Cano Health Intrinsic Value – Cano Health: Upcoming Shareholder Meeting Sparks Volatility in Undervalued Stock

June 18, 2023

🌥️Trending News

The upcoming key shareholder meeting for Cano Health ($NYSE:CANO) is rapidly approaching, and the stock has been undervalued yet volatile. Cano Health is a healthcare services company that provides a range of services to the Latino community, including primary care, specialist providers, and laboratory services. Investors are interested in the potential for further growth in the underserved Latino community while also keeping an eye on the competitive landscape as the company grows. The upcoming shareholder meeting is expected to provide more clarity on Cano Health’s plans for future growth, and could potentially result in an uplift of the stock’s value.

In addition, this meeting could provide further insights into the company’s strategy for expanding its market share and how it will differentiate itself from competitors. Ultimately, investors will be keeping a close eye on Cano Health’s upcoming shareholder meeting to get a better understanding of the company’s future plans and opportunities for growth. With the stock currently undervalued yet volatile, this meeting could prove to be a turning point for the company and its investors.

Stock Price

On Friday, the stock opened at $1.3 and closed at $1.4, a rise of 6.0% from its prior closing price of $1.3. Investors are hoping that the meeting will bring positive news that could further drive up the stock price. It is likely that the upcoming meeting will be closely watched by investors keen to see what impact it will have on the stock. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cano Health. More…

| Total Revenues | Net Income | Net Margin |

| 2.9k | -236.08 | -1.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cano Health. More…

| Operations | Investing | Financing |

| -138.6 | -60.16 | 130.6 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cano Health. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.94k | 1.44k | 1.07 |

Key Ratios Snapshot

Some of the financial key ratios for Cano Health are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 96.4% | – | -14.3% |

