Chevron Corporation Stock Fair Value Calculation – J.P. Morgan Upgrades Chevron as Valuation Reaches Parity

June 1, 2023

☀️Trending News

Chevron Corporation ($NYSE:CVX) is a leading global energy company that is engaged in every aspect of the oil and natural gas industry. It is involved in the exploration, production, refining, marketing and transportation of oil and gas. Chevron also produces petrochemicals, as well as provides energy services. Recently, J.P. Morgan upgraded Chevron as its valuation reached parity with its peers. The sell rating it previously had on the stock has been removed. This is due to Chevron’s strong production and refined product demand, which has continued to stay strong throughout the pandemic-induced economic downturn.

Additionally, the company has made significant investments in renewable energy, making it an attractive investment for those looking to diversify their portfolios with clean energy alternatives. With its upgraded rating, investors are now able to take advantage of Chevron’s attractive valuation and move forward with investing in the company.

Stock Price

J.P. Morgan recently upgraded CHEVRON CORPORATION stock to “overweight” from “neutral” as its valuation reached parity with that of rival oil majors ExxonMobil and Royal Dutch Shell. On Wednesday, CHEVRON CORPORATION opened at $151.5 and closed at $150.6, down by 1.6% from its previous closing price of 153.1. This was despite J.P. Morgan’s rating upgrade which highlighted the potential of the stock. Analysts at the firm noted that CHEVRON CORPORATION has underperformed its sector peers over the last five years and that its current valuation should provide attractive upside potential for investors. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Chevron Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 232.25k | 35.78k | 15.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Chevron Corporation. More…

| Operations | Investing | Financing |

| 41.55k | -11.45k | -23.62k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Chevron Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 255.89k | 255.89k | 84.81 |

Key Ratios Snapshot

Some of the financial key ratios for Chevron Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 19.7% | 636.5% | 21.8% |

