Bally’s Corporation Intrinsic Value – Exchange Traded Concepts LLC Increases Investment in Bally’s Corporation by 8.8% in Q4

April 12, 2023

Trending News 🌥️

Bally’s Corporation ($NYSE:BALY) is a leading owner and operator of gaming and entertainment facilities in the United States. Bally’s also has a presence in several other U.S. states through its online gaming platform. The company has seen strong revenue growth in recent years and is now positioned to further capitalize on the future of the gaming industry. The latest investment by Exchange Traded Concepts LLC is a vote of confidence in the company’s growth prospects.

Share Price

On Tuesday, BALLY’S CORPORATION stock opened at $18.7 and closed at $19.0, up by 1.6% from last closing price of $18.7. The company’s stock price has been on an upward trend since the start of the fourth quarter, and is likely to continue to rise in the coming months. Investors are likely to take note of this news and keep a close eye on BALLY’S CORPORATION moving forward. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Bally’s Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 2.26k | -425.55 | 0.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Bally’s Corporation. More…

| Operations | Investing | Financing |

| 270.97 | -302.92 | 43.24 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Bally’s Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.3k | 5.49k | 17.27 |

Key Ratios Snapshot

Some of the financial key ratios for Bally’s Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 62.7% | 10.8% | -10.9% |

| FCF Margin | ROE | ROA |

| -1.5% | -16.2% | -2.4% |

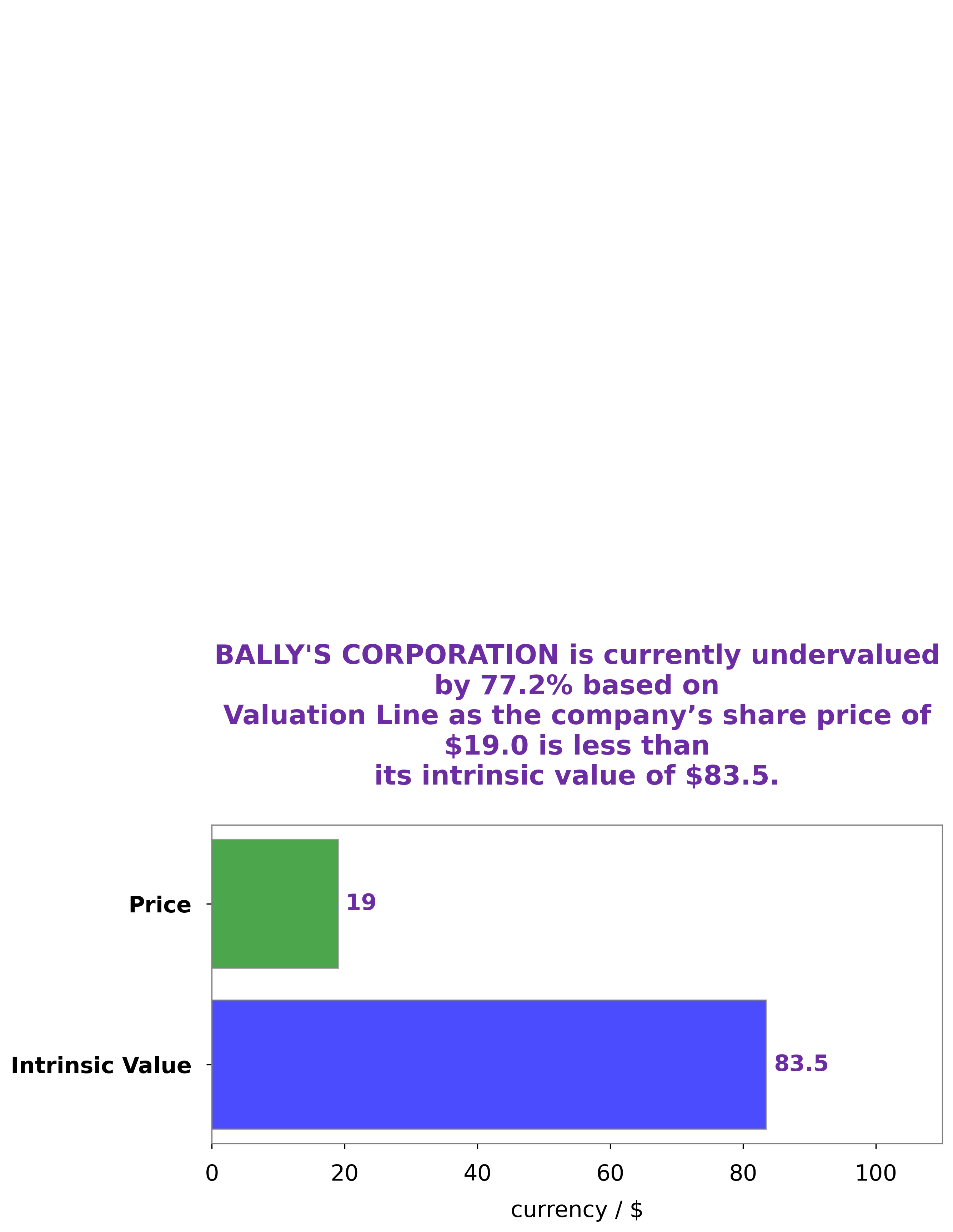

Analysis – Bally’s Corporation Intrinsic Value

At GoodWhale, we recently analyzed BALLY’S CORPORATION‘s wellbeing. After carefully studying their financial statements and other data, we calculated their intrinsic value to be around $83.5 using our proprietary Valuation Line. This means that the current price of BALLY’S CORPORATION stock, which is currently trading at $19.0, is undervalued by 77.3%. This presents a great opportunity for investors to buy the stock and potentially earn a large return on their investment. More…

Peers

Despite the fierce rivalry, Ballys Corp has managed to remain an industry leader, through its innovative approach to gaming, customer service, and technological advances.

– Century Casinos Inc ($NASDAQ:CNTY)

