Bally’s Corporation Stock Fair Value Calculator – Bally’s Corporation Struggles to Find Relevant Business Opportunities Amidst Global Shutdown

April 26, 2023

Trending News 🌥️

Bally’s Corporation ($NYSE:BALY), the American casino and hotel operator, is struggling to find relevant business opportunities amidst the global shutdown. With the closures of its casinos and hotels due to the pandemic, Bally’s finds itself in an unfortunate position as it waits for international travel restrictions to ease up. Its portfolio includes land-based casinos and horse racetracks, as well as riverboat and pari-mutuel casinos. The shuttering of its major businesses has had a significant impact on the company’s financial performance. This is largely due to a decrease in overall customer visits, which was exacerbated by travel restrictions.

In addition, Bally’s has had to pay out more in expenses including employee compensation and benefits, as well as utilities and other fixed costs. Due to the financial hardship caused by the pandemic, Bally’s Corporation has been hard at work trying to find new and innovative ways to stay competitive in the market. The company has recently announced several strategic initiatives, such as its agreement to acquire FanDuel Group, an operator of fantasy sports websites, and its partnership with Bay Mills Indian Community to build a casino in Michigan. It is hoping that these efforts will help it stay afloat and remain relevant in the industry. Although it has made efforts to remain competitive, the company still faces an uphill battle as it waits for the economy to recover. It remains to be seen how the company will fare in the coming months.

Market Price

Bally’s Corporation, a publicly traded company on the New York Stock Exchange, has faced major struggles in the wake of the global shutdown. On Tuesday, BALLY’S CORPORATION stock opened at $17.9 and closed at $17.1, marking a 6.0% drop from its last closing price of 18.2. This steep decline is indicative of the difficulties the business is facing in the current market climate, as it struggles to identify new opportunities for growth. The company has been forced to look for creative solutions to stay afloat, with many of their existing investments proving to be redundant due to the lack of consumer demand and travel restrictions.

Additionally, the decreased consumer spending power is another factor weighing on Bally’s Corporation’s ability to find profitable opportunities. As the global shutdown continues, Bally’s Corporation is looking for innovative ways to stay relevant in the market and remain competitive amidst the economic downturn. Despite the challenges, the company remains optimistic that they will be able to weather the storm and come out on top in the long run. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Bally’s Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 2.26k | -425.55 | 0.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Bally’s Corporation. More…

| Operations | Investing | Financing |

| 270.97 | -302.92 | 43.24 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Bally’s Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.3k | 5.49k | 17.27 |

Key Ratios Snapshot

Some of the financial key ratios for Bally’s Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 62.7% | 10.8% | -10.9% |

