BKD Stock Fair Value – Shares of Brookdale Senior Living Soar 10% After Updating Q1 2023 Guidance

April 11, 2023

Trending News ☀️

Shares of Brookdale Senior Living ($NYSE:BKD) soared by 10% in after hours trading after the company released an updated forecast for their Q1 2023 earnings. Brookdale Senior Living is a leading provider of senior living services for the elderly, offering a variety of residential, health, and hospitality services. As one of the largest senior living operators in the United States and the only national full-service senior living provider, they have a strong presence in the industry. The company recently updated their preliminary guidance for Q1 2023, which saw their shares jump by 10% after hours.

This new guidance demonstrated their continued commitment to providing high quality and compassionate care for seniors, as well as their ability to provide innovative solutions for the ever-changing needs of seniors. This has been a major factor in their continued success and growth in the industry. With this kind of commitment, it is no wonder that investors are so excited about their prospects.

Share Price

The stock opened at $2.9 and saw an impressive 4.2% increase from its previous closing price of $2.9. The surge in share prices came after the company announced that its Q1 2023 guidance is better than expected. Investors are now expecting the company to deliver double-digit earnings growth in the quarter.

This news has been highly encouraging for investors, who have been eagerly awaiting a potential turnaround for BROOKDALE SENIOR LIVING. The updated guidance has given them renewed confidence in the company’s future prospects and has them optimistic about the performance of the stock. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for BKD. More…

| Total Revenues | Net Income | Net Margin |

| 2.74k | -238.43 | -10.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for BKD. More…

| Operations | Investing | Financing |

| 3.28 | -67.43 | 100.38 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for BKD. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.94k | 5.35k | 3.11 |

Key Ratios Snapshot

Some of the financial key ratios for BKD are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -12.2% | -65.4% | -1.0% |

