Booking Holdings Stock Fair Value – $BKNG Stock Trend Tracker: Booking Holdings Common Stock on the Rise

June 4, 2023

🌥️Trending News

Booking Holdings ($NASDAQ:BKNG) Inc. (BKNG) is one of the world’s largest travel and hospitality companies, with notable brands such as Priceline, Kayak, OpenTable, Booking.com and Rentalcars.com. The company’s stock has been on a steady upward trajectory in recent years and is currently sitting at an all-time high. It is likely that its strong financial performance, in addition to its overwhelming presence in the global travel industry, has kept investors bullish on the stock.

To track the price trend of Booking Holdings Inc. common stock ($BKNG), investors should look no further than the company’s stock chart. With a strong presence in the global travel and hospitality industry, BKNG is well positioned to capitalize on future growth opportunities.

Share Price

Booking Holdings Inc. Common Stock (ticker symbol $BKNG) is on the rise, with the stock opening at $2577.3 on Friday and closing at $2625.6, a 3.0% increase from its prior closing price of 2550.0. This positive trend in the stock price reflects investors’ confidence in Booking Holdings’ financial performance and long-term growth potential. As one of the leading global online travel companies, Booking Holdings has a portfolio of well-known brands such as Booking.com, Priceline.com, Kayak, and OpenTable. Over the past year, the company has seen steady growth in its business operations as more people turn to online booking services for their travel needs.

The company’s strong financial performance and forward-looking strategy have also contributed to its increasing stock price. This trend of positive growth in stock price is expected to continue in the coming months as Booking Holdings continues to execute on its growth strategy. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Booking Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 18.17k | 4.02k | 22.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Booking Holdings. More…

| Operations | Investing | Financing |

| 7.75k | 1.19k | -5.32k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Booking Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 25.21k | 24.13k | 28.86 |

Key Ratios Snapshot

Some of the financial key ratios for Booking Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.8% | 1.2% | 30.8% |

