Barnes Group Stock Fair Value Calculator – ProShare Advisors LLC Invests in Barnes Group in Fourth Quarter

May 5, 2023

Trending News 🌥️

Barnes Group ($NYSE:B) Inc. is a leading global provider of highly engineered products and services for diverse industrial markets, including aerospace and healthcare. The company has a long history of delivering innovation, precision, quality, and value to its customers. In the fourth quarter, Barnes Group Inc. reported that ProShare Advisors LLC had taken on a new stake in the company, as evidenced by their most recent Form 13F filing. This filing revealed that ProShare Advisors LLC had purchased shares of Barnes Group Inc. in the fourth quarter.

The value of their holdings was not revealed in the filing, but analysts believe that the stake could have a significant impact on the company’s share price in the future. It is unclear at this time what ProShare Advisors LLC plans to do with its newly acquired shares, but investors are hopeful that they will be able to leverage their new stake to generate positive returns for themselves and other shareholders. Investors are optimistic that the company’s strong performance will continue as they benefit from ProShare Advisors LLC’s investment.

Stock Price

In response to the announcement, the BARNES GROUP stock opened at $41.5 and closed at $41.0, for a decline of 1.8% from the previous closing price of 41.7. Investors were cautious of the company’s outlook and the potential implications of the investment from ProShare Advisors LLC. The market is still waiting to observe how the investment pans out and how it might affect Barnes Group Inc’s performance in the coming year. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Barnes Group. More…

| Total Revenues | Net Income | Net Margin |

| 1.28k | 6.15 | 3.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Barnes Group. More…

| Operations | Investing | Financing |

| 117.09 | -38.83 | -75.09 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Barnes Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.44k | 1.06k | 27.28 |

Key Ratios Snapshot

Some of the financial key ratios for Barnes Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -3.8% | -20.6% | 3.5% |