| FCF Margin | ROE | ROA |

| -7.1% | -3.2% | -0.3% |

Analysis – BKD Stock Fair Value

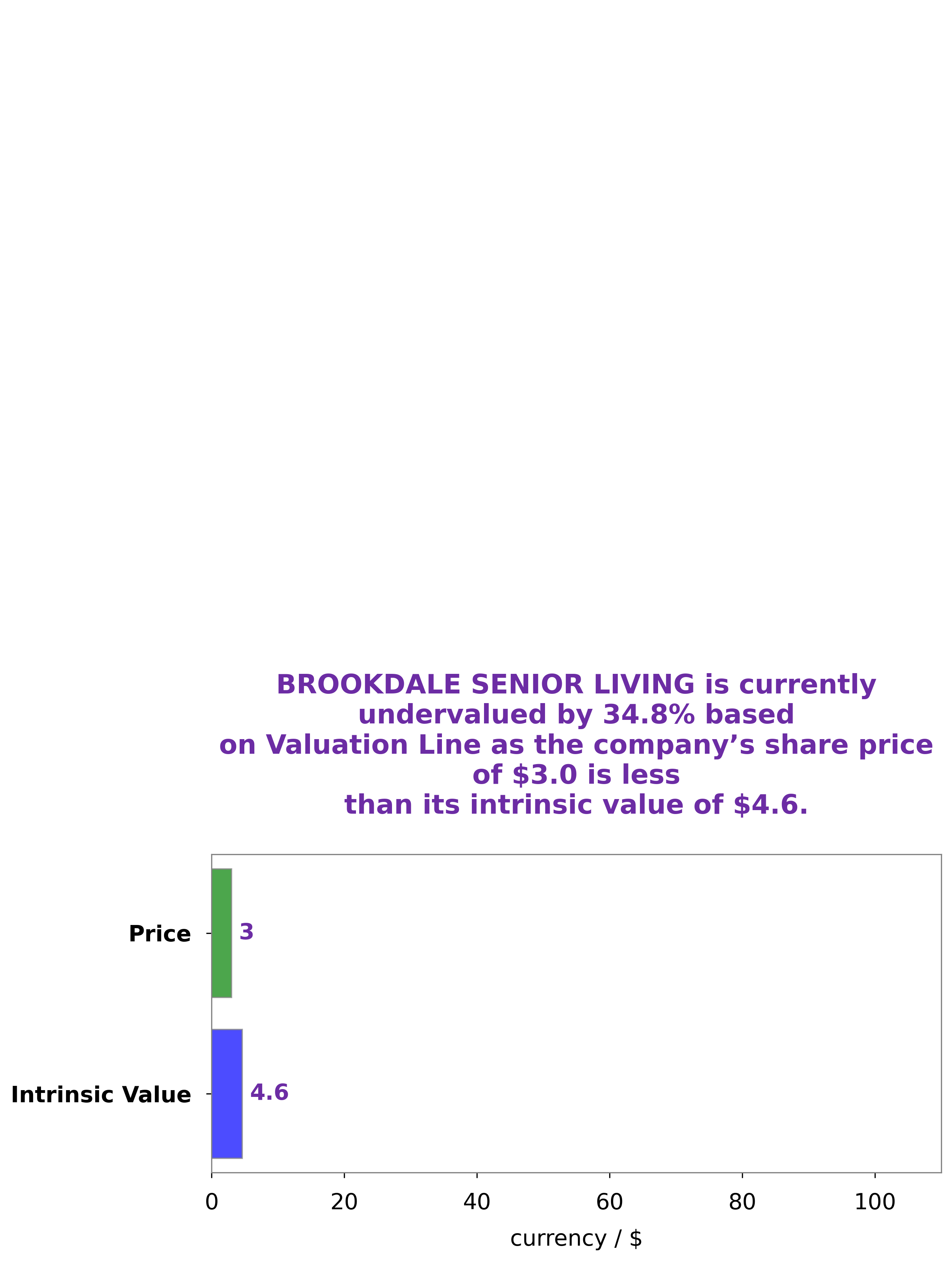

At GoodWhale, we have analyzed the financials of BROOKDALE SENIOR LIVING and found that the intrinsic value of its share is around $4.6. This value has been calculated by our proprietary Valuation Line which takes into consideration the fundamentals and financial performance of the company. Currently, BROOKDALE SENIOR LIVING stock is traded at $3.0 and is undervalued by 35.2%. This presents an attractive opportunity for investors to make a considerable return on their investments. More…

Peers

Brookdale Senior Living Inc. is one of the largest senior living providers in the United States. It is headquartered in Nashville, Tennessee and has over 1,000 senior living communities in 44 states. Brookdale’s competitors include Summerset Group Holdings Ltd, National Healthcare Corp, and Amedisys Inc.

– Summerset Group Holdings Ltd ($NZSE:SUM)

Summerset Group Holdings Ltd is a New Zealand-based company engaged in the manufacture, sale and provision of retirement village, homecare and cemetery services. The Company operates through three segments: Retirement Villages, Homecare Services and Cemeteries. It offers a range of products and services to meet the needs of retirees, their families and loved ones. The Company’s subsidiaries include Summerset Management Services Limited, which is engaged in the provision of management services to the Company’s retirement villages; Summerset Homes Limited, which is engaged in the design and construction of retirement village homes; and Summerset Cemeteries Limited, which is engaged in the operation of cemeteries.

– National Healthcare Corp ($NYSEAM:NHC)

National Healthcare Corporation is a diversified healthcare company that owns and operates long-term care facilities, retirement centers, and home health care businesses. The company has a market capitalization of 920.8 million as of 2022 and a return on equity of 2.92%. National Healthcare Corporation’s long-term care facilities provide skilled nursing, rehabilitation, and assisted living services to seniors. The company’s retirement centers offer independent and assisted living, as well as memory care services. National Healthcare Corporation’s home health care businesses provide home health care services, including skilled nursing, physical therapy, and home health aides.

– Amedisys Inc ($NASDAQ:AMED)

Amedisys Inc is a healthcare services company with a market cap of 2.98B as of 2022. The company has a return on equity of 11.56%. Amedisys Inc provides home health, hospice, and personal care services to patients in the United States. The company was founded in 1982 and is headquartered in Baton Rouge, Louisiana.

Summary

Brookdale Senior Living Inc. recently updated their preliminary Q1 2023 guidance, and the stock reacted favorably with a 10% increase in share price after hours trading that same day. This suggests investors are optimistic about the company’s outlook, particularly given the challenging operating environment caused by the pandemic. Analysts suggest that investors keep an eye on Brookdale Senior Living’s performance over the coming quarters, as key metrics such as occupancy rates, revenue and cost management will indicate the strength of their operations going forward. With all of these factors in mind, analysts recommend that potential investors conduct further due diligence before committing to any investments in this stock.

Recent Posts