Bruker Corporation Intrinsic Value – Bruker Corporation and Canopy Biosciences Collaborate to Unlock the Secrets of Spatial Biology

April 14, 2023

Trending News 🌥️

Bruker Corporation ($NASDAQ:BRKR) is a leading provider of scientific instruments, analytical and diagnostic solutions. By combining their expertise in cell biology with data science, Canopy Biosciences is enabling medicine to progress research in the field of spatial biology. Through this collaboration, Bruker Corporation and Canopy Biosciences aim to develop innovative solutions to identify and characterize the intricate interplay between the biochemical, mechanical and electric properties of cells in 3D cultures. By unlocking the secrets of spatial biology, this collaboration also has potential to revolutionize the development of new therapies and treatments for a wide range of diseases.

Share Price

Bruker Corporation, a leading provider of life science tools and services, and Canopy Biosciences, a provider of innovative tools for spatial biology, have announced a collaboration. On Wednesday, BRUKER CORPORATION stock opened at $80.6 and closed at $81.3, up by 1.8% from its previous closing price of 79.9. This is a promising development for both companies, as well as for the research community as a whole. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Bruker Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 2.53k | 296.6 | 12.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Bruker Corporation. More…

| Operations | Investing | Financing |

| 274.4 | -251.6 | -415.3 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Bruker Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.61k | 2.49k | 7.58 |

Key Ratios Snapshot

Some of the financial key ratios for Bruker Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.9% | 15.1% | 17.0% |