| FCF Margin | ROE | ROA |

| 6.1% | 2.1% | 1.2% |

Analysis – Barnes Group Stock Fair Value Calculator

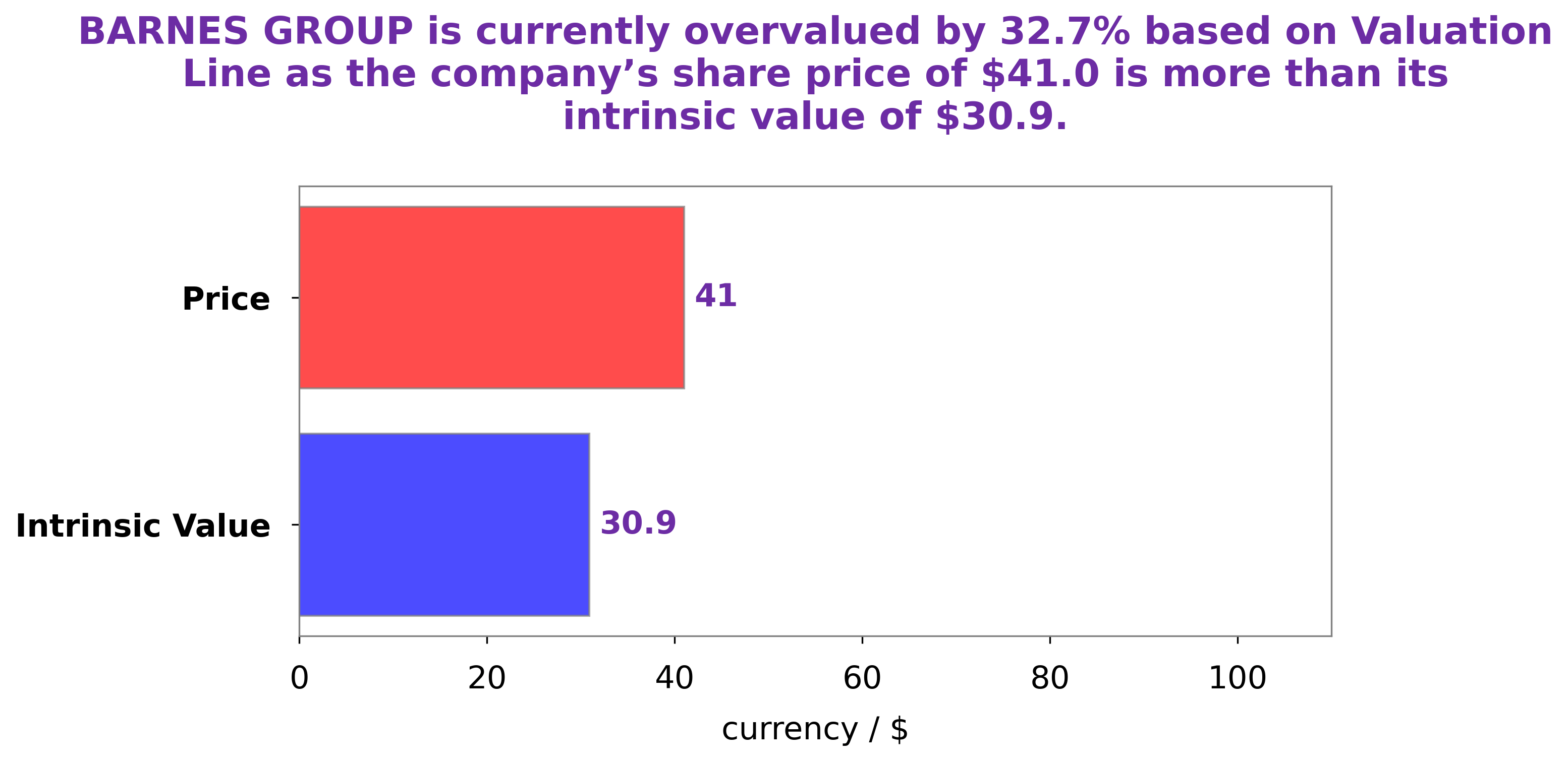

At GoodWhale, we have conducted an analysis of BARNES GROUP‘s financials, and calculated the fair value of their stock to be around $30.9. We arrived at this figure using our proprietary Valuation Line, which takes into account the company’s fundamentals and current market conditions. However, BARNES GROUP’s share is currently trading at $41.0, overvalued by 32.9%. This indicates that there is potential for profit, but also that investors should be cautious and be sure to keep an eye on the stock before making a decision. More…

Peers

Since its inception in 1857, Barnes Group Inc has been engaged in a cutthroat competition with Cummins Inc, Schumag AG, and Harmonic Drive Systems Inc. All four companies have been vying for the top spot in the market share.

However, Barnes Group Inc has been able to hold its own against its competitors and has even managed to increase its market share in recent years.

– Cummins Inc ($NYSE:CMI)

Cummins Inc is a global power leader that designs, manufactures, sells, and services diesel and alternative fuel engines from 2.8 to 95 liters, diesel and alternative-fueled electrical generator sets, and related components and technology. Headquartered in Columbus, Indiana, (USA) Cummins currently employs approximately 55,600 people committed to powering a more prosperous world through three principal business segments: Engine, Electrical, and Components.

– Schumag AG ($LTS:0NIY)

Schumag AG is a publicly traded company with a market capitalization of 8.72 million as of 2022. The company has a return on equity of 1981.48%. Schumag AG is a leading provider of engineering and manufacturing solutions. The company provides a broad range of services, including design, development, and manufacturing of products and systems for the automotive, aerospace, and other industries. Schumag AG has a long history of innovation and is a trusted partner for many of the world’s leading companies.

– Harmonic Drive Systems Inc ($TSE:6324)

Harmonic Drive Systems Inc, headquartered in Tokyo, Japan, is a manufacturer of motion control products. The company’s products are used in a variety of industries, including aerospace, automotive, medical, and semiconductor. Harmonic Drive Systems Inc has a market cap of 458.21B as of 2022 and a Return on Equity of 5.85%. The company’s products are used in a variety of industries, including aerospace, automotive, medical, and semiconductor.

Summary

Barnes Group Inc. is a publicly traded company with a focus on industrial products and services. To analyze the investment, investors should consider macroeconomic trends in the industry, Barnes Group’s competitive position, and the company’s financials.

Additionally, investors should assess the management team’s strategy and ability to execute, as well as its track record. It is also important to evaluate the potential risks associated with investing in Barnes Group, such as political and regulatory risk, technological change, and changes in customer preferences. Investors should use a combination of qualitative and quantitative analysis to determine whether investing in Barnes Group is the right decision for them.

Recent Posts