Resorts, Hilton Worldwide Holdings, and Marriott International are all major competitors in the hotel industry.

– Wyndham Hotels & Resorts Inc ($NYSE:WH)

Wyndham Hotels & Resorts Inc is one of the largest hotel companies in the world, with over 7,500 hotels across more than 80 countries. The company offers a wide range of hotel brands, from economy to luxury, and its portfolio includes some of the most well-known hotel brands in the world, such as Wyndham, Ramada, Days Inn, and Super 8. Wyndham Hotels & Resorts is headquartered in Parsippany, New Jersey.

The company’s market cap is 6.2B as of 2022 and its ROE is 30.65%.

– Hilton Worldwide Holdings Inc ($NYSE:HLT)

Hilton Worldwide Holdings Inc. is a hospitality company that owns, leases, manages, develops, and franchises hotels and resorts. The company operates in three segments: Owned and Leased Hotels, Management and Franchise, and Timeshare. As of December 31, 2020, it owned, leased, or managed 2,084 properties with 883,944 rooms. Hilton Worldwide Holdings Inc. was founded in 1919 and is headquartered in McLean, Virginia.

– Marriott International Inc ($NASDAQ:MAR)

Marriott International is one of the world’s largest hotel companies, with more than 6,000 properties in over 120 countries and territories. Marriott operates and franchises hotels and timeshare properties under 30 brands, including Marriott, Ritz-Carlton, Sheraton, and Westin. The company also has a vacation ownership division, Marriott Vacations Worldwide. Marriott was founded in 1927 by J. Willard Marriott and Frank J. Taylor.

Summary

Choice Hotels International is an attractive investment opportunity due to its strong balance sheet and stable cash flows. The company has a long-term strategic plan in place to drive growth and profitability, which includes expanding its presence in strategic international markets and further developing its loyalty program. Its portfolio of midscale and economy brands has enabled it to remain competitive and resilient in the face of market competition and continuously evolving consumer trends. The company’s financial performance is also supported by its diversified business model, with a focus on cost efficiency, technological innovation, and targeted marketing activities.

Recent Posts