Chevron Corporation Intrinsic Value Calculation – Whales Betting Big on Chevron: What Are They Seeing?

June 3, 2023

🌥️Trending News

Investors known as whales are betting big on Chevron Corporation ($NYSE:CVX), one of the world’s largest integrated energy companies. Its diversified portfolio includes natural gas, oil, and chemicals subsidiaries in addition to its well-known retail gasoline brands: Caltex, Chevron, and Texaco. In addition to its strong presence in the upstream oil and gas sector, Chevron has significant investments in renewable energy sources such as solar, wind, and hydroelectric power. It is also involved in cutting-edge technologies related to energy efficiency and environmental protection.

Chevron’s stock has seen significant growth in recent months due to increased demand for energy from emerging markets. The company is also investing heavily in projects to develop new sources of oil and gas, which should help it to maintain its position as a leading energy company for years to come. With strong fundamentals and a portfolio of attractive projects, it’s no wonder that whales are betting big on Chevron.

Share Price

On Wednesday, Chevron Corporation stock opened at $151.5 and closed at $150.6, down by 1.6% from prior closing price of 153.1. Despite this minor decline, institutional investors and hedge funds have recently been betting big on the oil giant. So, what is it that they see that has prompted such an overwhelming show of confidence? The answer could lie in Chevron’s recently announced dividend increase. The sizable increase was made possible by impressive gains in exploration and production, in addition to Chevron’s commitment to cost-cutting measures and operational efficiency, both of which have helped to maximize their profits.

Chevron also has a long history of paying out dividends, further adding to their appeal for investors and underscoring the company’s commitment to shareholders. This, combined with their strong balance sheet and impressive cash flows, makes Chevron a desirable investment option for those looking for a relatively safe bet with good returns. Overall, these factors make it clear why institutional investors and hedge funds have been betting big on Chevron Corporation stock recently. They are confident that Chevron’s strong operational performance will continue to drive their growth and dividend yields, making them a safe and profitable investment. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Chevron Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 232.25k | 35.78k | 15.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Chevron Corporation. More…

| Operations | Investing | Financing |

| 41.55k | -11.45k | -23.62k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Chevron Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 255.89k | 255.89k | 84.81 |

Key Ratios Snapshot

Some of the financial key ratios for Chevron Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 19.7% | 636.5% | 21.8% |