Century Casinos Inc is a company that operates casinos and gaming venues throughout the world. It has been in operation since 1992 and has grown to become one of the largest gaming operators in the world. As of 2023, Century Casinos Inc has a market capitalization of 263.4 million and a Return on Equity (ROE) of 32.18%. This indicates that the company is efficiently utilizing its resources to generate profit. The company operates several casinos in Europe, Canada, and the United States, including Colorado, Missouri, and West Virginia. It also provides online gaming services via its websites and mobile applications. Century Casinos Inc is committed to providing quality entertainment experiences to its customers and has been investing in technology and new gaming products.

– Boyd Gaming Corp ($NYSE:BYD)

Boyd Gaming Corporation is a leading diversified owner and operator of gaming entertainment properties located in the United States. The company operates a variety of casinos, hotels, and entertainment venues throughout the country. As of 2023, Boyd Gaming has a market cap of 6.38B and a Return on Equity of 36.77%, indicating strong financial performance over the past few years. The company is well positioned to continue to build on its success and capitalize on future growth opportunities.

– Escalade Inc ($NASDAQ:ESCA)

Escalade Inc is a public company that manufactures and markets sporting goods, office products, and home furniture. It has a market capitalization of 168.52M as of 2023, meaning that the total value of all the company’s shares is worth 168.52M. Additionally, Escalade Inc has a Return on Equity (ROE) of 11.14%, which measures how efficiently the company is using its equity to generate profits. This indicates that the company is making good use of its shareholders’ investments and is delivering good returns.

Summary

This is an indication that there is confidence in the company’s financial performance and outlook. Analysts have recommended that current investors continue to hold their positions, while others are encouraged to consider investing in Bally’s due to its strong growth potential and solid financial position. With a diversified portfolio of properties and services, Bally’s has achieved financial success through stable revenues and profits. The company also offers a variety of digital gaming options, making it an attractive option for investors looking to capitalize on the growing trend towards online gaming.

Recent Posts