Capri Holdings Stock Intrinsic Value – Amalgamated Bank Reduces Stake in Capri Holdings Limited by 25.3% in Q1

July 30, 2023

🌧️Trending News

The company’s portfolio consists of prestigious brands such as Michael Kors, Versace, and Jimmy Choo. Capri Holdings ($NYSE:CPRI) Limited is continuing to focus on its core brands in order to remain competitive in the increasingly competitive luxury goods market. However, it is uncertain how these measures will affect its share price in the long run.

Analysis – Capri Holdings Stock Intrinsic Value

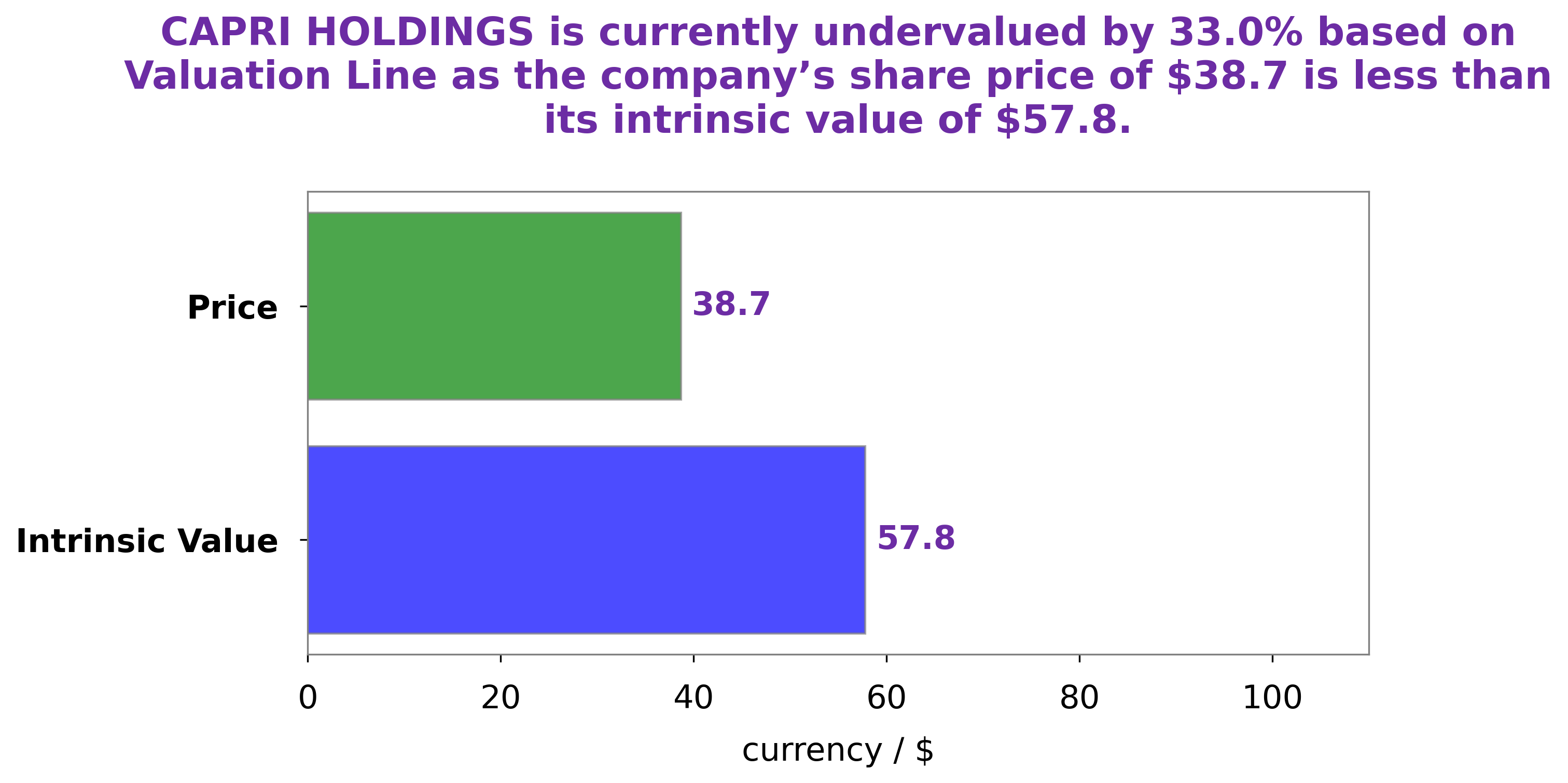

At GoodWhale, we have conducted an analysis of CAPRI HOLDINGS‘ fundamentals. After running our proprietary Valuation Line, we have determined a fair value of the share to be around $61.6. Currently, the CAPRI HOLDINGS stock is trading at $37.1, which means it is undervalued by as much as 39.8% according to our analysis. This provides an attractive opportunity for potential investors looking to add CAPRI HOLDINGS to their portfolio. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Capri Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 5.62k | 616 | 13.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Capri Holdings. More…

| Operations | Investing | Financing |

| 771 | 183 | -776 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Capri Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.29k | 5.45k | 15.75 |

Key Ratios Snapshot

Some of the financial key ratios for Capri Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.4% | 14.5% | 14.9% |

| FCF Margin | ROE | ROA |

| 9.7% | 25.7% | 7.2% |

Peers

The fashion industry is extremely competitive, with companies constantly vying for market share. Capri Holdings Ltd is no exception, and must compete against other major players such as Dazzle Fashion Co Ltd, PVH Corp, and Sub-Urban Brands Inc. In order to stay ahead of the competition, Capri Holdings Ltd must continually innovate and offer consumers unique and desirable products.

– Dazzle Fashion Co Ltd ($SHSE:603587)

Dazzle Fashion Co Ltd is a fashion company with a market cap of 6.76B as of 2022. The company has a Return on Equity of 11.66%. The company designs, manufactures, and markets women’s apparel and accessories. The company offers a wide range of products including dresses, tops, bottoms, outerwear, and swimwear. The company operates in two segments: wholesale and retail. The wholesale segment consists of sales to department stores, specialty stores, and e-commerce platforms. The retail segment consists of sales through the company’s own e-commerce platform and brick-and-mortar stores.

– PVH Corp ($NYSE:PVH)

PVH Corp is a publicly traded company with a market capitalization of 3.08 billion as of 2022. The company has a return on equity of 11.85%. PVH Corp is a holding company that operates through its subsidiaries. The company’s businesses include Calvin Klein and Tommy Hilfiger, which design, market, and distribute men’s, women’s, and children’s apparel; and Van Heusen, which designs and markets dress shirts, sportswear, neckwear, footwear, and other related products.

Summary

CAPRI HOLDINGS is an American fashion company, which is the parent company of luxury brands Michael Kors, Versace, and Jimmy Choo. Despite this, the stock price of the company moved up on the same day. This suggests that investors remain bullish on CAPRI HOLDINGS, positioning the company for long-term growth.

Furthermore, analysts expect the company to benefit from its diversified portfolio of luxury brands as well as their strong presence in the digital space. Despite external factors such as the ongoing pandemic, CAPRI HOLDINGS is expected to maintain its position as a leader in the fashion industry.

Recent Posts