| FCF Margin | ROE | ROA |

| -6.4% | -97.3% | -13.3% |

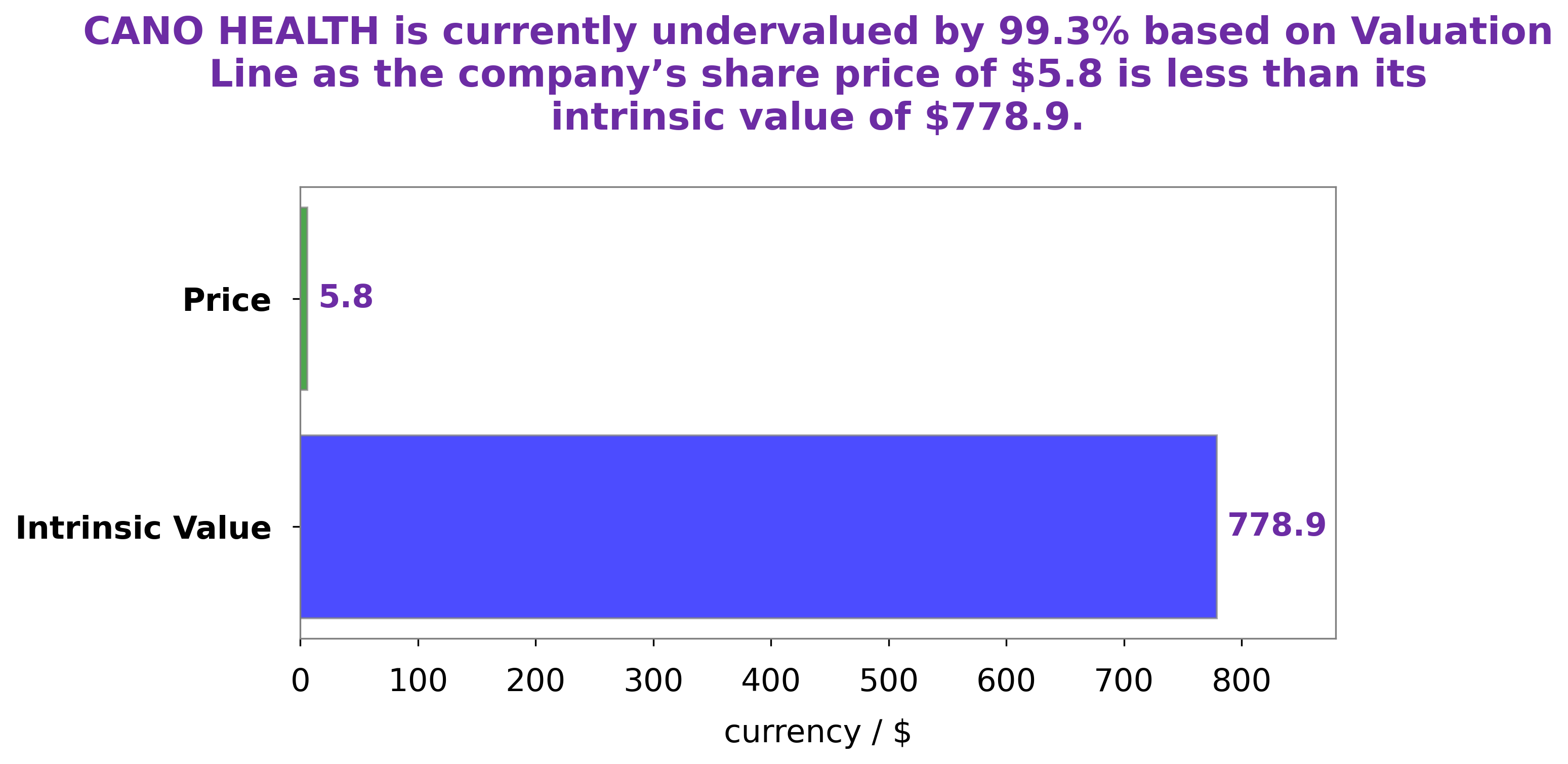

Analysis – Cano Health Intrinsic Value

At GoodWhale, we have conducted an analysis of CANO HEALTH‘s wellbeing. Our proprietary Valuation Line has calculated the fair value of CANO HEALTH share to be around $11.5. However, the current stock price for CANO HEALTH is only $1.4 – meaning it is significantly undervalued by 87.8%. This represents a great opportunity for investors looking to make a good return on their investments. More…

Peers

Attendo AB is a provider of healthcare services, while Universal Health Services Inc is a provider of both healthcare services and products.

– EMC Instytut Medyczny SA ($LTS:0LTC)

EMC Instytut Medyczny SA is a Polish company that provides medical diagnostic services. The company has a market capitalization of 472.49 million as of 2022 and a return on equity of 2.52%. EMC Instytut Medyczny SA provides medical diagnostic services including blood tests, X-rays, and ultrasounds. The company also offers laboratory services such as genetic testing and IVF.

– Attendo AB ($LTS:0RCY)

Attendo AB is a Swedish company that provides healthcare and social services. The company has a market cap of 4.03B as of 2022 and a Return on Equity of 8.28%. Attendo AB provides services to municipalities, county councils, and the private sector in Sweden, Finland, Norway, Denmark, Poland, and Austria. The company offers a range of services, including primary healthcare, specialist healthcare, social services, and elderly care.

– Universal Health Services Inc ($NYSE:UHS)

Universal Health Services, Inc. is one of the largest healthcare management companies in the United States. It owns and operates hospitals, outpatient facilities, and behavioral health and addiction treatment centers. As of 2022, the company’s market capitalization was 7.97 billion and its return on equity was 11.27%. Universal Health Services, Inc. is headquartered in King of Prussia, Pennsylvania.

Summary

Cano Health is currently undervalued but volatile, with its stock price having moved up on the same day that a key shareholder meeting was announced. Analysts have noted that despite the short-term volatility of the stock, it could be an attractive option for long-term investors due to its potential for growth and its attractive dividend yield.

In addition, the company has strong fundamentals and possesses potential for growth, which makes it a promising investment option. Other factors that could positively impact Cano Health’s stock price include making strategic acquisitions and expanding into new markets. This makes Cano Health a stock worth monitoring for experienced investors and those looking for long-term returns.

Recent Posts