| FCF Margin | ROE | ROA |

| 5.7% | 26.2% | 7.4% |

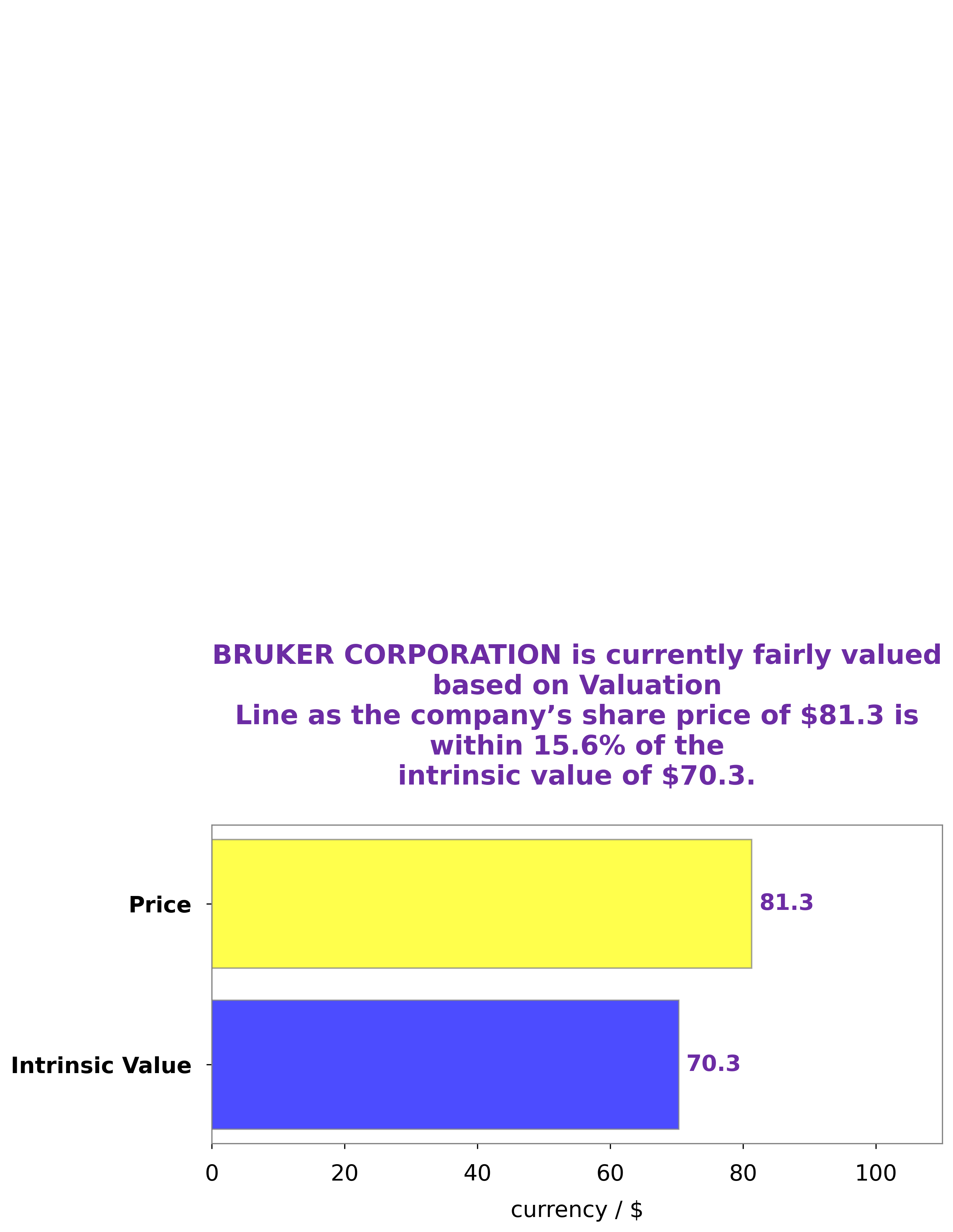

Analysis – Bruker Corporation Intrinsic Value

At GoodWhale, we’ve recently completed an analysis of BRUKER CORPORATION‘s financials. After looking at the company’s historical performance and current operating environment, we’ve determined that the fair value of BRUKER CORPORATION’s stock is around $70.3. This is based on our proprietary Valuation Line, which is designed to fairly assess a company’s worth. Right now, BRUKER CORPORATION’s stock is trading at $81.3, which is a 15.6% premium from our estimated fair value. We believe this is an indication that the stock is currently overvalued. As always, investors should be aware of the risks involved when trading in the stock market and should monitor the stock closely for any changes. More…

Peers

Its products are used in a variety of applications, including drug discovery, food and environmental testing, and materials science research. The company’s main competitors are Tecan Group AG, Stevanato Group SPA, and Cerus Corporation.

– Tecan Group AG ($LTS:0QLN)

Tecan Group AG is a leading provider of laboratory instruments and solutions. The company has a market cap of 4.56B as of 2022 and a Return on Equity of 6.13%. Tecan provides a wide range of products and services for the life science research, diagnostics and pharmaceutical sectors. The company offers a broad range of solutions for drug discovery, genomics, diagnostics and forensics. Tecan also provides contract research services to the pharmaceutical industry.

– Stevanato Group SPA ($NYSE:STVN)

Stevanato Group SPA is a company that manufactures and sells pharmaceuticals and medical devices. The company has a market cap of 4.89B as of 2022 and a return on equity of 11.0%. The company’s products are sold in over 100 countries and it has a presence in Europe, North America, and Asia.

– Cerus Corp ($NASDAQ:CERS)

Cerus Corp is a medical technology company that specializes in blood safety. The company’s primary product is the Intercept Blood System, which is designed to inactivate viruses, bacteria, parasites, and other potentially harmful agents in donated blood. Cerus Corp’s market cap as of 2022 is 625.13M, and its ROE is -28.3%. The company has been facing some financial difficulties in recent years, but continues to invest in research and development in order to bring new products to market.

Summary

BRUKER Corporation is a global leader in the development and manufacturing of high-performance scientific instruments and solutions used by researchers and scientists in a variety of industries. Investing analysis of the company indicates that it has a strong financial position with healthy revenue growth, low debt levels, and low operating costs.

In addition, it has a solid base of existing products and expanding portfolio, as well as a diverse customer base made up of universities and governmental organizations. It also benefits from strong brand recognition. BRUKER is focused on innovation and has recently introduced several new products and technologies. Overall, BRUKER is well-positioned to continue its success in the future.

Recent Posts