| FCF Margin | ROE | ROA |

| 13.6% | 19.9% | 12.4% |

Analysis – Chevron Corporation Intrinsic Value Calculation

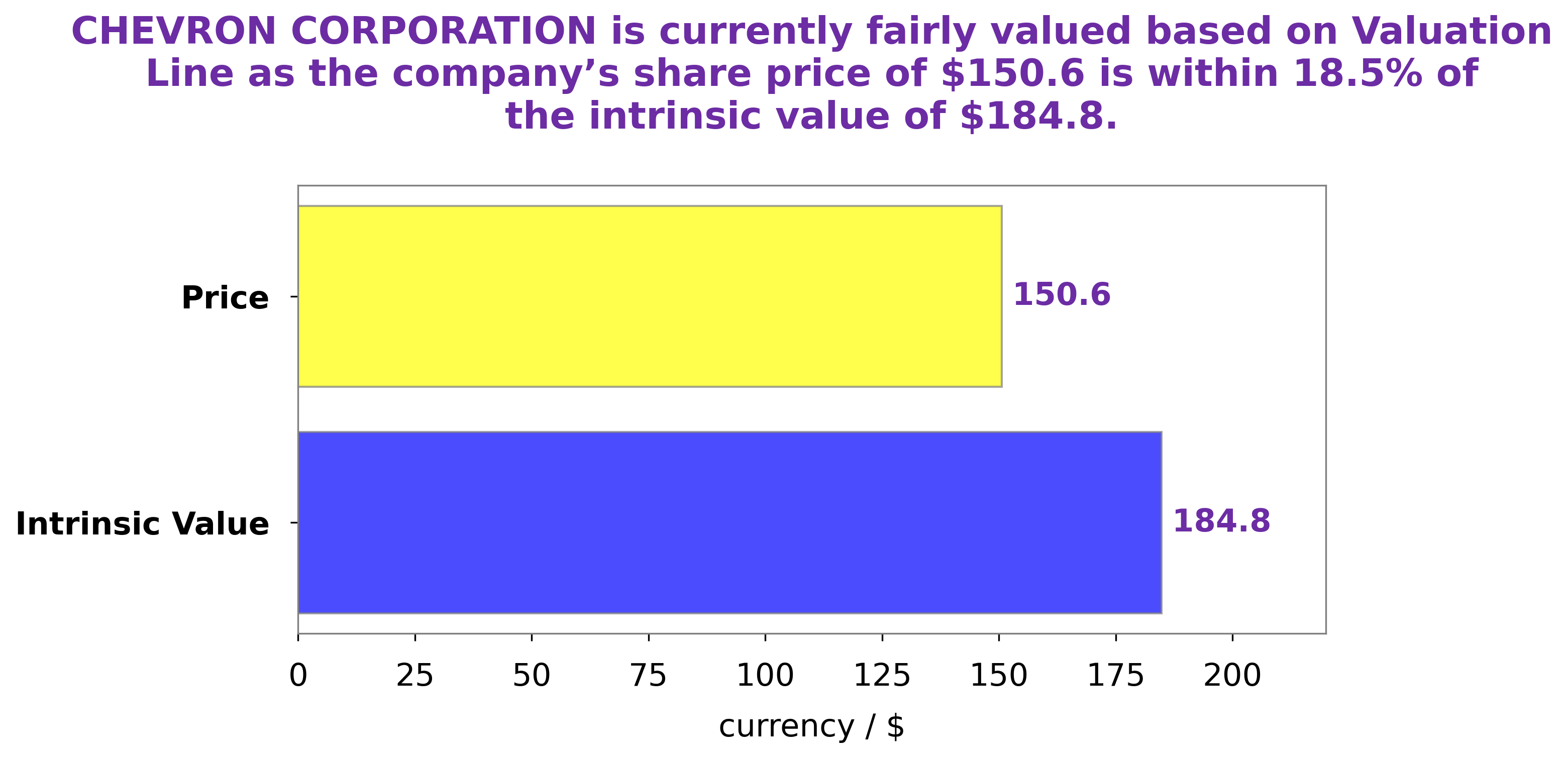

At GoodWhale, we analyze the financials of CHEVRON CORPORATION in order to determine the fair value of their stock. After our thorough analysis, we concluded that the CHEVRON CORPORATION share should be valued at around $184.8. However, we noticed that CHEVRON CORPORATION stock is currently being traded at just $150.6, which is an 18.5% undervaluation from its fair price. This presents a great buying opportunity for investors who are looking to invest in CHEVRON CORPORATION. More…

Peers

The Chevron Corp competes with Exxon Mobil Corp, Occidental Petroleum Corp, and ConocoPhillips. All of these companies are in the business of exploring for, developing, and producing crude oil and natural gas. Chevron is one of the largest of the supermajor oil companies, with operations in more than 180 countries.

– Exxon Mobil Corp ($NYSE:XOM)

Exxon Mobil Corporation is an American multinational oil and gas corporation headquartered in Irving, Texas. It is the largest direct descendant of John D. Rockefeller’s Standard Oil Company, and was formed on November 30, 1999 by the merger of Exxon (formerly the Standard Oil Company of New Jersey) and Mobil (formerly the Standard Oil Company of New York). The world’s seventh largest company by revenue, ExxonMobil is also the seventh largest publicly traded company by market capitalization. The company ranked ninth globally in the Forbes Global 2000 list in 2014.

– Occidental Petroleum Corp ($NYSE:OXY)

Occidental Petroleum Corp is a large American oil and gas company with operations in the United States, the Middle East, and Latin America. The company has a market cap of 63.77B as of 2022 and a return on equity of 29.73%. Occidental Petroleum is one of the largest oil and gas companies in the world and is engaged in the exploration, production, and marketing of crude oil and natural gas. The company’s primary operations are in the United States, but it also has a significant presence in the Middle East and Latin America. Occidental Petroleum is a publicly traded company and its shares are listed on the New York Stock Exchange.

– ConocoPhillips ($NYSE:COP)

ConocoPhillips is an American multinational energy corporation with its headquarters in Houston, Texas. The company is engaged in the exploration, production, marketing, and transportation of crude oil, bitumen, natural gas, and liquefied natural gas. As of December 31, 2019, the company had estimated proved reserves of 8.4 billion barrels of oil equivalent.

ConocoPhillips has a market capitalization of $150.08 billion as of January 2021. The company’s return on equity was 30.9% for the year ended December 31, 2020.

ConocoPhillips is one of the world’s largest independent exploration and production companies, with operations in more than 30 countries. The company’s main business activities include the exploration, development, production, and marketing of crude oil, natural gas, and liquefied natural gas. ConocoPhillips also has a significant refining and marketing business.

Summary

Chevron Corporation is an American multinational energy corporation engaged in oil and natural gas exploration and production. Chevron is seen as a strong investment in the energy industry, with its share price having increased significantly over the past few years. Analysts are optimistic about Chevron’s future prospects as it has large reserves of oil and gas, strong cash flow, and a well-diversified portfolio of upstream and downstream operations. The company is investing heavily in technology to reduce its environmental impact, and is looking to expand into renewable energy sources such as solar and wind power.

Chevron also offers attractive dividend payments, which are expected to remain steady or increase in the future. Chevron is a reliable choice for long-term investors.

Recent Posts