Centrus Energy Stock Intrinsic Value – Comparing Financial Performance: Centrus Energy (NYSE:LEU) and Smart Sand (NASDAQ:SND) in Focus

April 9, 2023

Trending News ☀️

Centrus Energy ($NYSEAM:LEU) (NYSE:LEU) and Smart Sand (NASDAQ:SND) are two companies with different industries and performance in the stock market. A comparison of their financial performance is needed in order to make a well-informed decision when investing. Centrus Energy is an American energy company that focuses on uranium conversion, uranium enrichment, and nuclear fuel cycle services. The company has major operations in the United States and Canada, providing customers with a full range of services.

Smart Sand is a manufacturer and marketer of industrial proppants used in hydraulic fracturing, or fracking, to extract oil and natural gas from underground shale formations. Overall, Centrus Energy appears to be performing better financially than Smart Sand in recent years, as evidenced by its higher revenue growth, net income growth and adjusted EBITDA. Investing in either company should be done with careful consideration of each company’s financial performance and the overall market conditions.

Stock Price

Centrus Energy (NYSE: LEU) had a positive day on Monday, with the stock opening at $32.5 and closing at $32.9, a 2.1% increase from its last closing price of $32.2. These results suggest that investors are showing greater confidence in Centrus Energy’s financial performance compared to Smart Sand’s. The company’s strong financials and increasing stock price make it an attractive investment for those looking for a long-term return. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Centrus Energy. More…

| Total Revenues | Net Income | Net Margin |

| 293.8 | 50.7 | 17.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Centrus Energy. More…

| Operations | Investing | Financing |

| 20.6 | -0.7 | -4.3 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Centrus Energy. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 705.5 | 779.6 | -5.06 |

Key Ratios Snapshot

Some of the financial key ratios for Centrus Energy are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.9% | – | 23.2% |