| FCF Margin | ROE | ROA |

| 40.7% | 181.3% | 13.9% |

Analysis – Booking Holdings Stock Fair Value

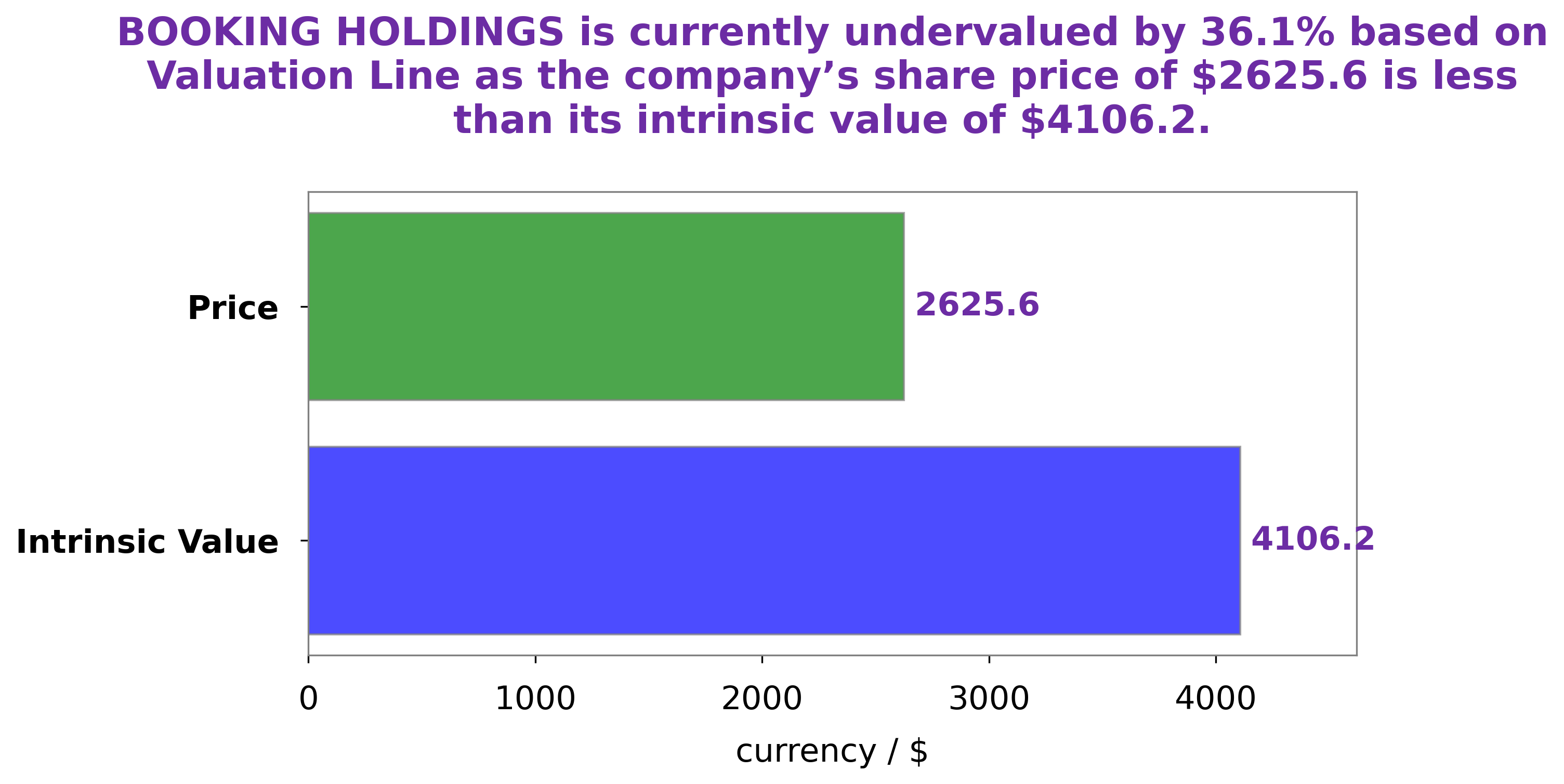

At GoodWhale, we have conducted a thorough analysis of BOOKING HOLDINGS‘s financials. Our proprietary Valuation Line indicates that the intrinsic value of a BOOKING HOLDINGS share is approximately $4106.2. Currently, the stock is trading at $2625.6, which is 36.1% below its true value. Therefore, we believe that BOOKING HOLDINGS stock is currently undervalued and may represent an attractive investment opportunity. More…

Peers

Booking Holdings Inc, Expedia Group Inc, Ezfly International Travel Agent Co Ltd, and Adventure Inc are all travel companies that compete for customers. They all offer different services, but they all aim to make booking travel easier and more convenient for customers.

– Expedia Group Inc ($NASDAQ:EXPE)

Expedia Group is an online travel company that owns and operates a portfolio of travel brands. Its brands include Expedia.com, Hotels.com, trivago, HomeAway, Orbitz, Travelocity, Wotif, lastminute.com.au, and eLong. The company offers a one-stop travel booking experience to its customers. It enables customers to compare prices and book travel services from a single platform.

– Ezfly International Travel Agent Co Ltd ($TPEX:2734)

Ezfly International Travel Agent Co Ltd is a travel company based in Taiwan. The company offers a variety of travel services, including flight tickets, hotel reservations, and tour packages. Ezfly International Travel Agent Co Ltd has a market cap of 912.87M as of 2022, a Return on Equity of -19.32%. The company has been negatively impacted by the COVID-19 pandemic, as travel restrictions have prevented customers from using its services. Ezfly International Travel Agent Co Ltd is working to adapt its business model in order to survive the pandemic and continue operating in the future.

– Adventure Inc ($TSE:6030)

Adventure Inc. is a publicly traded company with a market capitalization of $85.43 billion as of 2022. The company’s return on equity is 13.93%. Adventure Inc. operates in the adventure travel industry, providing travelers with unique and immersive experiences. The company has a strong focus on customer service and safety, and has been recognized as a leader in the industry. Adventure Inc. offers a variety of travel products and services, including adventure tours, safaris, and cruise vacations.

Summary

Booking Holdings is a leading global provider of online travel services, operating a portfolio of well-known brands in the travel and hospitality industries. Investors have been attracted to its ability to capitalize on the growing demand for online travel services, with its strong presence in multiple markets and its suite of digital products. Analysts recommend investing in Booking Holdings due to its resilience, stability, and strong competitive position in the industry.

Furthermore, the company has invested in technology and product innovation which has enabled it to remain competitive and profitable. With continued growth potential and a reputable brand, Booking Holdings promises investors a solid return on their investments.

Recent Posts