| FCF Margin | ROE | ROA |

| -1.5% | -16.2% | -2.4% |

Analysis – Bally’s Corporation Stock Fair Value Calculator

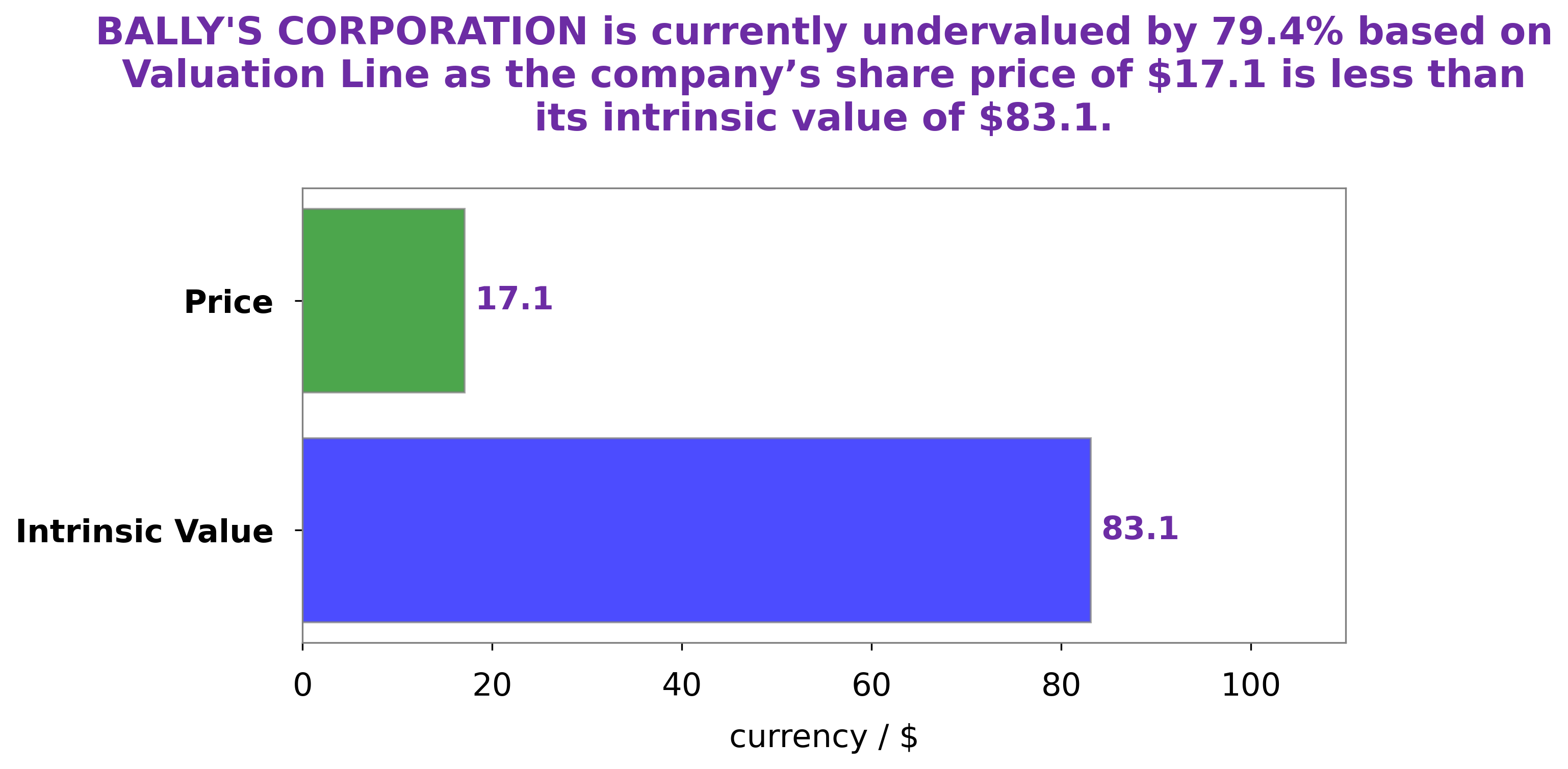

GoodWhale has analyzed the fundamentals of BALLY’S CORPORATION, and we are pleased to provide our findings. Our proprietary Valuation Line indicates that the intrinsic value of BALLY’S CORPORATION shares is around $83.1. This implies that BALLY’S CORPORATION stock is currently undervalued by 79.4%, as it is currently trading at $17.1. We believe this presents a tremendous opportunity for investors to benefit from the discrepancy between the intrinsic value and market price. Considering BALLY’S CORPORATION’s strong fundamentals, we are confident that it could be a great choice for long-term investments. More…

Peers

Despite the fierce rivalry, Ballys Corp has managed to remain an industry leader, through its innovative approach to gaming, customer service, and technological advances.

– Century Casinos Inc ($NASDAQ:CNTY)

Century Casinos Inc is a company that operates casinos and gaming venues throughout the world. It has been in operation since 1992 and has grown to become one of the largest gaming operators in the world. As of 2023, Century Casinos Inc has a market capitalization of 263.4 million and a Return on Equity (ROE) of 32.18%. This indicates that the company is efficiently utilizing its resources to generate profit. The company operates several casinos in Europe, Canada, and the United States, including Colorado, Missouri, and West Virginia. It also provides online gaming services via its websites and mobile applications. Century Casinos Inc is committed to providing quality entertainment experiences to its customers and has been investing in technology and new gaming products.

– Boyd Gaming Corp ($NYSE:BYD)

Boyd Gaming Corporation is a leading diversified owner and operator of gaming entertainment properties located in the United States. The company operates a variety of casinos, hotels, and entertainment venues throughout the country. As of 2023, Boyd Gaming has a market cap of 6.38B and a Return on Equity of 36.77%, indicating strong financial performance over the past few years. The company is well positioned to continue to build on its success and capitalize on future growth opportunities.

– Escalade Inc ($NASDAQ:ESCA)

Escalade Inc is a public company that manufactures and markets sporting goods, office products, and home furniture. It has a market capitalization of 168.52M as of 2023, meaning that the total value of all the company’s shares is worth 168.52M. Additionally, Escalade Inc has a Return on Equity (ROE) of 11.14%, which measures how efficiently the company is using its equity to generate profits. This indicates that the company is making good use of its shareholders’ investments and is delivering good returns.

Summary

Bally’s Corporation is a leading casino operator in the United States, with a large presence in Las Vegas, Atlantic City, and other major cities. Despite the company’s strong market position and extensive experience in the casino industry, its stock has been languishing in recent months. Investors have become increasingly concerned about Bally’s financial performance, and have been hesitant to invest in the company due to its uncertain future. While Bally’s may still be a good long-term investment opportunity, investors should carefully consider the risks associated with investing in the company before making any decisions.

Recent Posts