| FCF Margin | ROE | ROA |

| 6.8% | -49.0% | 6.1% |

Analysis – Centrus Energy Stock Intrinsic Value

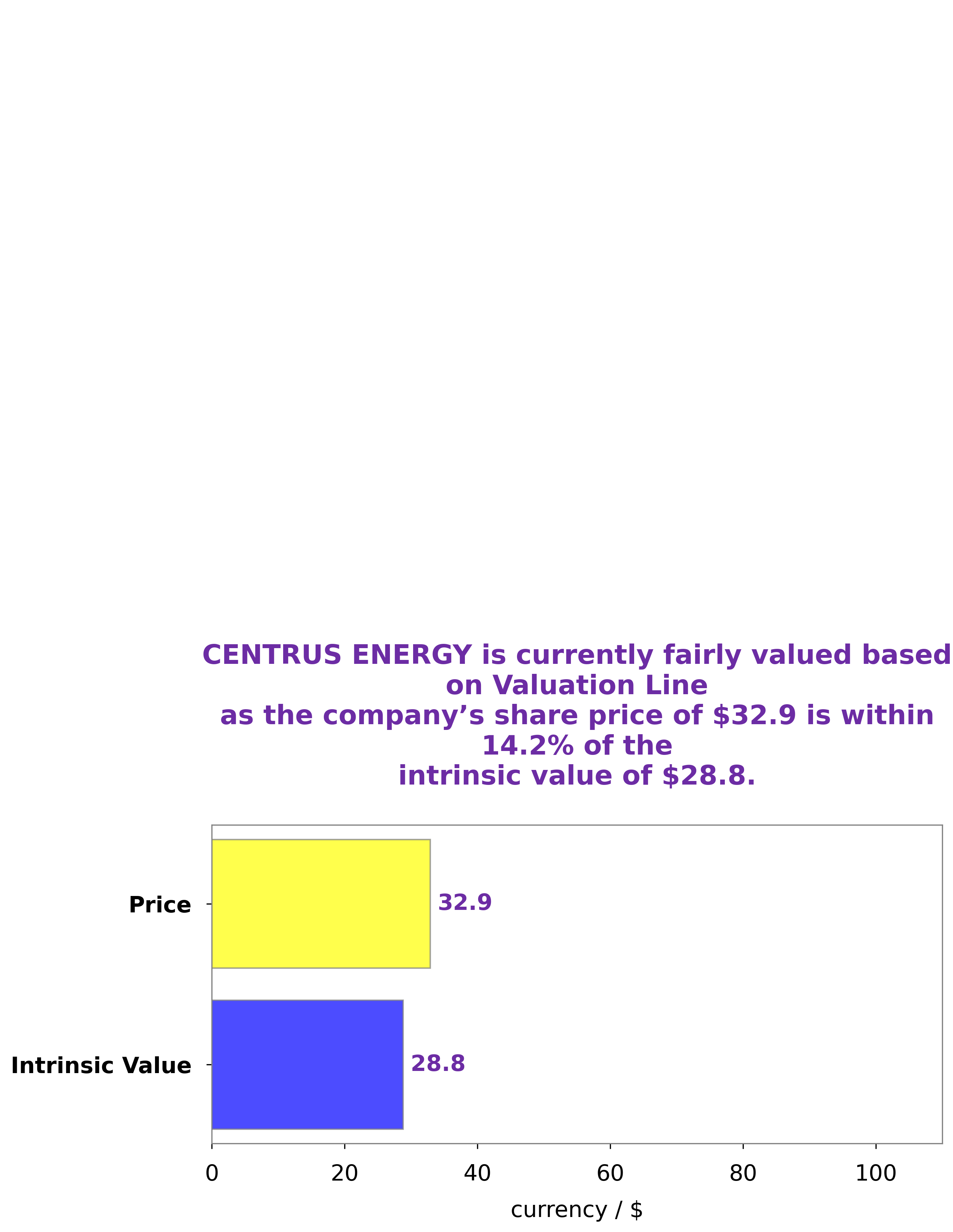

At GoodWhale, we conducted an analysis of CENTRUS ENERGY‘s wellbeing. Our proprietary Valuation Line was used to calculate the intrinsic value of CENTRUS ENERGY share, which is around $28.8. As a result, investors should pay attention to the stock’s value before making decisions on whether to buy. More…

Peers

The competition between Centrus Energy Corp and its competitors is fierce. Each company is striving to be the best in the industry, and they are all fighting for market share. Peninsula Energy Ltd, Mencast Holdings Ltd, and PT Indika Energy Tbk are all major competitors of Centrus Energy Corp, and they are all fighting for a piece of the pie.

– Peninsula Energy Ltd ($ASX:PEN)

Peninsula Energy Ltd is a uranium mining and exploration company. The company has a market capitalization of 164.78 million as of 2022 and a return on equity of -3.03%. The company’s primary operations are in South Australia and the United States. The company’s uranium projects include the Karoo Uranium Project in South Africa, the Lance Uranium Project in Wyoming, and the Kintyre Uranium Project in Western Australia.

– Mencast Holdings Ltd ($SGX:5NF)

Mancast Holdings Ltd is a Hong Kong-based investment holding company principally engaged in the provision of manganese products. The Company operates through three segments. The Manganese Products segment is engaged in the manufacture and sale of electrolytic manganese metal products, including ingots, flakes, powders and briquettes. The Steel and Iron Ore segment is engaged in the trading of steel products and iron ore. The Others segment is engaged in the provision of management services. The Company operates businesses in Mainland China, Hong Kong, Taiwan, Europe, South America and other countries.

– PT Indika Energy Tbk ($IDX:INDY)

Indika Energy Tbk. is an Indonesian energy company that focuses on coal mining through its subsidiaries. It has a market cap of 16.65T as of 2022 and a return on equity of 66.28%. The company has been criticized for its environmental and social impacts.

Summary

Investing in Centrus Energy (NYSE:LEU) can be a smart move as the company provides a range of nuclear energy-related services and products. Furthermore, the company is well-positioned in the nuclear energy industry and is poised to benefit from the expected global increase in demand for nuclear energy.

Recent Posts