| FCF Margin | ROE | ROA |

| 13.6% | 19.9% | 12.4% |

Analysis – Chevron Corporation Stock Fair Value Calculation

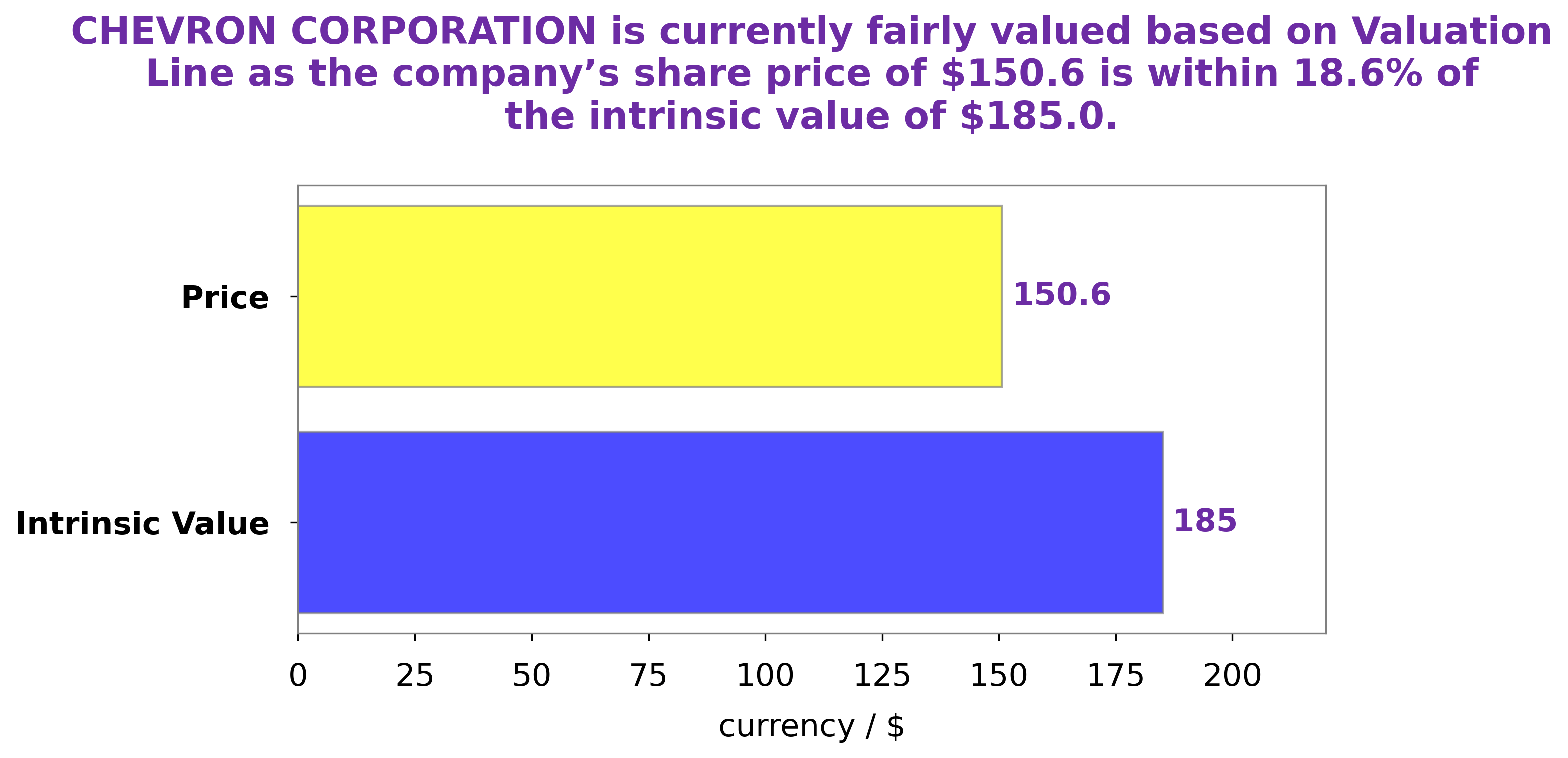

At GoodWhale, we analyzed the financials of CHEVRON CORPORATION and used our proprietary Valuation Line to calculate a fair value of $185.0 for its share. Currently, CHEVRON CORPORATION stock is traded at $150.6 – an 18.6% discount from its fair value. This indicates that CHEVRON CORPORATION’s share is undervalued in the market. As such, investors could consider buying the share at its current price level. More…

Peers

The Chevron Corp competes with Exxon Mobil Corp, Occidental Petroleum Corp, and ConocoPhillips. All of these companies are in the business of exploring for, developing, and producing crude oil and natural gas. Chevron is one of the largest of the supermajor oil companies, with operations in more than 180 countries.

– Exxon Mobil Corp ($NYSE:XOM)

Exxon Mobil Corporation is an American multinational oil and gas corporation headquartered in Irving, Texas. It is the largest direct descendant of John D. Rockefeller’s Standard Oil Company, and was formed on November 30, 1999 by the merger of Exxon (formerly the Standard Oil Company of New Jersey) and Mobil (formerly the Standard Oil Company of New York). The world’s seventh largest company by revenue, ExxonMobil is also the seventh largest publicly traded company by market capitalization. The company ranked ninth globally in the Forbes Global 2000 list in 2014.

– Occidental Petroleum Corp ($NYSE:OXY)

Occidental Petroleum Corp is a large American oil and gas company with operations in the United States, the Middle East, and Latin America. The company has a market cap of 63.77B as of 2022 and a return on equity of 29.73%. Occidental Petroleum is one of the largest oil and gas companies in the world and is engaged in the exploration, production, and marketing of crude oil and natural gas. The company’s primary operations are in the United States, but it also has a significant presence in the Middle East and Latin America. Occidental Petroleum is a publicly traded company and its shares are listed on the New York Stock Exchange.

– ConocoPhillips ($NYSE:COP)

ConocoPhillips is an American multinational energy corporation with its headquarters in Houston, Texas. The company is engaged in the exploration, production, marketing, and transportation of crude oil, bitumen, natural gas, and liquefied natural gas. As of December 31, 2019, the company had estimated proved reserves of 8.4 billion barrels of oil equivalent.

ConocoPhillips has a market capitalization of $150.08 billion as of January 2021. The company’s return on equity was 30.9% for the year ended December 31, 2020.

ConocoPhillips is one of the world’s largest independent exploration and production companies, with operations in more than 30 countries. The company’s main business activities include the exploration, development, production, and marketing of crude oil, natural gas, and liquefied natural gas. ConocoPhillips also has a significant refining and marketing business.

Summary

Chevron Corporation has seen a change in its investment outlook recently, with J.P. Morgan lifting their sell rating due to increased valuations. Investors should consider Chevron’s size and scope within the oil and gas industry, as well as its ability to generate strong returns on invested capital over time. Financial analysis should focus on Chevron’s long-term prospects for market share growth, margin expansion, and capital efficiency.

Additionally, investors should evaluate the risk of commodity price fluctuations and assess the impact of macroeconomic, political, and technological developments on the company’s performance. Factors such as competitive strategies, cash flow, and dividend history should also be taken into account when making an investment decision.

Recent Posts