AWK Stock Fair Value – HighTower Advisors LLC Reduces Stake in American Water Works Company, by 0.8%

May 17, 2023

Trending News 🌥️

HighTower Advisors LLC, a leading institutional investor, recently reduced its stake in American Water Works ($NYSE:AWK) Company, Inc. by 0.8%. The company also has a wide range of activities related to the production and sale of water-related products and services, such as engineering, construction, and operation of water and wastewater systems. The company’s stock is listed on the New York Stock Exchange (NYSE) and trades under the ticker symbol AWK.

The stock has experienced a lot of volatility in recent months, as seen in the 0.8% reduction in HighTower Advisors LLC’s stake in the company. Despite this, American Water Works Company continues to be a strong and reliable investment with a proven track record of success.

Analysis – AWK Stock Fair Value

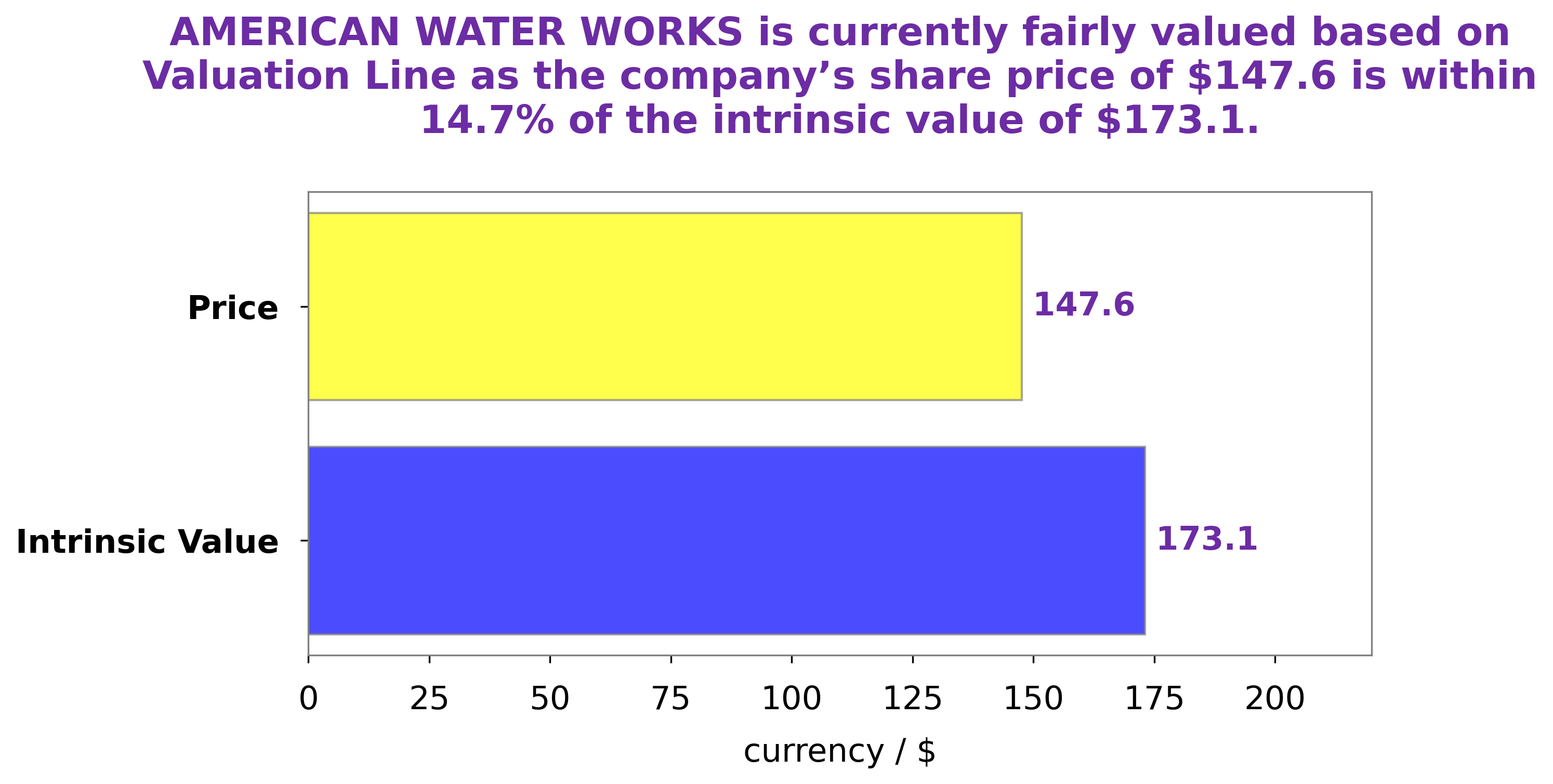

GoodWhale has conducted a fundamental analysis on AMERICAN WATER WORKS and found the fair value of its shares to be around $173.1. This value was determined by our proprietary Valuation Line which takes into account multiple factors such as cost of capital, growth, and cash flow. We also note that the current market price of AMERICAN WATER WORKS stock is around $147.6, which is undervalued by 14.7%. This may provide an attractive opportunity for investors who seek to capitalize on the potential upside of this stock. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for AWK. More…

| Total Revenues | Net Income | Net Margin |

| 3.89k | 832 | 21.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for AWK. More…

| Operations | Investing | Financing |

| 1.24k | -2.85k | 1.75k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for AWK. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 28.29k | 18.74k | 49.05 |

Key Ratios Snapshot

Some of the financial key ratios for AWK are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.2% | 3.1% | 38.0% |

| FCF Margin | ROE | ROA |

| -33.3% | 10.7% | 3.3% |

Peers

American Water Works Co Inc, American States Water Co, Global Water Resources Inc, and Artesian Resources Corp are all water utilities companies. They are all in the business of providing water and wastewater services to residential, commercial, and industrial customers.

– American States Water Co ($NYSE:AWR)

American States Water Co is a water and wastewater utility company that serves nearly million people in the United States. The company has a market cap of 3.22B as of 2022 and a ROE of 12.01%. American States Water Co is the largest water utility company in California and the fourth largest in the United States. The company also provides wastewater services to approximately 700,000 people in Arizona, Illinois, New Mexico, and Texas.

– Global Water Resources Inc ($NASDAQ:GWRS)

Global Water Resources, Inc. is a water resource management company that provides water and wastewater services to residential and commercial customers in the Phoenix metropolitan area. The company has a market cap of $296.66 million and a return on equity of 21.79%. Global Water Resources is headquartered in Scottsdale, Arizona.

– Artesian Resources Corp ($NASDAQ:ARTNA)

Artesian Resources Corp is a water utility company that serves the metropolitan area of Wilmington, Delaware. It is the largest provider of water and wastewater services in the state of Delaware, and is the 8th largest provider of water and wastewater services in the United States. The company has a market cap of 496.24M as of 2022 and a Return on Equity of 10.87%.

Summary

American Water Works Company, Inc. has seen a 0.8% reduction in institutional investor HighTower Advisors LLC’s stake. This could be indicative of a shift in sentiment towards the stock, and could be seen as an opportunity for other investors to assess the value of American Water Works. Analysts should consider factors such as the company’s financial performance, outlook, competitive landscape, and industry trends when evaluating the investment potential of the stock. Additionally, investors should consider any upcoming catalysts or news that may move the stock in either direction.

Recent Posts